Answered step by step

Verified Expert Solution

Question

1 Approved Answer

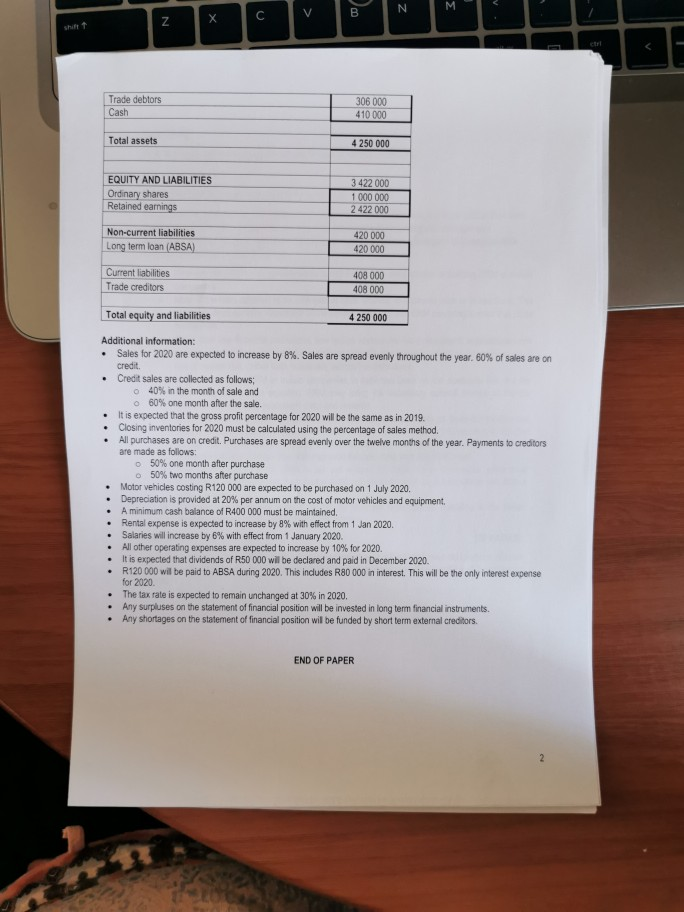

S ected to increase by d as follows; th of sale and after the sale. oss profit percentag 2020 must be calcula edit. Purchases

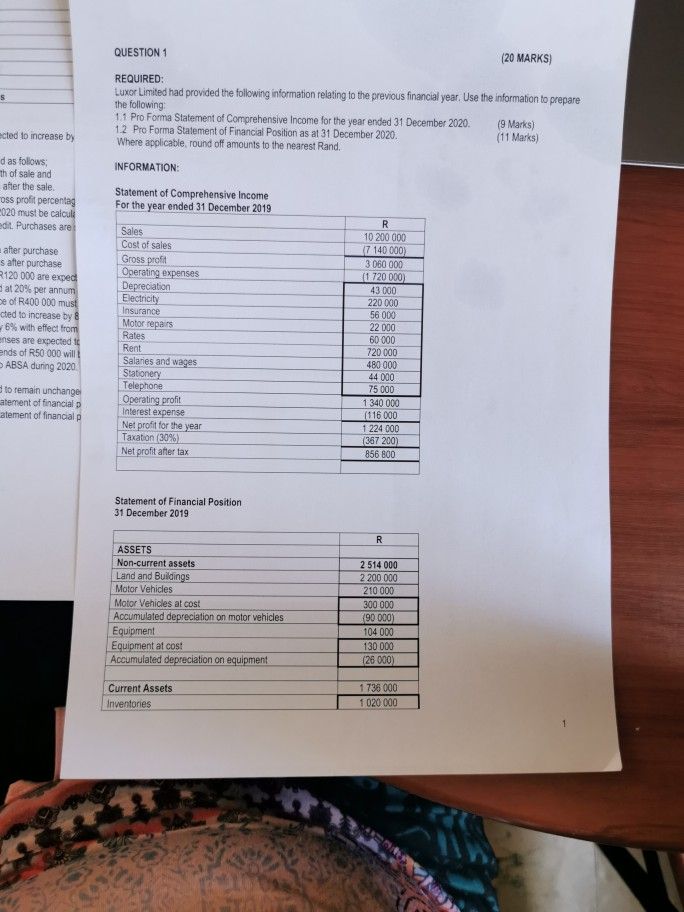

S ected to increase by d as follows; th of sale and after the sale. oss profit percentag 2020 must be calcula edit. Purchases are after purchase s after purchase R120 000 are exped at 20% per annum ce of R400 000 must cted to increase by 8 6% with effect from enses are expected t ends of R50 000 will ABSA during 2020. to remain unchange atement of financial p catement of financial p QUESTION 1 REQUIRED: (20 MARKS) Luxor Limited had provided the following information relating to the previous financial year. Use the information to prepare the following: 1.1 Pro Forma Statement of Comprehensive Income for the year ended 31 December 2020. 1.2 Pro Forma Statement of Financial Position as at 31 December 2020. Where applicable, round off amounts to the nearest Rand. INFORMATION: Statement of Comprehensive Income For the year ended 31 December 2019 Sales Cost of sales Gross profit Operating expenses Depreciation Electricity Insurance R 10 200 000 (7 140 000) 3 060 000 (1 720 000) 43 000 220 000 56 000 Motor repairs 22 000 Rates 60 000 Rent 720 000 Salaries and wages 480 000 Stationery 44 000 Telephone 75 000 Operating profit Interest expense Net profit for the year Taxation (30%) Net profit after tax 1 340 000 (116 000 1224 000 (367 200) 856 800 (9 Marks) (11 Marks) Statement of Financial Position 31 December 2019 ASSETS Non-current assets Land and Buildings Motor Vehicles Motor Vehicles at cost Accumulated depreciation on motor vehicles Equipment Equipment at cost Accumulated depreciation on equipment Current Assets Inventories R 2 514 000 2 200 000 210 000 300 000 (90 000) 104 000 130 000 (26 000) 1 736 000 1 020 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started