Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S Suppose we think we can sell 50,000 cans of shark attractant per year at a price of $4 per can. It costs us

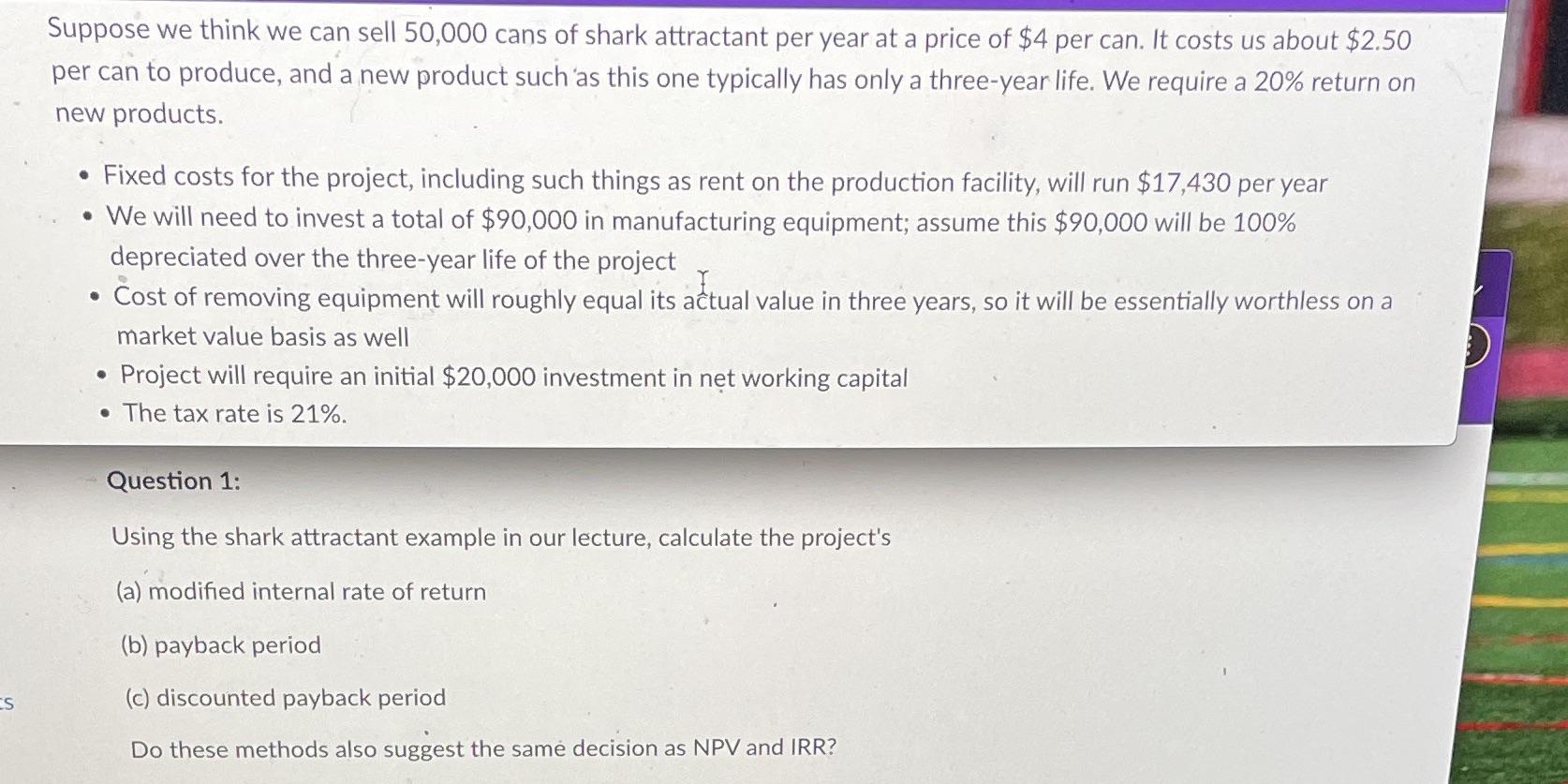

S Suppose we think we can sell 50,000 cans of shark attractant per year at a price of $4 per can. It costs us about $2.50 per can to produce, and a new product such as this one typically has only a three-year life. We require a 20% return on new products. Fixed costs for the project, including such things as rent on the production facility, will run $17,430 per year . We will need to invest a total of $90,000 in manufacturing equipment; assume this $90,000 will be 100% depreciated over the three-year life of the project Cost of removing equipment will roughly equal its actual value in three years, so it will be essentially worthless on a market value basis as well Project will require an initial $20,000 investment in net working capital The tax rate is 21%. Question 1: Using the shark attractant example in our lecture, calculate the project's (a) modified internal rate of return (b) payback period (c) discounted payback period Do these methods also suggest the same decision as NPV and IRR?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the modified internal rate of return MIRR payback period and discounted payback period for the shark attractant project we need to first calculate the projects cash flows We can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started