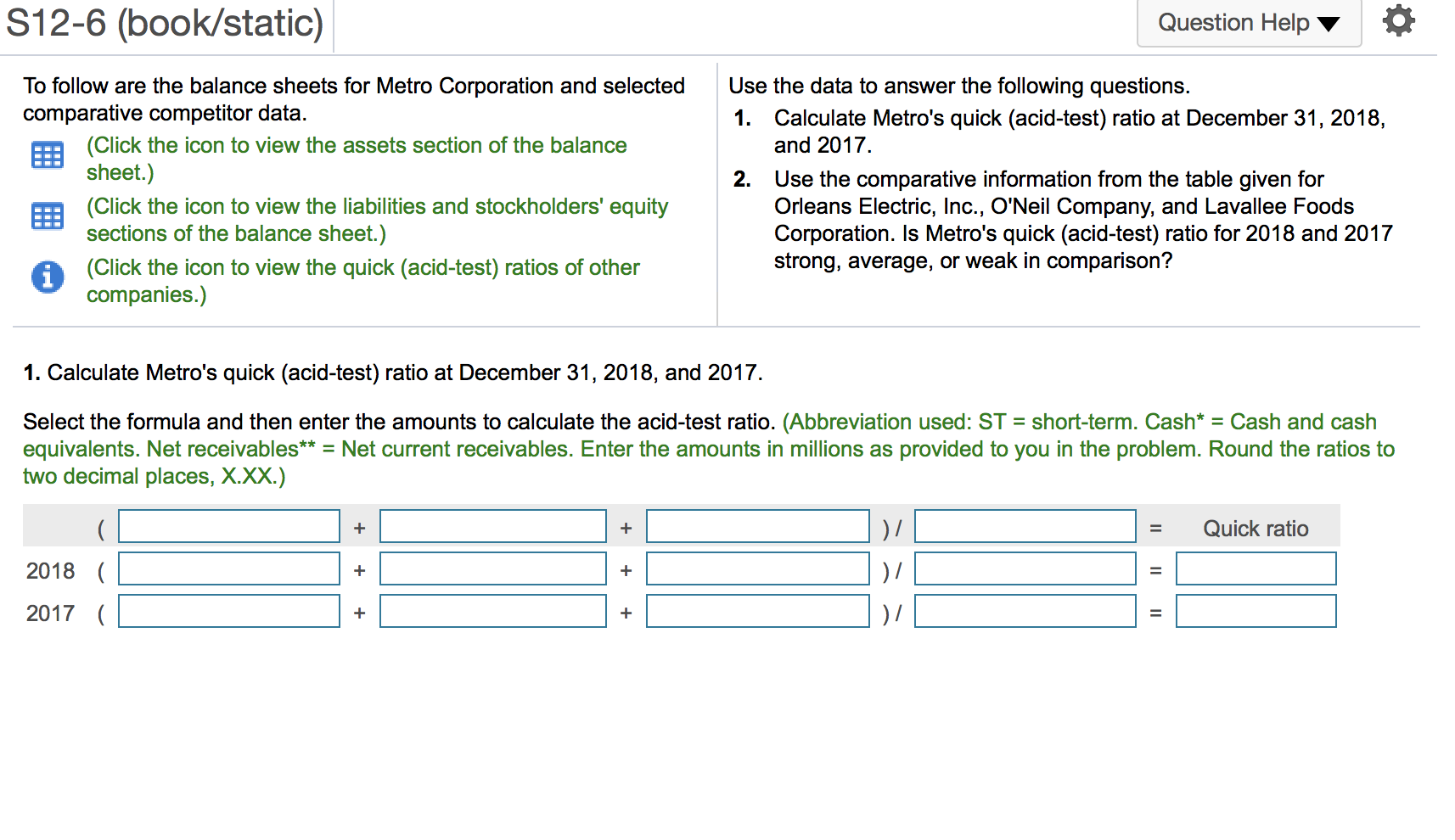

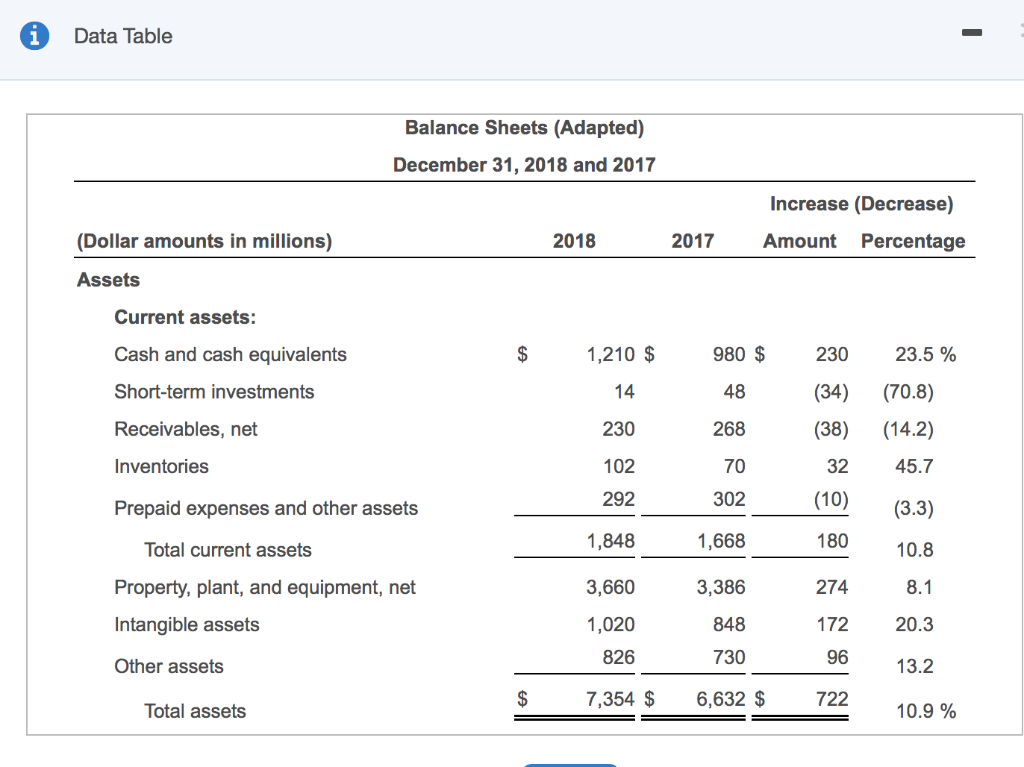

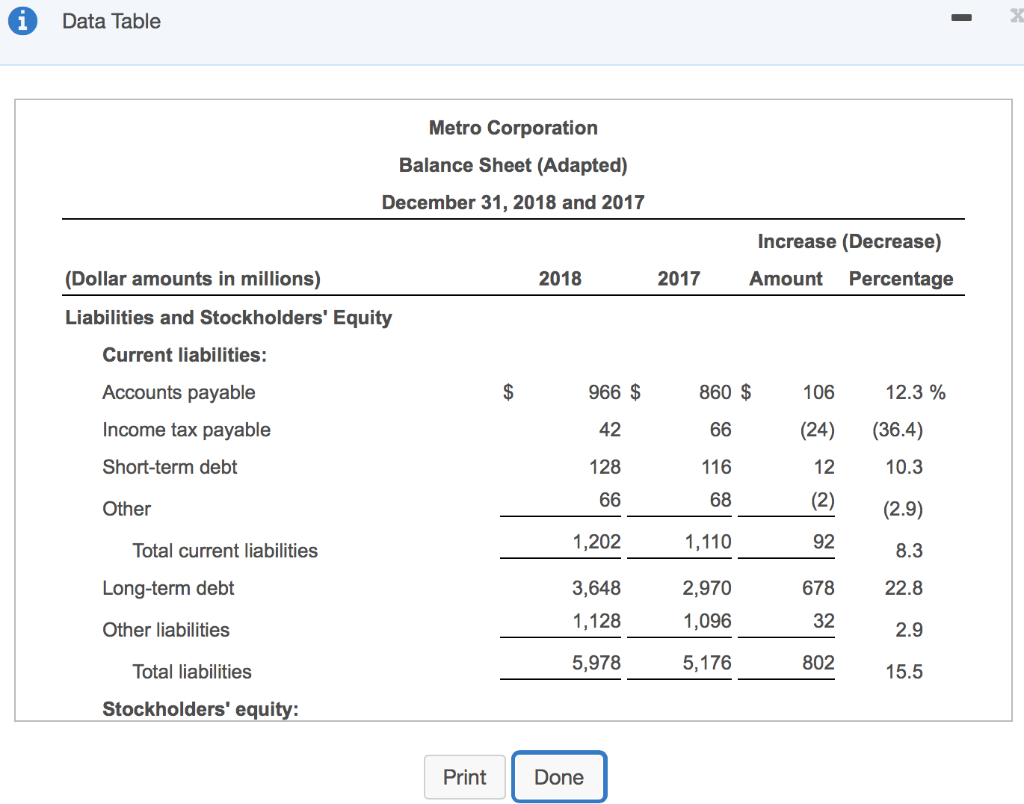

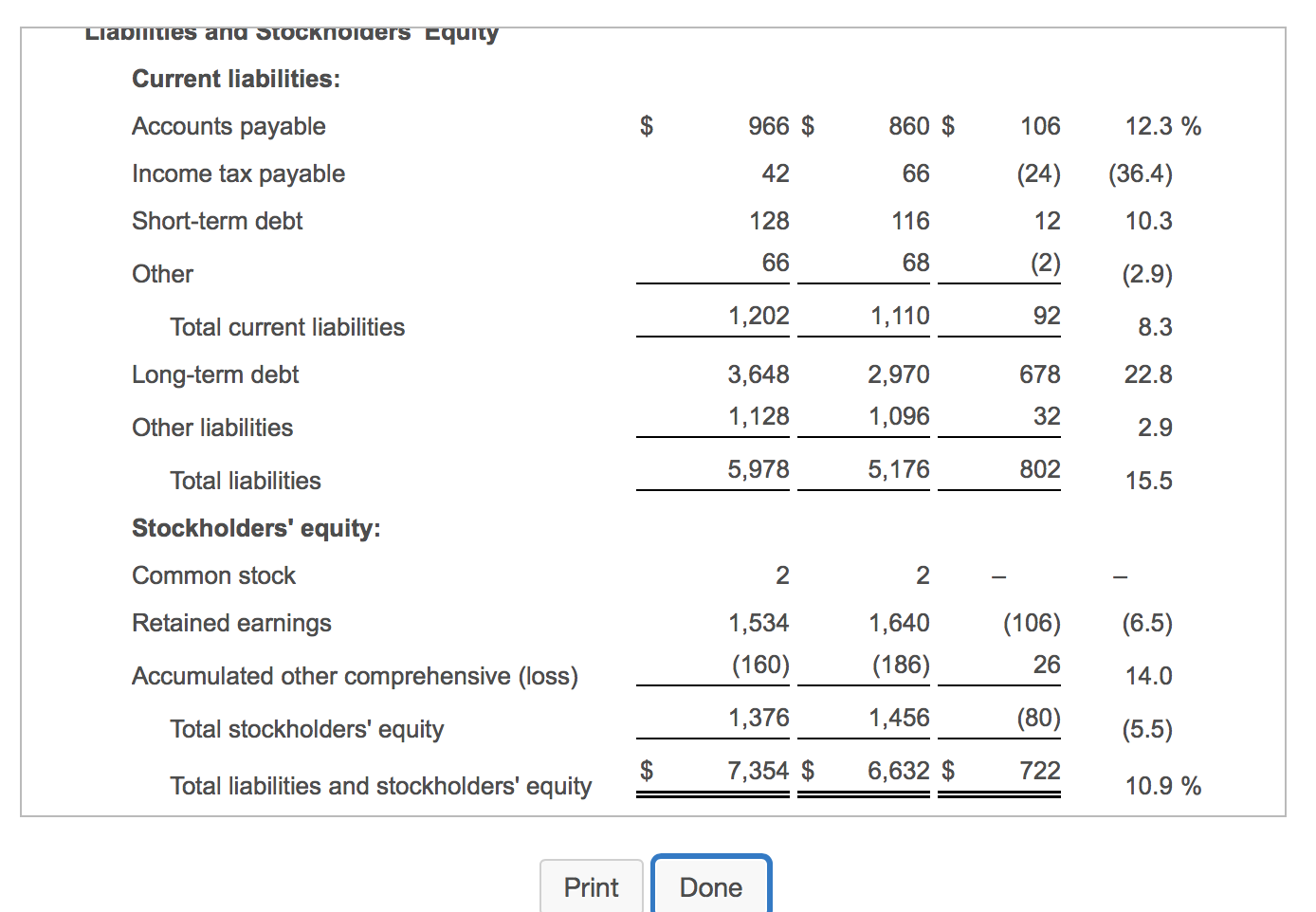

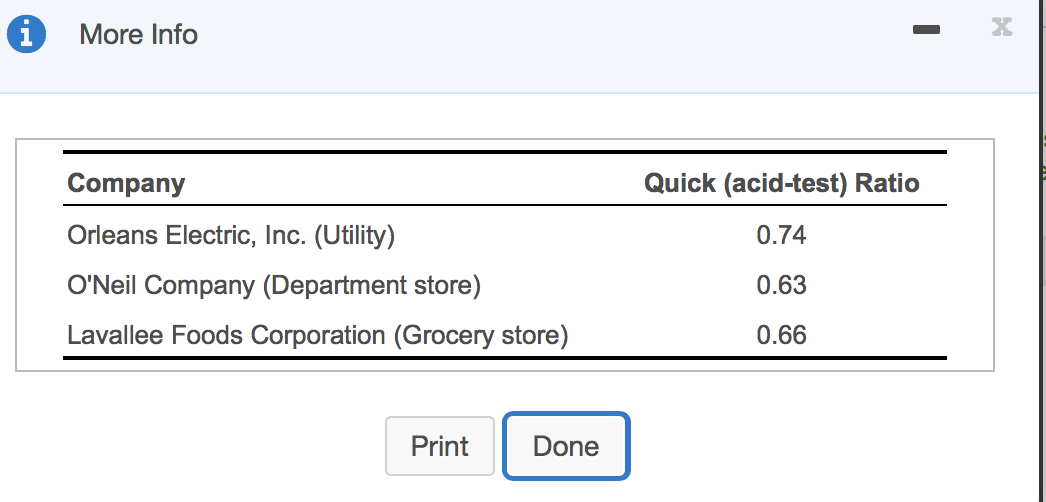

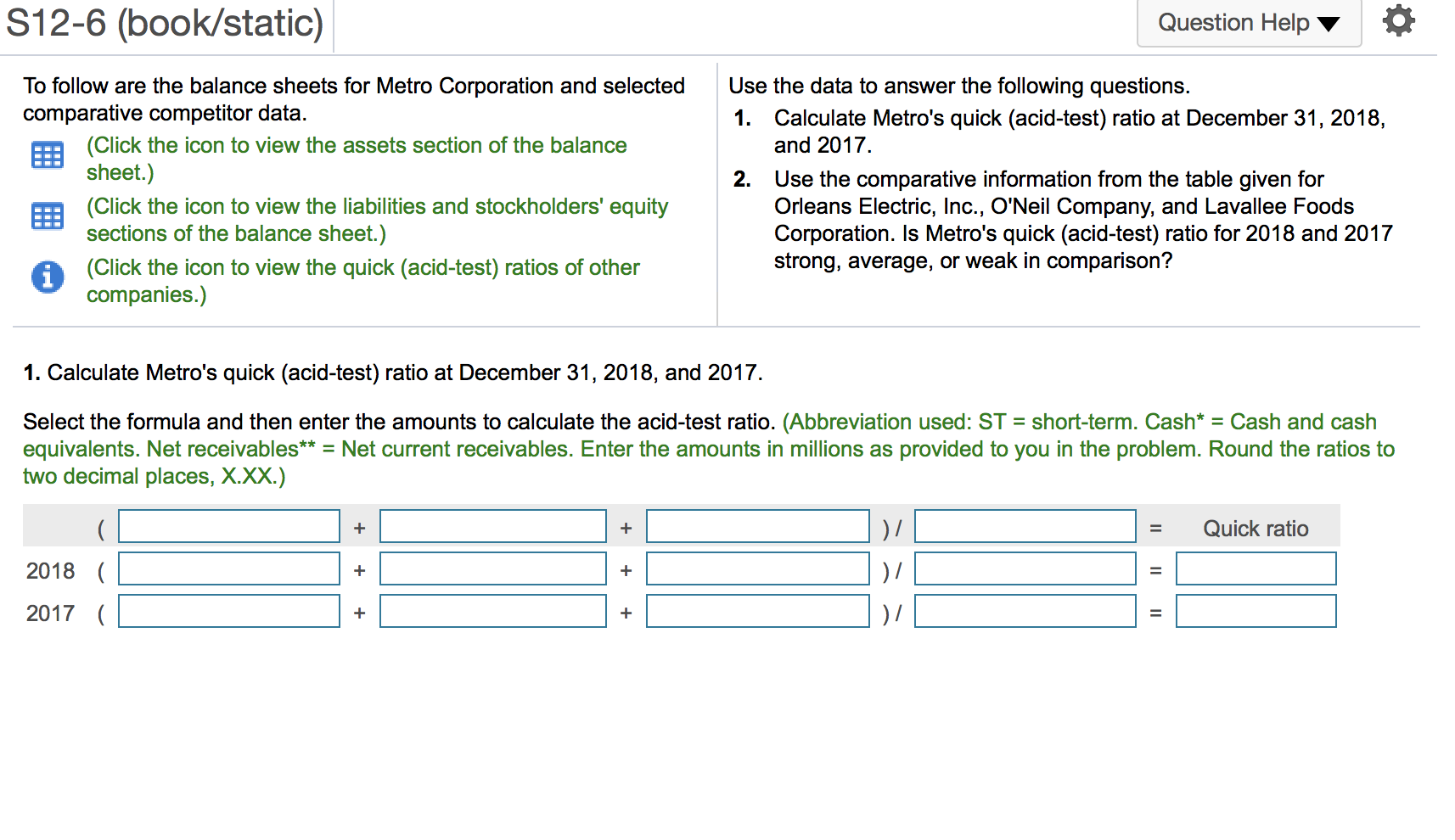

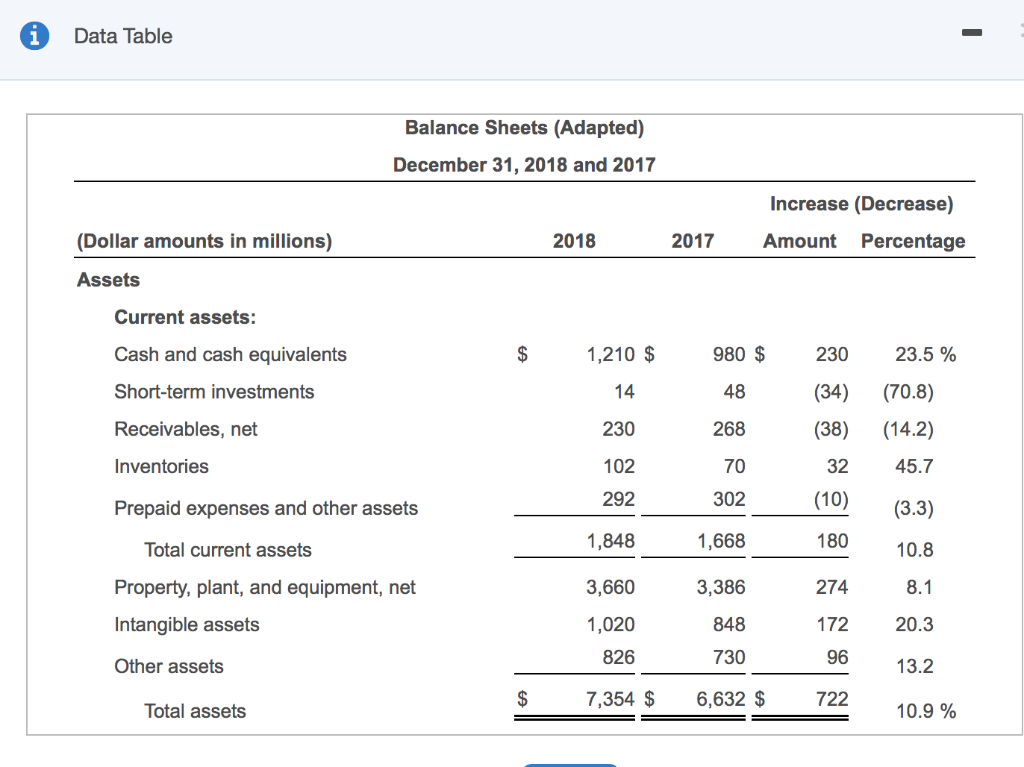

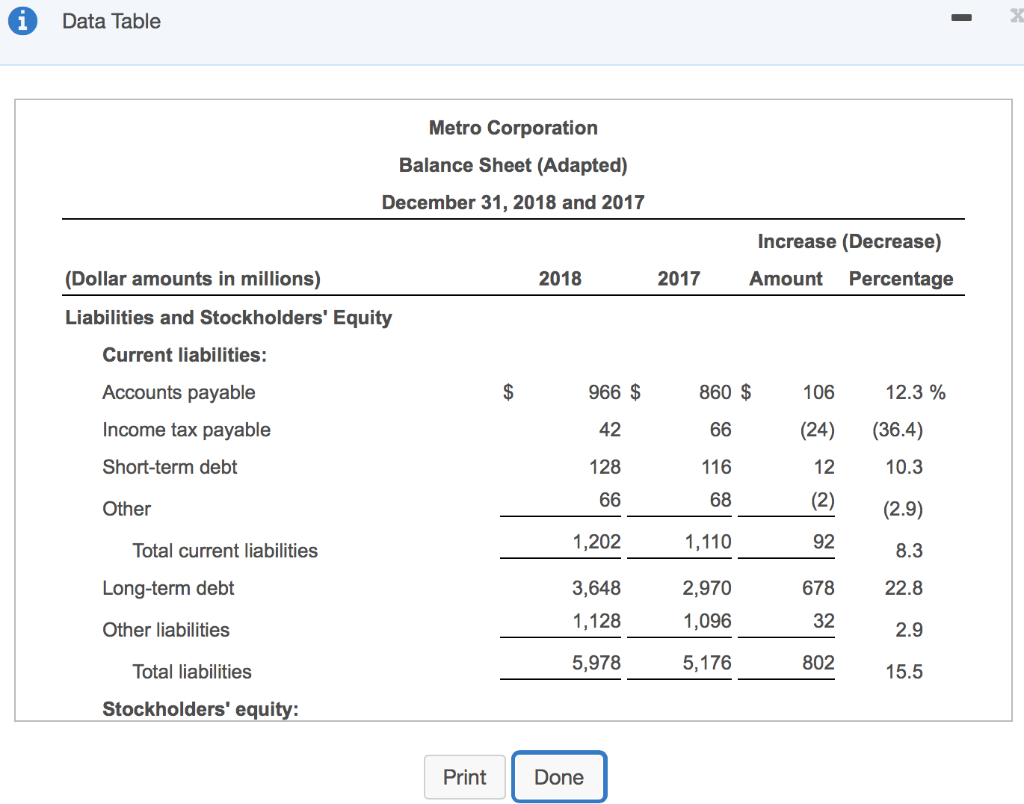

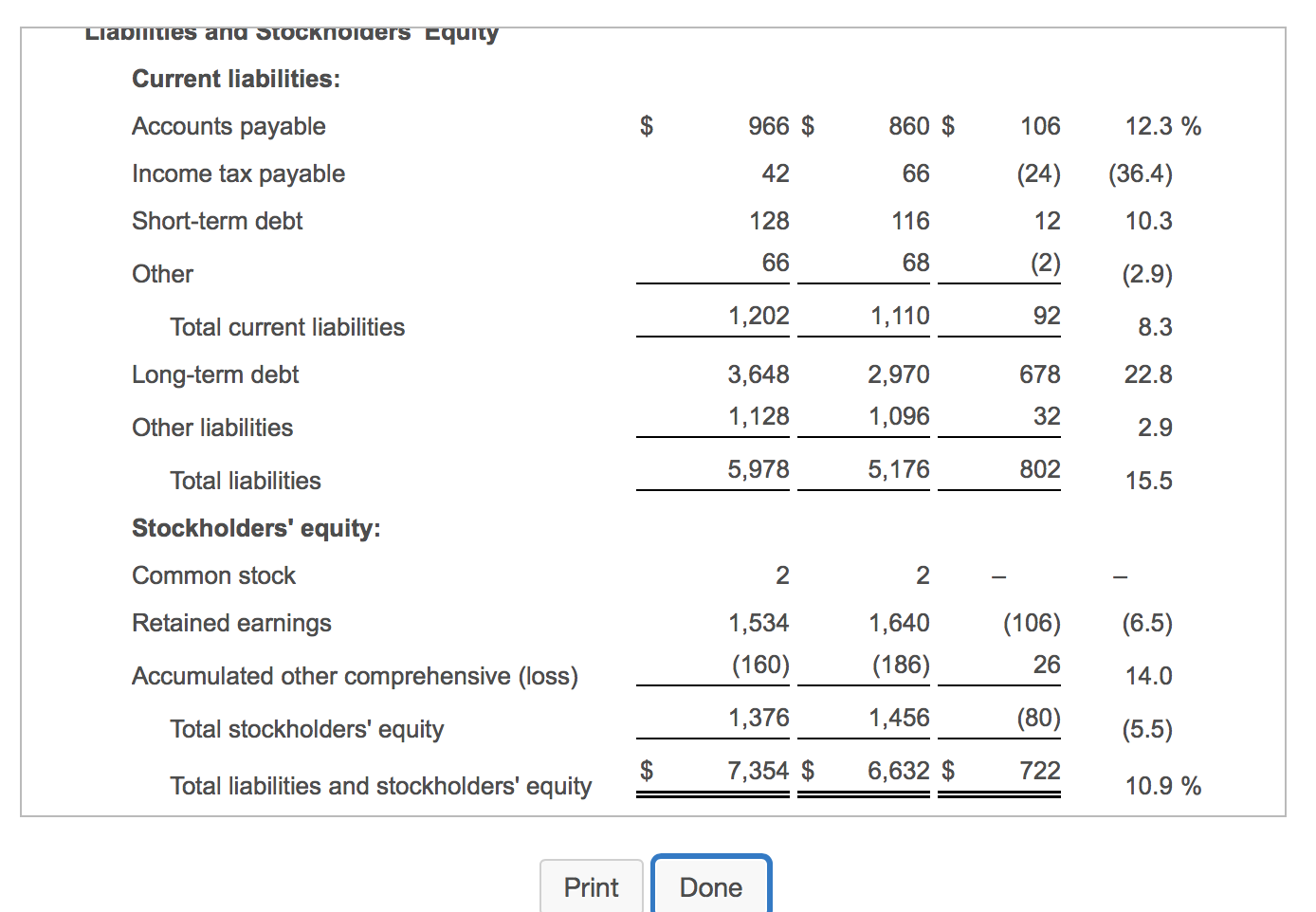

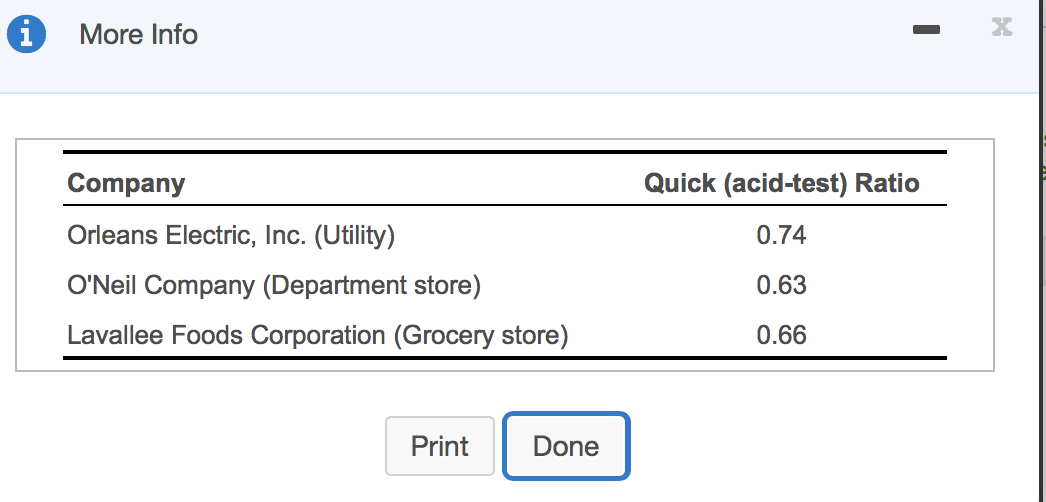

S12-6 (book/static) Question Help To follow are the balance sheets for Metro Corporation and selected comparative competitor data. (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) A (Click the icon to view the quick (acid-test) ratios of other companies.) Use the data to answer the following questions. 1. Calculate Metro's quick (acid-test) ratio at December 31, 2018, and 2017. 2. Use the comparative information from the table given for Orleans Electric, Inc., O'Neil Company, and Lavallee Foods Corporation. Is Metro's quick (acid-test) ratio for 2018 and 2017 strong, average, or weak in comparison? 1. Calculate Metro's quick (acid-test) ratio at December 31, 2018, and 2017. Select the formula and then enter the amounts to calculate the acid-test ratio. (Abbreviation used: ST = short-term. Cash* = Cash and cash equivalents. Net receivables** = Net current receivables. Enter the amounts in millions as provided to you in the problem. Round the ratios to two decimal places, X.XX.) ( + + ) = Quick ratio 2018 ( + ) = + + 2017 + Data Table Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) (Dollar amounts in millions) 2018 2017 Amount Percentage Assets Current assets: Cash and cash equivalents $ 1,210 $ 980 $ 230 23.5 % Short-term investments 14 48 (34) (70.8) Receivables, net 230 268 (38) (14.2) Inventories 102 70 32 45.7 292 302 Prepaid expenses and other assets (10) (3.3) 1,848 Total current assets 1,668 180 10.8 3,660 3,386 274 8.1 Property, plant, and equipment, net Intangible assets 1,020 848 172 20.3 826 730 96 Other assets 13.2 $ 7,354 $ 6,632 $ 722 Total assets 10.9 % i Data Table Metro Corporation Balance Sheet (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Liabilities and Stockholders' Equity Current liabilities: $ 966 $ 860 $ 106 12.3 % Accounts payable Income tax payable 42 66 (24) (36.4) Short-term debt 128 116 12 10.3 Other 66 68 (2) (2.9) Total current liabilities 1,202 1,110 92 8.3 Long-term debt 678 22.8 3,648 1,128 2,970 1,096 Other liabilities 32 2.9 5,978 Total liabilities 5,176 802 15.5 Stockholders' equity: Print Done Liabilities and STOCKnolders Equity Current liabilities: $ 966 $ 860 $ 106 12.3 % Accounts payable Income tax payable 42 66 (24) (36.4) Short-term debt 128 116 12 10.3 Other 68 66 (2) (2.9) 1,202 Total current liabilities 1,110 92 8.3 Long-term debt 678 22.8 3,648 1,128 2,970 1,096 32 Other liabilities 2.9 5,978 5,176 802 Total liabilities 15.5 Stockholders' equity: Common stock 2 2 Retained earnings (6.5) 1,534 (160) 1,640 (186) (106) 26 Accumulated other comprehensive (loss) 14.0 Total stockholders' equity 1,376 1,456 (80) (5.5) $ 7,354 $ Total liabilities and stockholders' equity 6,632 $ 722 10.9 % Print Done i More Info - X Quick (acid-test) Ratio 0.74 Company Orleans Electric, Inc. (Utility) O'Neil Company (Department store) Lavallee Foods Corporation (Grocery store) 0.63 0.66 Print Done