Answered step by step

Verified Expert Solution

Question

1 Approved Answer

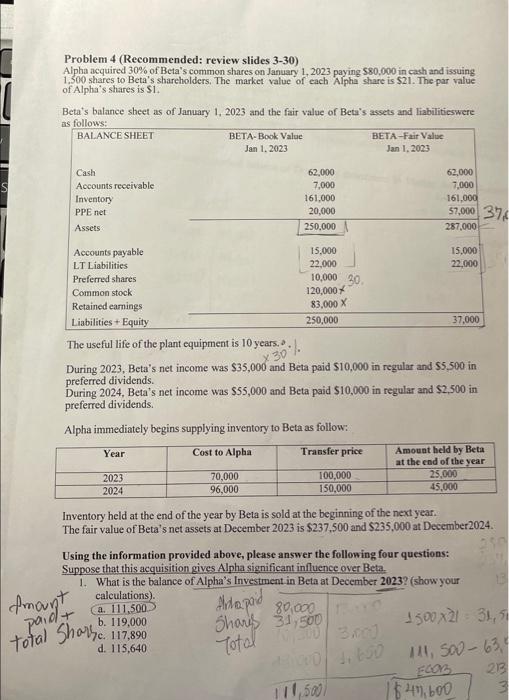

S Problem 4 (Recommended: review slides 3-30) Alpha acquired 30% of Beta's common shares on January 1, 2023 paying $80,000 in cash and issuing 1,500

S Problem 4 (Recommended: review slides 3-30) Alpha acquired 30% of Beta's common shares on January 1, 2023 paying $80,000 in cash and issuing 1,500 shares to Beta's shareholders. The market value of each Alpha share is $21. The par value of Alpha's shares is $1. Beta's balance sheet as of January 1, 2023 and the fair value of Beta's assets and liabilitieswere as follows: BALANCE SHEET Cash Accounts receivable Inventory PPE net Assets Accounts payable LT Liabilities Preferred shares Common stock Retained earnings Liabilities + Equity Year BETA-Book Value Jan 1, 2023 2023 2024 1. 62,000 7,000 161,000 20,000 250,000 Alpha immediately begins supplying inventory to Beta as follow: Cost to Alpha 70,000 96,000 (a. 111,500 Amount total Shorre: 117.890 b. 119,000 7c. d. 115,640 15,000 22,000 10,000 30, 120,000 X 83,000 X 250,000 The useful life of the plant equipment is 10 years. During 2023, Beta's net income was $35,000 and Beta paid $10,000 in regular and $5,500 in preferred dividends. x 30 During 2024, Beta's net income was $55,000 and Beta paid $10,000 in regular and $2,500 in preferred dividends. Transfer price BETA-Fair Value Jan 1, 2023 100,000 150,000 62,000 7,000 161,000 57,000 37,0 287,000 15,000 22,000 370 13.000 10,500 3.000 13.000 1.650 111,500/ 37,000 Inventory held at the end of the year by Beta is sold at the beginning of the next year. The fair value of Beta's net assets at December 2023 is $237,500 and $235,000 at December2024. Amount held by Beta at the end of the year 25,000 45,000 Using the information provided above, please answer the following four questions: Suppose that this acquisition gives Alpha significant influence over Beta. 1. What is the balance of Alpha's Investment in Beta at December 2023? (show your calculations). Aloha paid Shares 31,500 80,000 Total 1847, 600 250 937, 13 1500x21= 31,50 111, 500-63,0 213 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started