Star Textiles is a cloth wholesale business in Mumbai, India, managed by Amir Chaudhary as sole proprietor. The company procures cloth from various suppliers who

Star Textiles is a cloth wholesale business in Mumbai, India, managed by Amir Chaudhary as sole proprietor. The company procures cloth from various suppliers who act as intermediaries between cloth manufacturers and wholesale businesses. Amir took on the responsibility of running the company at a young age when his father passed away in 2013.

It’s December 2018, and Amir is contemplating whether a new venture makes sense for Star Textiles. Though he’s been managing the family business in Mumbai as the chief executive for only five years, he has quickly learned the ins and outs of the business and expanded it, making some radical decisions. Currently, he’s considering a new plan that involves having cloth woven and dyed from various manufacturers directly instead of buying the cloth in bulk from suppliers. He had requested quotes from potential weaving and finishing partners and is now poring over the numbers to analyze his options.

Star Textiles was founded in 1987 by Azad Chaudhary. The family-owned company joined a small number of wholesale shopkeepers in Reddy Cloth Market (RCM) who sold cloth and related products to retailers in Mumbai. The merchants at this market bought cloth in bulk from various companies that specialized in procuring cloth from various manufacturers—primarily situated near the city of Nashik—and then separating the lots into smaller quantities and distributing them to retail businesses.

At that time, RCM had only a few hundred shops that operated at a wholesale level, the majority of which sold kurta pyjama fabric for men. (Kurta pyjama is a traditional Indian attire for men.) Although still developing, RCM was one of the biggest cloth wholesale markets in the Indian state of Maharashtra. The strong purchasing power of consumers, high demand for kurta pyjama, and low level of competition made the cloth business very attractive at that time.

Over the years, the dynamics of the wholesale market changed in Mumbai. Primarily because of good margins and very low barriers to entry, many people joined the cloth business. By 2018, RCM hosted more than 5,000 shops. At the same time, development of wholesale markets in different parts of the state of Maharashtra had diverted the flow of customers away from RCM.

Moreover, the nature of the business was highly commoditized. Manufacturers across almost all categories used certain standard construction styles of fabric. This made it easier for customers to compare prices across different qualities and buy from the cheapest available source. This intense competition compelled market players to discover all possibilities to access the cheapest way of procuring cloth.

One common method to expand a business was to offer easy credit terms. At its extreme, this could mean an accounts receivable turnover of 10 months or more. Such credit terms allowed wholesalers to enhance margins, as customers became relatively price-insensitive when they could pay the bill on easy terms. Yet there were a lot of challenges associated with selling on generous credit terms.

Due to high seasonal fluctuations in the retail sales over the year, customers were often unable to honor their commitment of payment terms. In addition, the flow of transactions wasn’t bill-to-bill (i.e., customers didn’t pay the first bill before placing a second order). In this way, some money was constantly tied up and couldn’t be included in the investment cycle of the business until that customer decided to pay the entire bill before making the next purchase. One important factor of this dynamic was the presence of the owner of the business in all dealings. When customers purchased from the owner directly, they paid their billing installments more quickly. But the owners and partners of the wholesale businesses had to keep a personal relationship with the buyers to ensure prompt payments.

This was the first big problem that Amir encountered when he took over running the business after his father was diagnosed with stage 4 cancer in mid-2013. The customers knew his father well but were evasive when Amir requested payments of outstanding bills. By 2018, Star Textiles was doing well financially but faced liquidity problems several times each year. The inventory was typically sold on credit of a month, but a shorter period or cash terms could be negotiated if Amir offered discounts.

With several suppliers to choose from, the customers of Star Textiles (i.e., cloth retailers) had an advantage in the negotiations. Amir had to continuously make visits to his customers to convince them to pay sooner. It was common for buyers to delay payments as much as possible, even sometimes refusing to pay altogether. Although the cloth was sold at a credit term of a month, it took buyers an average of two months to pay. And when a payment was made, it was usually paid in installments.

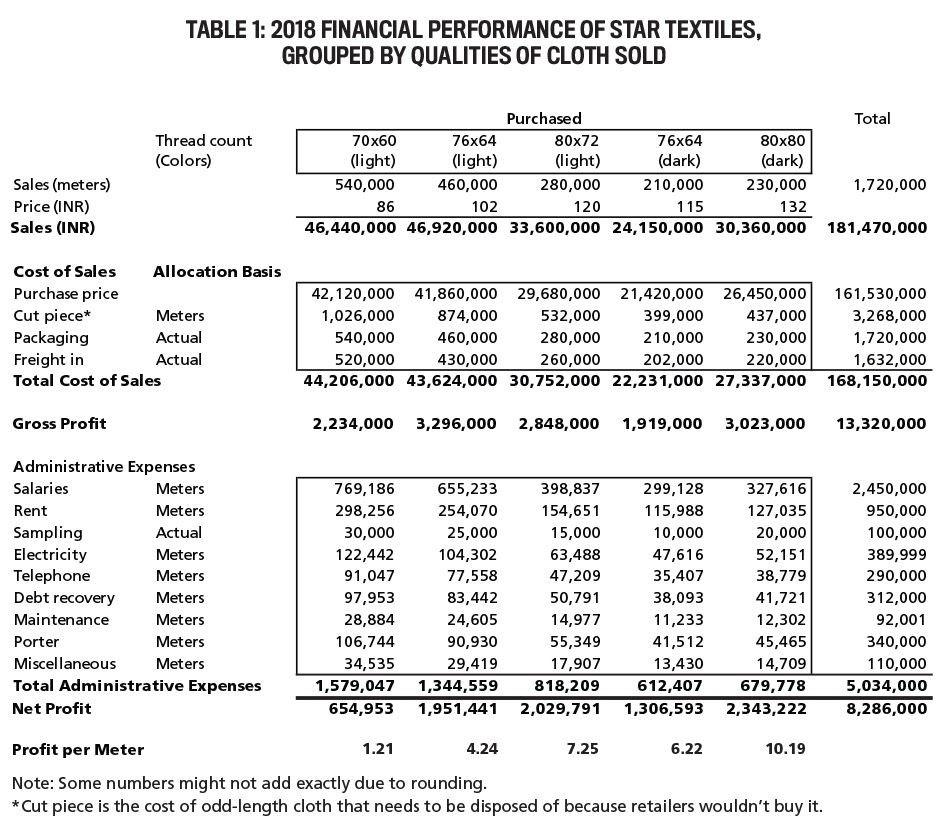

Retailers are financially unstable, and suppliers had little leverage over nonpaying customers. Sometimes, they had to hire people for debt recovery from buyers. Higher prices and increased supply in the market usually led to increased chances of slower payments or even nonpayment. Table 1 details Star Textiles’s financial results for 2018, categorized by the different qualities of cloth the business typically sells.

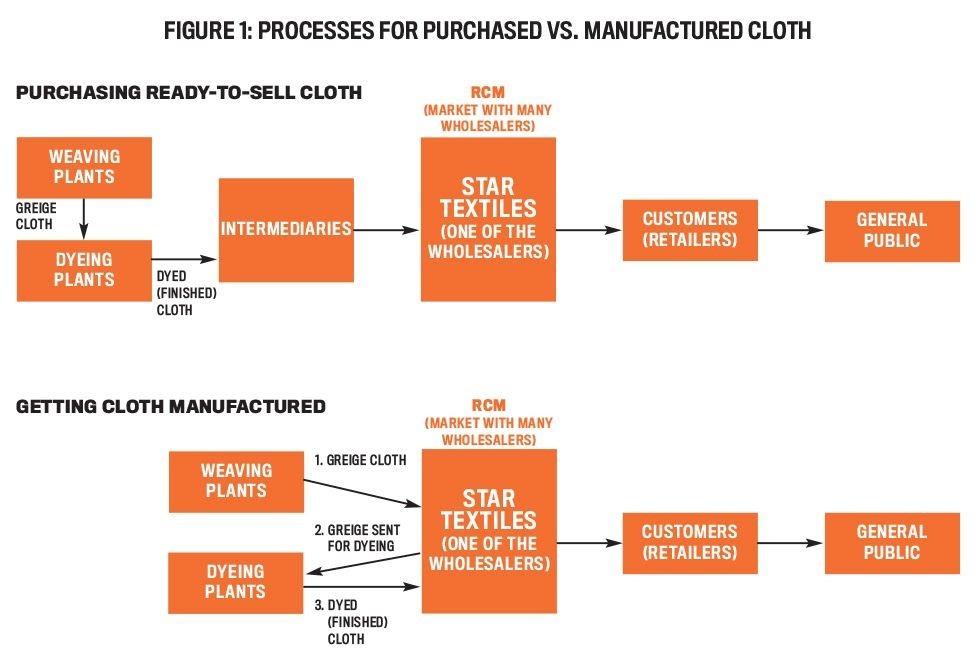

The current operating cycle for Star Textiles starts with securing quotes from intermediaries, which act as a link between manufacturers and Star Textiles. Then products of potential suppliers are checked, orders are placed, the cloth is received, sales are made to retailers, suppliers are paid, and eventually receivables are collected from the buyers.

Buying finished products from the intermediaries was a relatively simple process. Amir had to contact vendors for acquiring quotes and then visit them to negotiate the specifics of the order. Before placing the order, samples had to be sent to Star Textiles to be reviewed by management. This process would take a couple of days. The seller then delivered the order to Star Textiles’s warehouse.

Depending on the availability of the desired quality and colors, the average lead time from placing an order to receiving the cloth was about seven days. The cloth was bought at credit terms of about six weeks after receipt of the cloth. Star Textiles could order in quantities of 1,000 meters and specify quality and colors within one order. Inventory was kept at the warehouse or at the shop for 15 days on average before being sold.

The market was competitive, and businesses needed to order well in advance to ensure better-quality cloth ahead of busy seasons. The per-meter price of cloth varied by the quality and colors involved. For example, a 70-by-60 cloth with light colors could be bought at 78 Indian rupees (INR) per meter (1 INR = US$0.013). (Note: 70-by-60 is an example of thread count, which refers to the number of threads woven together in a square inch. It’s counted both lengthwise, called warp threads (70 in this case), and widthwise (60 in this case), called weft threads. The higher the thread count, the higher the quality of fabric and the smoother the

finish.)

The company had to arrange transportation of cloth to its warehouse, and such transportation costs average around 1 INR per meter. On average, such cloth was usually sold to retailers at a markup of about 10%, with credit terms of one month.

Over the last few weeks, Amir had pieced together information for Star Textiles to have its cloth manufactured instead of buying it from intermediaries. Amir had already contacted his bank, which was willing to finance his venture at an interest rate of 12%.

The operating and cash conversion cycle for manufacturing cloth differs from that for buying cloth. To have the cloth manufactured, Star Textiles would have to:

- Contact the broker for purchasing greige fabric (greige, or gray, fabric is unfinished woven fabric that has yet to be dyed or bleached),

- Order greige,

- Pay the greige supplier,

- Receive greige cloth,

- Send the cloth to a dyeing plant,

- Pay the dyeing bill,

- Receive the dyed cloth,

- Make the sale, and

- Receive money from the buyers.

The first step in the process of getting Star Textiles’s fabric manufactured was to buy the greige fabric from weaving mills. Weaving mills procure yarn from spinning mills and weave it into greige fabric, typically on order. If new to the market, a buyer would search for a well-reputed broker who can get greige fabric that matches the buyer’s requirements. The broker would charge the company 1% on the per-meter price of the greige fabric.

Buying greige wasn’t an easy task because the quality of the cloth from the loom weavers was inconsistent. For example, the weavers could claim that the thread they had used was of great quality, but, based on the look and feel of the fabric, customers could tell that the thread quality wasn’t as good as claimed. Because the looms require up-front payments, neither the weaver nor the broker would pay heed to claims made by the purchaser. A few existing big buyers in the market could retain a portion of the payment until the lot was dyed, and, if the fabric indicated any discrepancy from the specifications, the weaver would likely offer a discount. It was rare for a buyer to return the whole lot and get the cash reimbursed.

Another way to curb the problem of inconsistency was to hire a greige checker who would visit the loom facility and check the greige before it was sent for dyeing. A checker typically charged 0.20 INR per meter. Checkers, however, could turn out to be corrupt, as they might make a deal with the weaver to approve a defected lot.

The factors affecting greige costs include:

- Thread count (including warp and weft) of the greige.

- Quality of thread used. The quality depends on the manufacturer of the yarn and the composition of yarn (for example, 80% polyester and 20% viscose).

- The width of greige. Typically, 61 inches of greige was used, which shrinks to 54 inches after being dyed. A single suit requires about 4 meters of 54-inch-wide fabric.

- The quality of loom used to weave the cloth. The loom is a machine that weaves the cloth using yarn, and the quality of the cloth produced heavily depends on the technological features of the loom. A power loom is the cheapest, whereas an air jet is the most expensive type of loom used in India. Other commonly used types of looms include shutterless and rapier.

- Brand name of the cloth manufacturer. Some weaving mills sell greige cloth under their brand name, but others manufacture unbranded cloth for dyeing and finishing mills on order. Brand name has significant impact on the price of the cloth since customers could expect relatively greater consistency in quality compared to unbranded cloth.

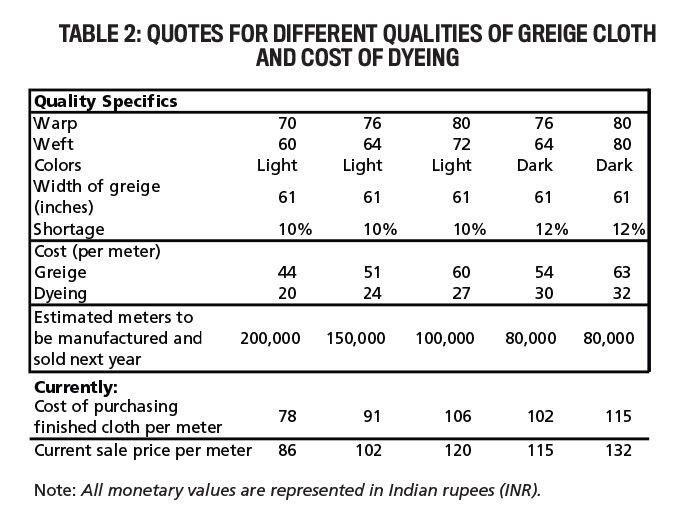

The whole process of placing the order with the looms and receiving greige cloth takes about a week. The greige cloth is then sent to the dyeing plants. The cost of getting the cloth dyed was one of the most significant costs after acquiring the greige. There were hundreds of dyeing plants in Nashik, Mumbai, and Gujarat, which offered different prices for different types of greiges. The dyeing cost typically varied with thread count of the greige and required color of the dyed fabric.

The difference in rates for a specific greige could also be enormous, depending on the quality of dyeing plants. For a certain greige, Al-Rahim Dyeing of Nashik (arguably the best dyeing plant in Nashik) charges 27 INR per meter. For the same greige, Lakhany Dyeing of Gujrat (the best dyeing plant in Maharashtra for wash-and-wear clothing) charges 60 INR per meter. Superior-quality greiges, woven by air jet looms, were sent to Lakhany. Greiges of power and shutterless looms were sent to Nashik dyeing plants.

The dyeing plants take orders in batches of 1,000 meters and demand payment up front. During the process, the cloth also experiences a shortage(i.e., shrinkage), which is the approximate percentage of cloth length that’s lost during the dyeing process. If the anticipated shortage is 10%, for example, then 100 meters of cloth will shorten to 90 meters after the processing. Shrinkage in width doesn’t matter since the greige cloth is manufactured at a width that anticipates it.

Dark colors (i.e., black, dark blue, or dark gray) are reactive, which means they’re relatively more expensive to dye and also end up with greater shortage compared to light-colored fabrics. In case the manufacturer wanted to produce the product in vat colors, which can endure more washes, the dyeing rate could increase up to 40 INR per meter. Finally, the dyed cloth is brought to the warehouse, where it’s checked for quality and packed into thaans (20- to

24-meters of cloth packaged into a roll around a piece of cardboard) for sale to retailers.

The process of dyeing the cloth takes about a week. A single bundle of summer wash-and-wear cloth is about 700 meters. But a single lot of 10 colors will be no less than 10,000 meters. A typical single production run of dyeing ranges from 1,000 to 1,400 meters for one color depending on the dyeing facility. Sometimes, the dyed cloth reveals poor fiber quality or damage received during the weaving or dyeing processes. Buyers have little recourse in these situations and have to take a financial hit by selling this cloth as damaged product.

All this effort could result in greater margins than buying cloth from vendors, which could also lead to better prices for customers. When Amir requested several quotes from weavers and dyeing units for their pricing, however, he claimed that he wanted to sell quality cloths rather than generic pieces of cloth.

Amir started reviewing the quotes he received for greige cloth and dyeing, as shown in Table 2. The table also lists the average cost and sale price of buying this quality of cloth from retailers instead of having it manufactured as well as the estimated number of meters that Star Textiles can get manufactured. The limitation on capacity means that Star Textiles might not be able to fulfill its total needs through manufactured cloth. The rest of the demand would be fulfilled by continuing to buy the cloth from suppliers.

Amir considered the two processes (see Figure 1). He estimated that other costs would remain more or less similar for the cloth he was going to get manufactured except for:

- A 50% increase in packaging cost per meter;

- Transportation costs, which would double (because the cloth has to move to several locations before being brought to the shop); and

- A 50% increase in sampling costs per meter. Sampling refers to the cost of a few pieces of cloth sent to current and potential customers for business development. Sometimes the buyers would send an experienced person to verify quality of the merchandise, and the buyer and seller would share the cost.

Amir was also aware of the fact that, at least for an initial period, he might not be able to sell the manufactured cloth at the same price and would need to offer a discount of about 2.5%. He would also need to hire two assistants, each at a salary of 20,000 INR per month, to help with the added workload. Considering that these costs weren’t substantial compared with the cost of goods sold, it seemed sensible to go ahead with the plan. But he wanted to go through the numbers in detail before he made a decision.

Amir also knew that he may not be able to increase the total number of meters sold to customers in the coming year, but things might change once customers recognize the improved quality of his offerings. He has asked your help in analyzing the financial and nonfinancial considerations of getting cloth manufactured rather buying it from suppliers.

- Use Table 1 to calculate the profit per meter if Amir decides to get the amount of the cloth shown in Table 2 manufactured instead of buying it from suppliers.

- How would Amir go about making this decision based on a differential/incremental profit basis?

- What other financial and nonfinancial considerations should Amir consider in making this decision?

- What course of action would you recommend?

PURCHASING READY-TO-SELL CLOTH WEAVING PLANTS GREIGE CLOTH FIGURE 1: PROCESSES FOR PURCHASED VS. MANUFACTURED CLOTH DYEING PLANTS DYED (FINISHED) CLOTH INTERMEDIARIES GETTING CLOTH MANUFACTURED WEAVING PLANTS DYEING PLANTS 1. GREIGE CLOTH 2. GREIGE SENT FOR DYEING 3. DYED (FINISHED) CLOTH RCM (MARKET WITH MANY WHOLESALERS) STAR TEXTILES (ONE OF THE WHOLESALERS) RCM (MARKET WITH MANY WHOLESALERS) STAR TEXTILES (ONE OF THE WHOLESALERS) CUSTOMERS (RETAILERS) CUSTOMERS (RETAILERS) GENERAL PUBLIC GENERAL PUBLIC Sales (meters) Price (INR) Sales (INR) Cost of Sales Purchase price Gross Profit TABLE 1: 2018 FINANCIAL PERFORMANCE OF STAR TEXTILES, GROUPED BY QUALITIES OF CLOTH SOLD Thread count (Colors) Cut piece* Packaging Freight in Total Cost of Sales Allocation Basis Meters Actual Actual Administrative Expenses Salaries Meters Rent Meters Actual Sampling Electricity Telephone Debt recovery Maintenance Porter Miscellaneous Total Administrative Expenses Net Profit Meters Meters Meters Meters Meters Meters 70x60 (light) 540,000 86 76x64 (light) 460,000 102 769,186 298,256 30,000 122,442 91,047 97,953 28,884 106,744 34,535 1,579,047 654,953 42,120,000 41,860,000 29,680,000 21,420,000 26,450,000 1,026,000 874,000 532,000 399,000 437,000 540,000 460,000 280,000 210,000 230,000 430,000 260,000 202,000 220,000 520,000 44,206,000 43,624,000 30,752,000 22,231,000 27,337,000 Purchased 46,440,000 46,920,000 33,600,000 24,150,000 30,360,000 181,470,000 655,233 254,070 25,000 104,302 77,558 83,442 24,605 90,930 29,419 80x72 (light) 280,000 120 1,344,559 1,951,441 2,234,000 3,296,000 2,848,000 1,919,000 3,023,000 13,320,000 4.24 76x64 (dark) 210,000 115 398,837 154,651 80x80 (dark) 230,000 132 7.25 299,128 115,988 15,000 10,000 63,488 47,616 47,209 35,407 50,791 38,093 14,977 11,233 12,302 55,349 41,512 45,465 17,907 13,430 14,709 612,407 679,778 818,209 2,029,791 1,306,593 2,343,222 Profit per Meter 1.21 Note: Some numbers might not add exactly due to rounding. *Cut piece is the cost of odd-length cloth that needs to be disposed of because retailers wouldn t buy it. 6.22 327,616 127,035 20,000 52,151 38,779 41,721 Total 10.19 1,720,000 161,530,000 3,268,000 1,720,000 1,632,000 168,150,000 2,450,000 950,000 100,000 389,999 290,000 312,000 92,001 340,000 110,000 5,034,000 8,286,000 TABLE 2: QUOTES FOR DIFFERENT QUALITIES OF GREIGE CLOTH AND COST OF DYEING Quality Specifics Warp Weft Colors Width of greige (inches) Shortage Cost (per meter) Greige Dyeing Estimated meters to be manufactured and sold next year 70 60 Light 61 10% 44 20 200,000 76 64 Light 61 10% 51 24 150,000 80 72 Light 61 10% 91 102 60 27 76 64 Dark 61 12% 54 30 Currently: Cost of purchasing finished cloth per meter 78 Current sale price per meter 86 Note: All monetary values are represented in Indian rupees (INR). 106 120 100,000 80,000 80,000 80 80 Dark 61 12% 102 115 63 32 115 132

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 As per conclusion of the figures seen excel sheet Amir will earn higher net profit with every thre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

61af4d9ee769d_85893.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started