Answered step by step

Verified Expert Solution

Question

1 Approved Answer

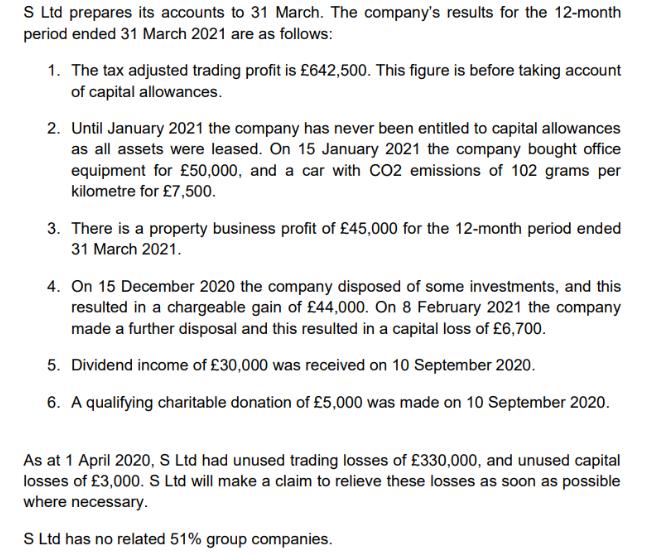

S Ltd prepares its accounts to 31 March. The company's results for the 12-month period ended 31 March 2021 are as follows: 1. The

S Ltd prepares its accounts to 31 March. The company's results for the 12-month period ended 31 March 2021 are as follows: 1. The tax adjusted trading profit is 642,500. This figure is before taking account of capital allowances. 2. Until January 2021 the company has never been entitled to capital allowances as all assets were leased. On 15 January 2021 the company bought office equipment for 50,000, and a car with CO2 emissions of 102 grams per kilometre for 7,500. 3. There is a property business profit of 45,000 for the 12-month period ended 31 March 2021. 4. On 15 December 2020 the company disposed of some investments, and this resulted in a chargeable gain of 44,000. On 8 February 2021 the company made a further disposal and this resulted in a capital loss of 6,700. 5. Dividend income of 30,000 was received on 10 September 2020. 6. A qualifying charitable donation of 5,000 was made on 10 September 2020. As at 1 April 2020, S Ltd had unused trading losses of 330,000, and unused capital losses of 3,000. S Ltd will make a claim to relieve these losses as soon as possible where necessary. S Ltd has no related 51% group companies. Required: Calculate S Ltd's corporation tax liability in respect of the 12-month period ended 31 March 2021, and advise the company by when this should be paid. S Ltd prepares its accounts to 31 March. The company's results for the 12-month period ended 31 March 2021 are as follows: 1. The tax adjusted trading profit is 642,500. This figure is before taking account of capital allowances. 2. Until January 2021 the company has never been entitled to capital allowances as all assets were leased. On 15 January 2021 the company bought office equipment for 50,000, and a car with CO2 emissions of 102 grams per kilometre for 7,500. 3. There is a property business profit of 45,000 for the 12-month period ended 31 March 2021. 4. On 15 December 2020 the company disposed of some investments, and this resulted in a chargeable gain of 44,000. On 8 February 2021 the company made a further disposal and this resulted in a capital loss of 6,700. 5. Dividend income of 30,000 was received on 10 September 2020. 6. A qualifying charitable donation of 5,000 was made on 10 September 2020. As at 1 April 2020, S Ltd had unused trading losses of 330,000, and unused capital losses of 3,000. S Ltd will make a claim to relieve these losses as soon as possible where necessary. S Ltd has no related 51% group companies. Required: Calculate S Ltd's corporation tax liability in respect of the 12-month period ended 31 March 2021, and advise the company by when this should be paid.

Step by Step Solution

★★★★★

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

S Ltd Tax Computations for the Year Ended 31 March 2021 Trading Profits Taxadjusted trading profit 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started