Answered step by step

Verified Expert Solution

Question

1 Approved Answer

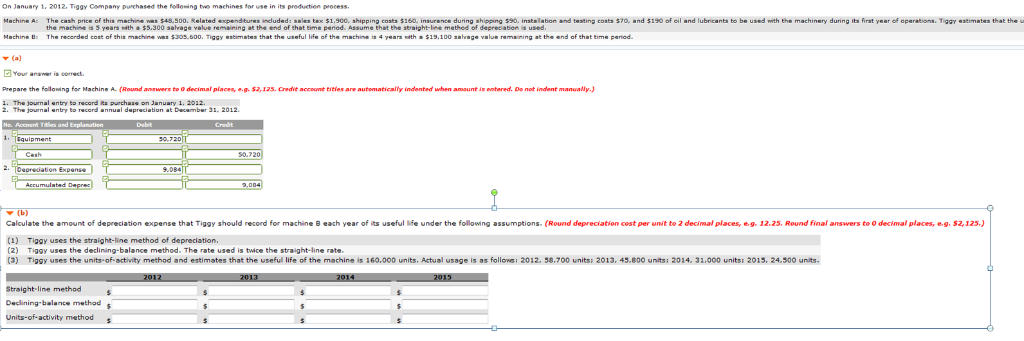

s production process. On January 1, 2012. Tiggy Company hased nachin or use Machine A The cash price of this machine was $48.50o. Related expenditures

s production process. On January 1, 2012. Tiggy Company hased nachin or use Machine A The cash price of this machine was $48.50o. Related expenditures induded: sales tax $1,900, shipping costs $160. insurance during shipping $90, instalabion and teating costs $70, and $190 of oil and lubricants to be used with the machinery during its firat year of operations. Tiggy eatimates that the u Marhine B end of that time paned. (a) Your anawer is correct Prepare the folloning for Machine A (Round answers to 0 decimal places, e.g. $2,125. Credit accoont tieles are automatically indented when amount is entered. Do not indent manually.) The igurnal untry to record annual depraciation at December 31, 2012 No. Account Titles and Explanation Debit rediti s0,720 1. TEquipment s0.72 Cash Oeprediation Expenss 9.084 T Accumulated Depre 9.004 (b) Calculate the amount depreciation expense that Tiggy should record for machine B each year f its useful e under the following assumptions. (Round depreciation cest per unit to 2 decimal places, e.g. 12.25. Round final answers to 0 decimal places, e.q. $2,125.) (1) e straight-line method of depreciation. Tipgy uses t e units-of-activity method and estimates that the useful life of the machine is 160.000 units. Actual usage is as follone: 2012. 58.700 units: 2013, 45.800 units: 2014, 31.000 units: 2015 ,500 units 2012 2013 2014 2015 Straight-line method Declining-balance method Units-of-activity method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started