Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S - Protected ViewSaved to this PC Search (Alt+0) Idan Elmakiyes References Mailings Review View Help ntain viruses. Unless you need to edit, it's safer

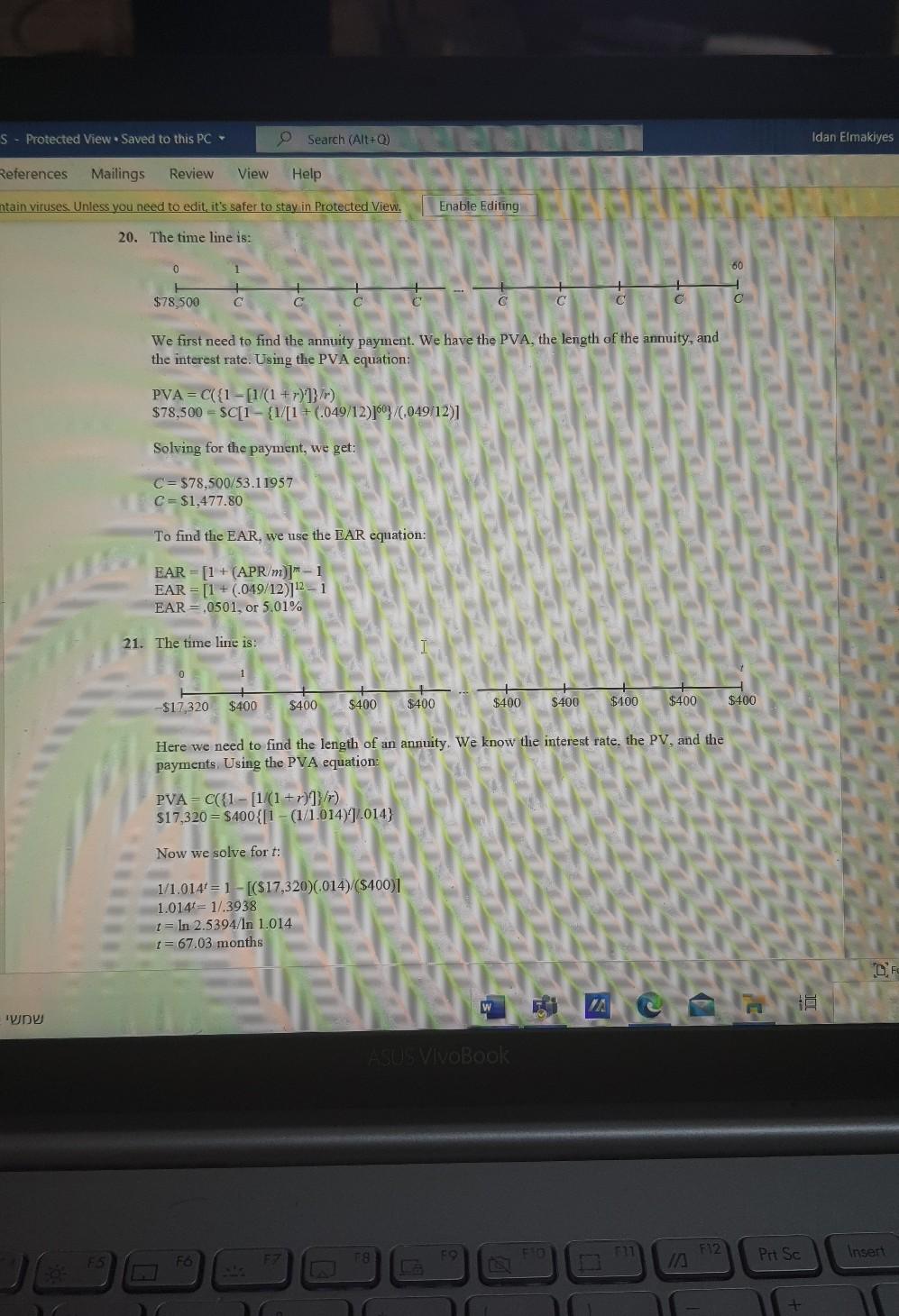

S - Protected ViewSaved to this PC Search (Alt+0) Idan Elmakiyes References Mailings Review View Help ntain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 20. The time line is: 0 60 $78,500 C C c C C We first need to find the annuity payment. We have the PVA, the length of the annuity, and the interest rate. Using the PVA equation: PVA = C({1-[1/(1 + r)]}/-) $78,500 = SC[1- {1/[1 + 0.049/12)]}/(.049/12) Solving for the payment, we get: C= $78,500/53.11957 C=$1,477.80 To find the EAR, we use the EAR equation: EAR = [1 + (APR/m) - 1 EAR = [1 + (.019/12)]12-1 EAR = .0501, or 5.01% 21. The time line is: $17,320 $400 $400 $400 $400 $400 $400 $100 $400 $400 Here we need to find the length of an annuity. We know the interest rate, the PV, and the payments Using the PVA equation: PVA = C({1- [1(1+r)1}/r) $17,320 = $400{[1 -(1/1.014)1.014) Now we solve fort: 1/1.0141 = 1 -[($17,320)(014) ($400) 1.0141=1/.3938 1 = In 2.5394/1n 1.014 1= 67.03 months w VA VOBOO FO F F F12 Insert Prt Sc JA + S - Protected ViewSaved to this PC Search (Alt+0) Idan Elmakiyes References Mailings Review View Help ntain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 20. The time line is: 0 60 $78,500 C C c C C We first need to find the annuity payment. We have the PVA, the length of the annuity, and the interest rate. Using the PVA equation: PVA = C({1-[1/(1 + r)]}/-) $78,500 = SC[1- {1/[1 + 0.049/12)]}/(.049/12) Solving for the payment, we get: C= $78,500/53.11957 C=$1,477.80 To find the EAR, we use the EAR equation: EAR = [1 + (APR/m) - 1 EAR = [1 + (.019/12)]12-1 EAR = .0501, or 5.01% 21. The time line is: $17,320 $400 $400 $400 $400 $400 $400 $100 $400 $400 Here we need to find the length of an annuity. We know the interest rate, the PV, and the payments Using the PVA equation: PVA = C({1- [1(1+r)1}/r) $17,320 = $400{[1 -(1/1.014)1.014) Now we solve fort: 1/1.0141 = 1 -[($17,320)(014) ($400) 1.0141=1/.3938 1 = In 2.5394/1n 1.014 1= 67.03 months w VA VOBOO FO F F F12 Insert Prt Sc JA +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started