Question

s Marc Goudreau, administrator of Clearwater Hospital, was puzzled by the prior months reports. Every month, its anyones guess whether the lab will show a

s

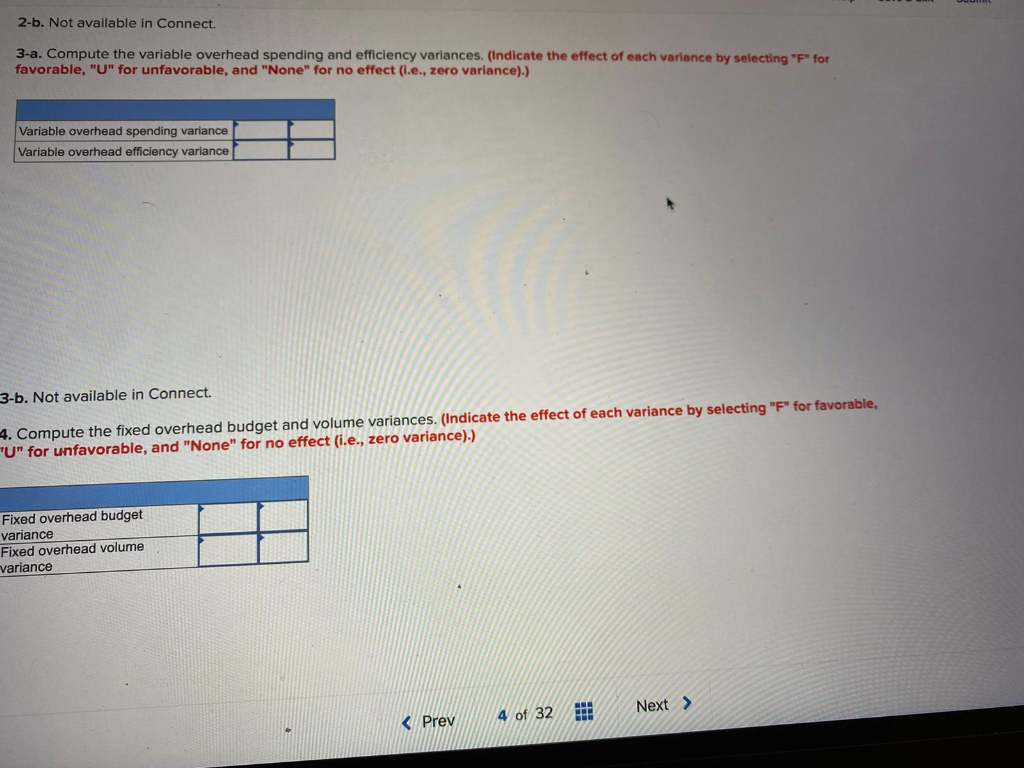

Marc Goudreau, administrator of Clearwater Hospital, was puzzled by the prior months reports. Every month, its anyones guess whether the lab will show a profit or a loss. Perhaps the only answer is to increase our lab fees again. We cant, replied Rhoda Groves, the controller. There are still a lot of complaints about the last increase, particularly from the insurance companies and government health units. Theyre now paying only about 82% of what we bill. Im beginning to think the problem is on the cost side. To determine if the Clearwater lab costs are in line with those of other hospital labs, Goudreau has asked you to evaluate the costs for the past month. Groves has provided you with the following information: Two basic types of tests are performed in the labsmears and blood tests. During the past month, 2,400 smears and 600 blood tests were performed in the lab. Small glass plates are used in both types of tests. During the past month, the hospital purchased 20,000 plates at a cost of $42,240. This cost is net of a 4% purchase discount. A total of 2,000 of these plates were unused at the end of the month; no plates were on hand at the beginning of the month. During the past month, 1,200 hours of labour time were used in performing smears and blood tests. The cost of this labour time was $11,700.00. The labs variable overhead cost last month totalled $5,630. Fixed overhead cost last month totalled $13,000. Clearwater Hospital has never used standard costs. By searching industry literature, however, you have determined the following nationwide averages for hospital labs: Plates: Three plates are required per lab test. These plates cost $2.20 each and are disposed of after the test is completed. Labour: Each smear should require 0.3 hours to complete, and each blood test should require 0.6 hours to complete. The average cost of this lab time is $12 per hour. Overhead: Overhead cost is based on direct labour-hours. The average rate of variable overhead is $4 per hour. The average rate of fixed overhead is $10 per hour. These rates are based on a denominator activity level of 1,250 hours per month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started