Answered step by step

Verified Expert Solution

Question

1 Approved Answer

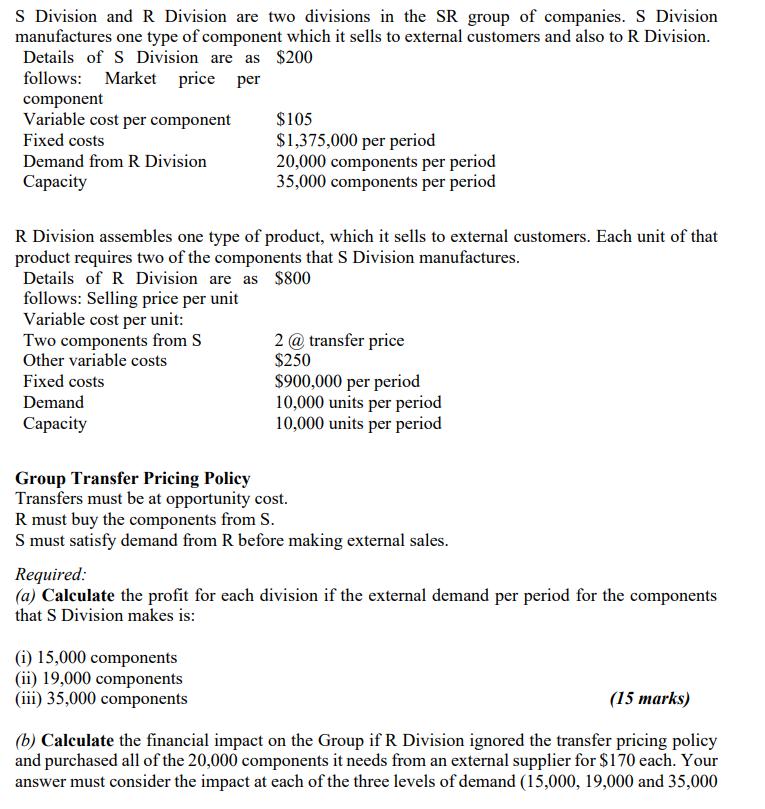

S Division and R Division are two divisions in the SR group of companies. S Division manufactures one type of component which it sells

![]()

S Division and R Division are two divisions in the SR group of companies. S Division manufactures one type of component which it sells to external customers and also to R Division. Details of S Division are as $200 follows: Market price per component Variable cost per component Fixed costs Demand from R Division Capacity $105 $1,375,000 per period 20,000 components per period 35,000 components per period R Division assembles one type of product, which it sells to external customers. Each unit of that product requires two of the components that S Division manufactures. Details of R Division are as follows: Selling price per unit Variable cost per unit: Two components from S Other variable costs Fixed costs Demand $800 2 @ transfer price $250 $900,000 per period Capacity Group Transfer Pricing Policy 10,000 units per period 10,000 units per period Transfers must be at opportunity cost. R must buy the components from S. S must satisfy demand from R before making external sales. Required: (a) Calculate the profit for each division if the external demand per period for the components that S Division makes is: (i) 15,000 components (ii) 19,000 components (iii) 35,000 components (15 marks) (b) Calculate the financial impact on the Group if R Division ignored the transfer pricing policy and purchased all of the 20,000 components it needs from an external supplier for $170 each. Your answer must consider the impact at each of the three levels of demand (15,000, 19,000 and 35,000 components) from external customers for the component manufactured by S Division.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started