Answered step by step

Verified Expert Solution

Question

1 Approved Answer

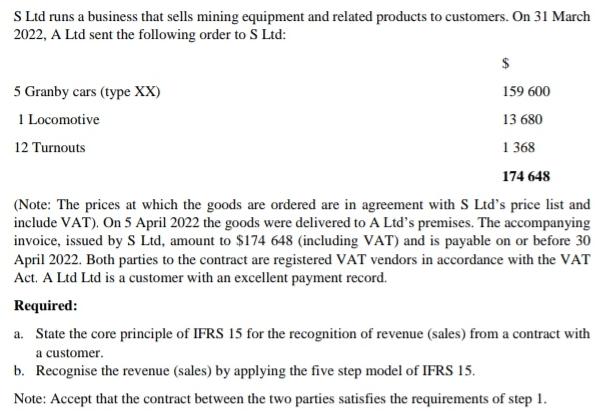

S Ltd runs a business that sells mining equipment and related products to customers. On 31 March 2022, A Ltd sent the following order

S Ltd runs a business that sells mining equipment and related products to customers. On 31 March 2022, A Ltd sent the following order to S Ltd: 5 Granby cars (type XX) 1 Locomotive 12 Turnouts $ 159 600 13 680 1368 174 648 (Note: The prices at which the goods are ordered are in agreement with S Ltd's price list and include VAT). On 5 April 2022 the goods were delivered to A Ltd's premises. The accompanying invoice, issued by S Ltd, amount to $174 648 (including VAT) and is payable on or before 30 April 2022. Both parties to the contract are registered VAT vendors in accordance with the VAT Act. A Ltd Ltd is a customer with an excellent payment record. Required: a. State the core principle of IFRS 15 for the recognition of revenue (sales) from a contract with a customer. b. Recognise the revenue (sales) by applying the five step model of IFRS 15. Note: Accept that the contract between the two parties satisfies the requirements of step 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Core Principle of IFRS 15 for Recognition of Revenue The core principle of IFRS 15 for the recognition of revenue from a contract with a customer is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started