Answered step by step

Verified Expert Solution

Question

1 Approved Answer

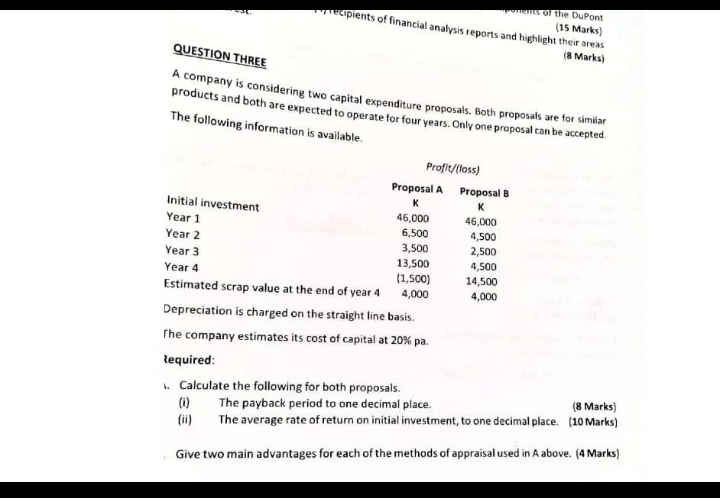

S of the DuPont (15 Marks) hecipients of financial analysis reports and highlight their areas (8 Marks) QUESTION THREE A company is considering two capital

S of the DuPont (15 Marks) hecipients of financial analysis reports and highlight their areas (8 Marks) QUESTION THREE A company is considering two capital expenditure proposals. Both proposals are for similar products and both are expected to operate for four years. Only one proposal can be accepted. The following information is available. Initial investment Profit/(ass) Proposal A Proposal K Year 1 46,000 46,000 Year 2 6,500 4,500 Year 3 3,500 2,500 Year 4 13,500 4,500 (1,500) 14,500 Estimated scrap value at the end of year 4 4,000 4,000 Depreciation is charged on the straight line basis. The company estimates its cost of capital at 20% pa. Required: Calculate the following for both proposals. (i) The payback period to one decimal place. (8 Marks) The average rate of return on initial investment, to one decimal place. (10 Marks) Give two main advantages for each of the methods of appraisal used in A above. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started