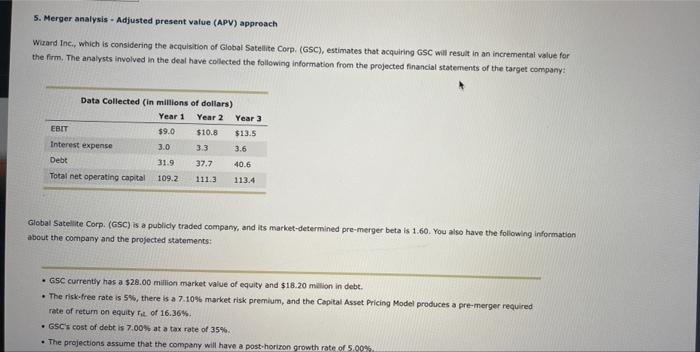

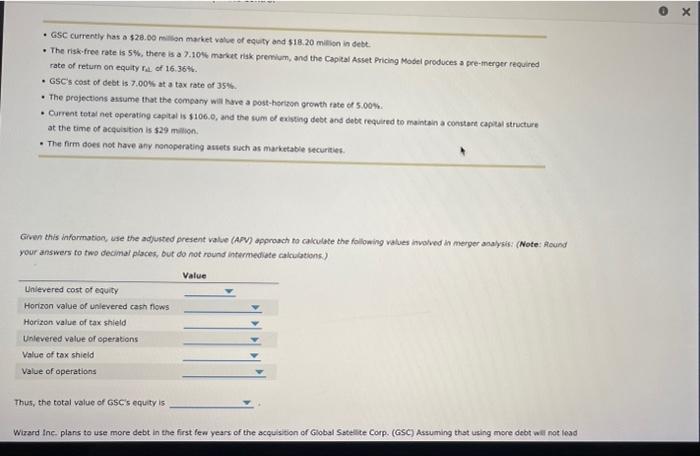

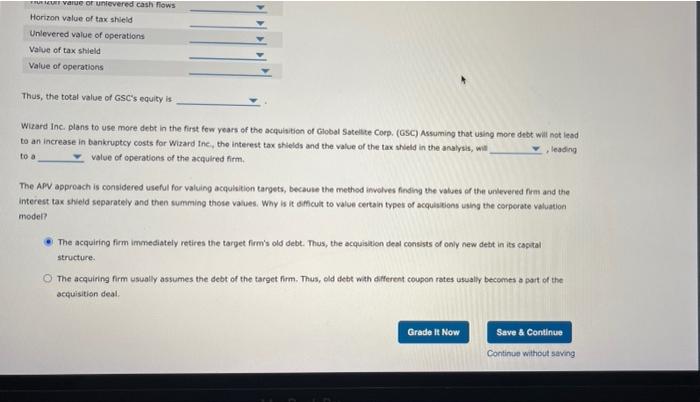

S. Merger analysis - Adjusted present value (APV) approach Wizard Inc., which is considering the acquisition of Global Satellite Corp. (GSC), estimates that acquiring GSC will result in an incremental value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target company Data Collected (in millions of dollars) Year 1 Year 2 Year 3 EBIT $9.0 $10.8 $13.5 3.0 3.6 Debt 31.9 37.7 40.6 Total net operating capital 109.2 1113 113.4 Interest expense 33 Global Satellite Corp. (GSC) is a publicly traded company, and its market-determined pre-merger beta is 1.60 You also have the following information about the company and the projected statements: GSC currently has a $28.00 million market value of equity and $18.20 million in debt. The risk-free rate is 5%, there is a 7.10% market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity rol of 16.36%. GSC's cost of debt is 7.00% at a tax rate of 35% The projections assume that the company will have a post-horizon growth rate of 5.00% GSC currently has a $28.00 million market value of equity and $18.20 million in debt The risk-free rate is 5%, there is a 7.10% matrisk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity of 16.36% GSC's cost of debt is 7.00% at a tax rate of 35% The projections assume that the company will have a post-horison growth rate of 5.00% . Current total net operating capital is $106.0, and the sum of existing debt and debe required to maintain a constant capital structure at the time of acquisition is $29 million . The firm does not have any nonoperating assets such as marketable securities Given this information, use the adjusted present value (APV) approach to calculate the following values involved in merger analysis: (Note: Round your answers to two decimal places, but do not round intermediate calculations) Value Unlevered cost of equity Horizon value of unlevered cash flows Horizon value of tax shield Unlevered value of operations Value of tax shield Value of operations Thus, the total value of GSC's equity is Wizard Inc. plans to use more debt in the first few years of the acquisition of Global Satellite Corp. (GSC) Assuming that using more debt wif not load Tvare of unlevered cash flows Horizon value of tax shield Unlevered value of operations Value of tax shield Value of operations Thus, the total value of GSC's equity is Wizard Inc. plans to use more debt in the first few years of the acquisition of Global Satellite Corp. (GSC) Assuming that using more debt will not lead to an increase in bankruptcy costs for Wizard tre, the interest tax shields and the value of the tax shield in the analysis, will leading value of operations of the acquired firm. to a The APV approach is considered useful for valuing acquisition targets, because the method involves finding the values of the unlevered from and the Interest tax shield separately and then summing those values. Why is it dificult to value certain types of acquisitions using the corporate valuation model? The acquiring firm immediately retires the target firm's old debt. Thus, the acquisition des consists of only new debt in its capital structure. The acquiring firm usually assumes the debt of the target firm. Thus, old debt with different coupon rates usually becomes a part of the acquisition deal Grade It Now Save & Continue Continue without saving