Answered step by step

Verified Expert Solution

Question

1 Approved Answer

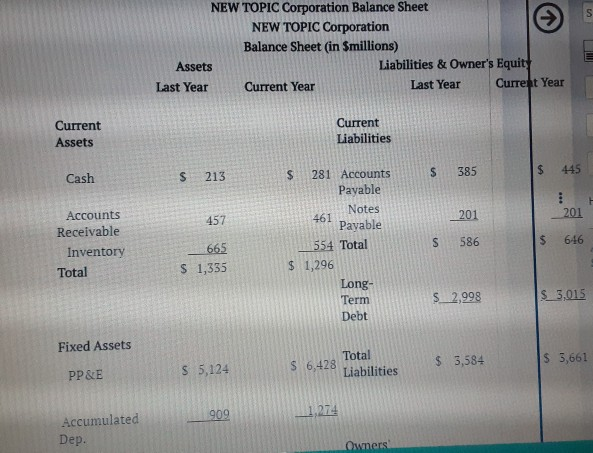

S NEW TOPIC Corporation Balance Sheet NEW TOPIC Corporation Balance Sheet (in Smillions) Assets Liabilities & Owner's Equity Last Year Current Year Last Year Current

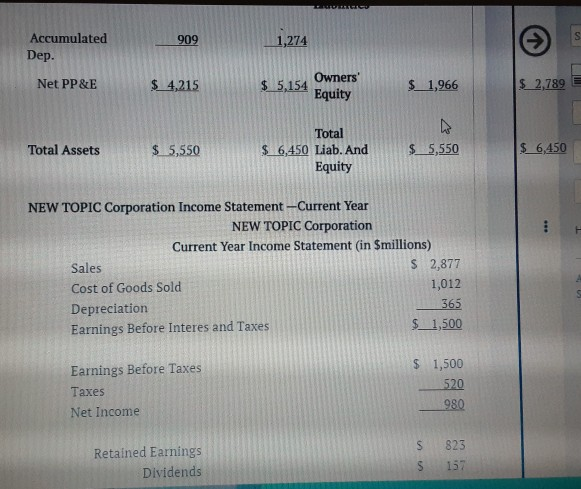

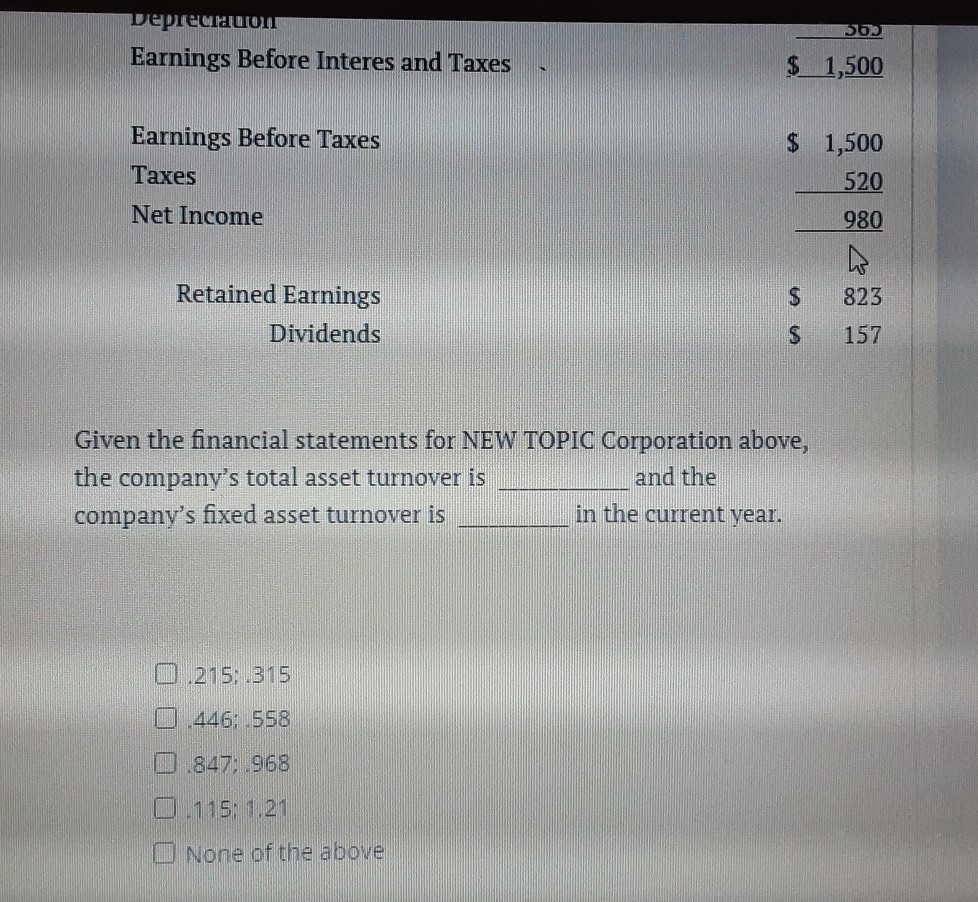

S NEW TOPIC Corporation Balance Sheet NEW TOPIC Corporation Balance Sheet (in Smillions) Assets Liabilities & Owner's Equity Last Year Current Year Last Year Current Year Current Assets Current Liabilities $ S 385 $ Cash $ 213 445 281 Accounts Pavable Notes 461 Payable 554 Total 457 201 201 Accounts Receivable Inventory Total S 586 $ 646 665 $ 1,335 $ 1,296 Long- Term Debt $ 2,998 $_3,015 Fixed Assets S 6,428 Total Liabilities $ 3,584 5,661 $ 5,124 PP&E 909 1,274 Accumulated Dep. Owners S 909 Accumulated Dep. 1,274 Net PP&E $ 4,215 $ 5,154 Owners' Equity $ 1,966 $ 2,789 Total Assets $ 5,550 Total $ 6,450 Lab. And Equity $_5,550 $ 6,450 NEW TOPIC Corporation Income Statement-Current Year NEW TOPIC Corporation Current Year Income Statement (in $millions) Sales $ 2,877 Cost of Goods Sold 1,012 Depreciation 365 Earnings Before Interes and Taxes $_1,500 Earnings Before Taxes Taxes Net Income $ 1,500 520 980 Retained Earnings Dividends $ 823 157 S SO Deprecauon Earnings Before Interes and Taxes $ 1,500 Earnings Before Taxes Taxes Net Income $ 1,500 520 980 w 823 $ Retained Earnings Dividends S 157 Given the financial statements for NEW TOPIC Corporation above, the company's total asset turnover is and the company's fixed asset turnover is in the current year. 0 215: 315 U 446: 558 1 847 968 115: 1,21 None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started