Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S - HW# 2 Search this cour DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a

SHW#

Search this cour

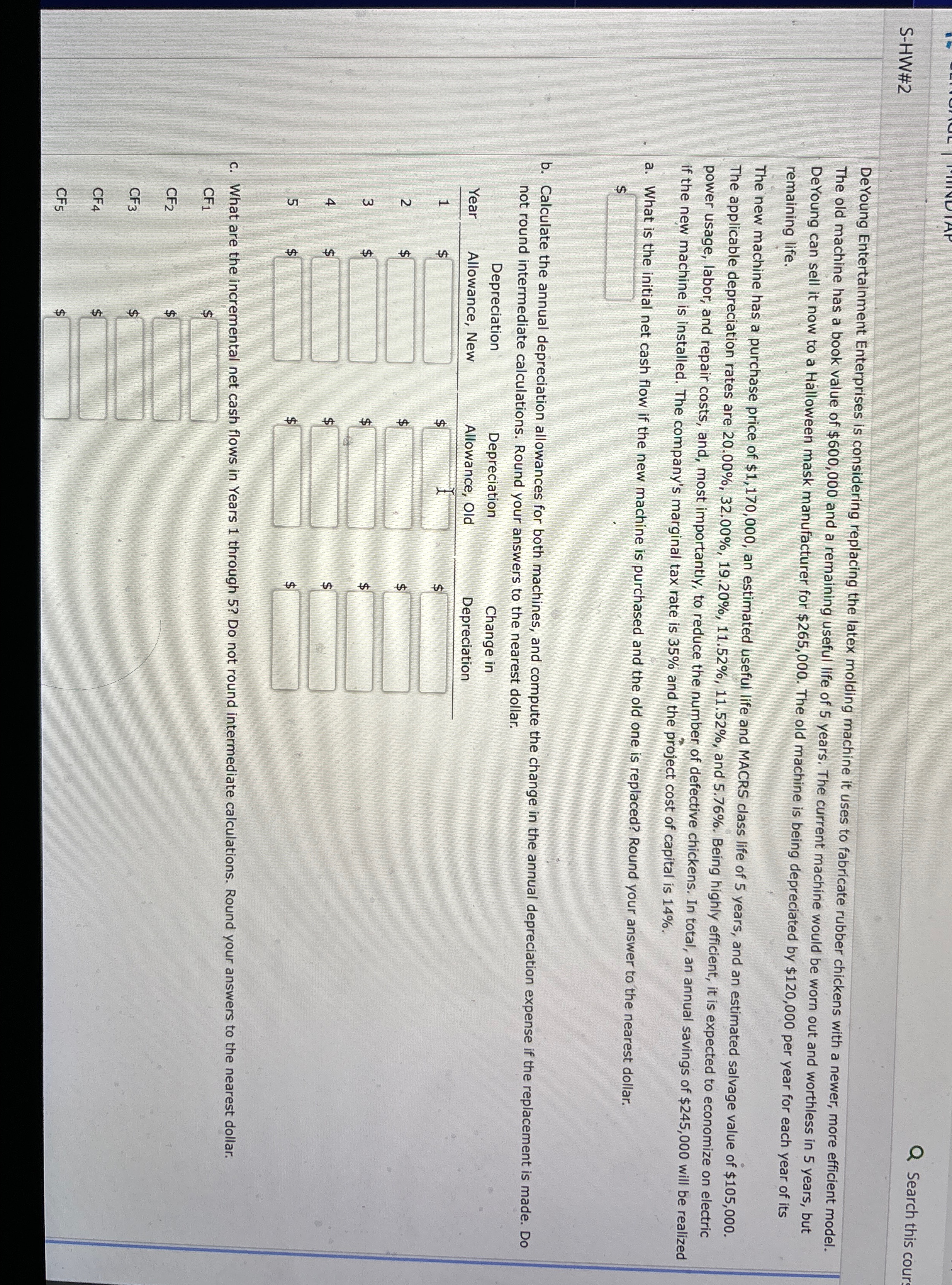

DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer, more efficient model. The old machine has a book value of $ and a remaining useful life of years. The current machine would be worn out and worthless in years, but DeYoung can sell it now to a Halloween mask manufacturer for $ The old machine is being depreciated by $ per year for each year of its remaining life.

The new machine has a purchase price of $ an estimated useful life and MACRS class life of years, and an estimated salvage value of $ The applicable depreciation rates are and Being highly efficient, it is expected to economize on electric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total, an annual savings of $ will be realized if the new machine is installed. The company's marginal tax rate is and the project cost of capital is

a What is the initial net cash flow if the new machine is purchased and the old one is replaced? Round your answer to the nearest dollar.

b Calculate the annual depreciation allowances for both machines, and compute the change in the annual depreciation expense if the replacement is made. Do not round intermediate calculations. Round your answers to the nearest dollar.

tableYeartableDepreciationAllowance NewtableDepreciationAllowance OldtableChange inDepreciation$$vdots

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started