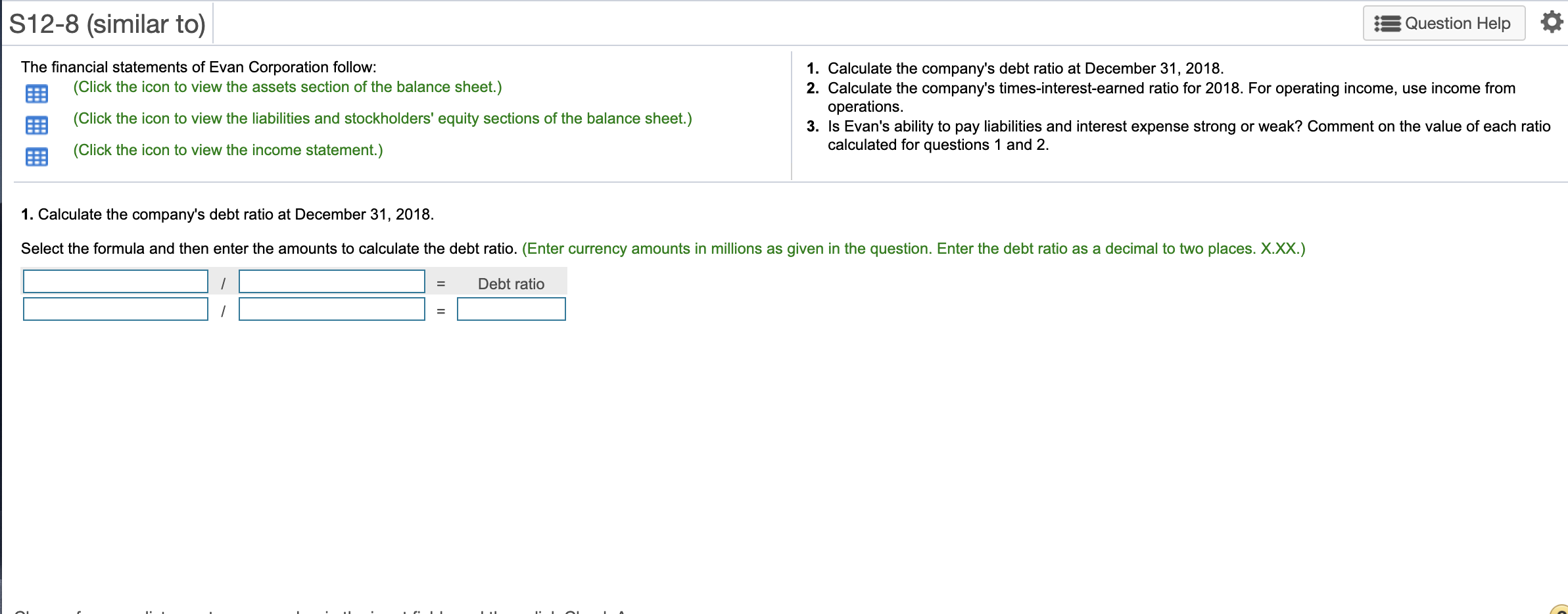

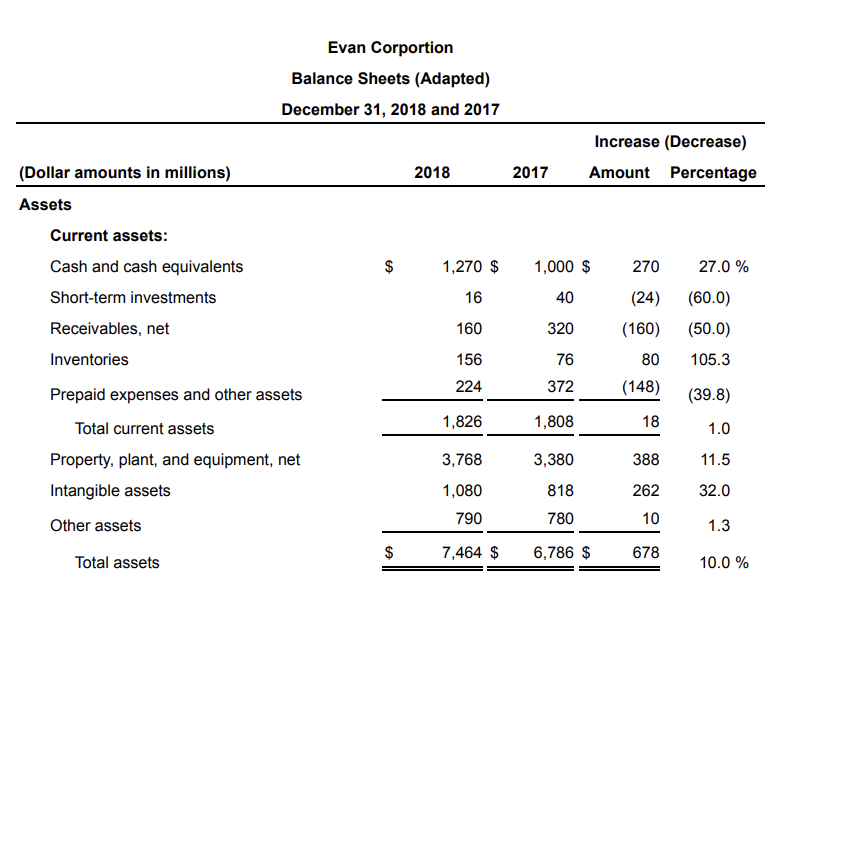

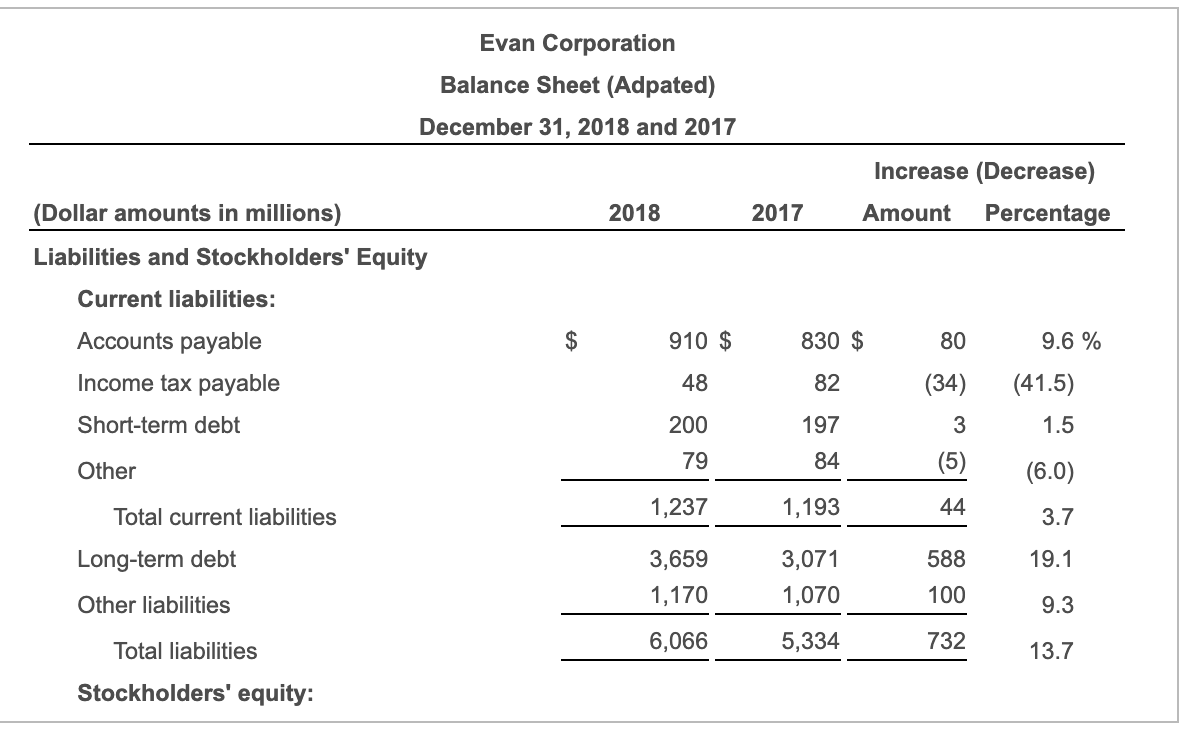

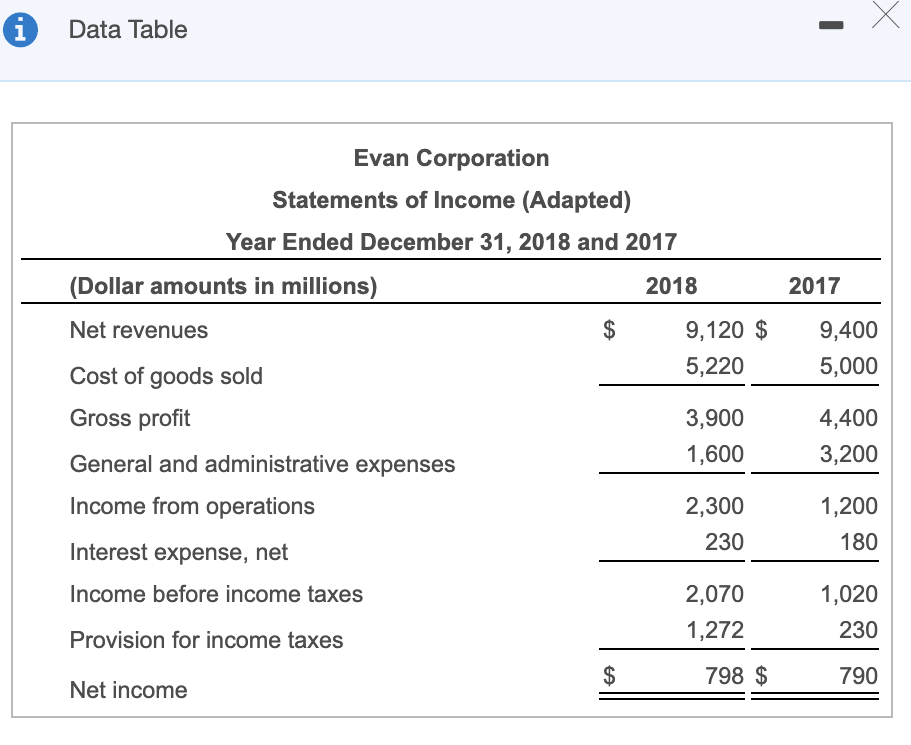

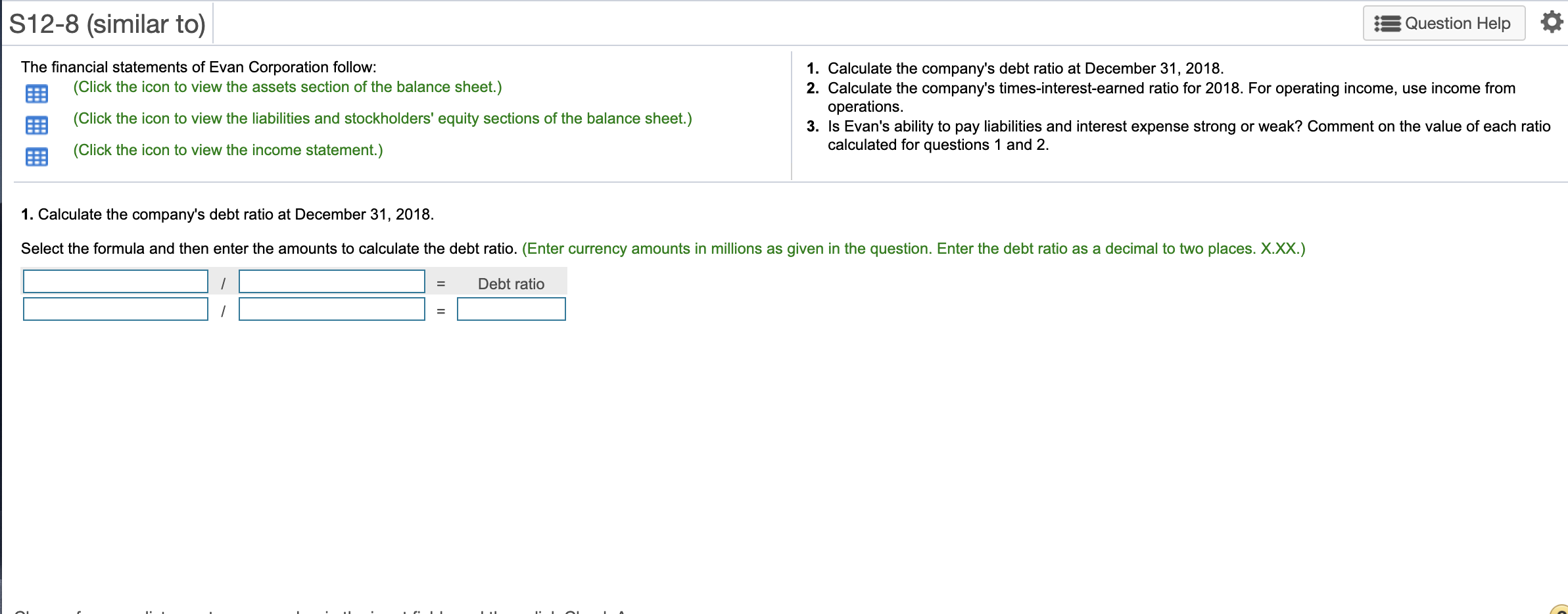

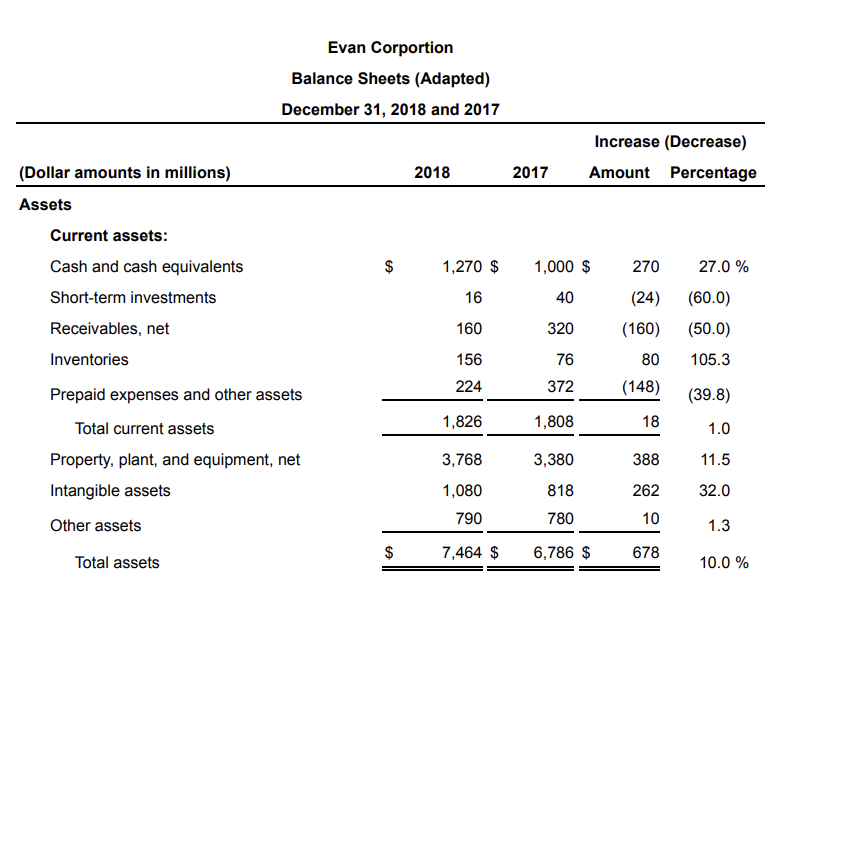

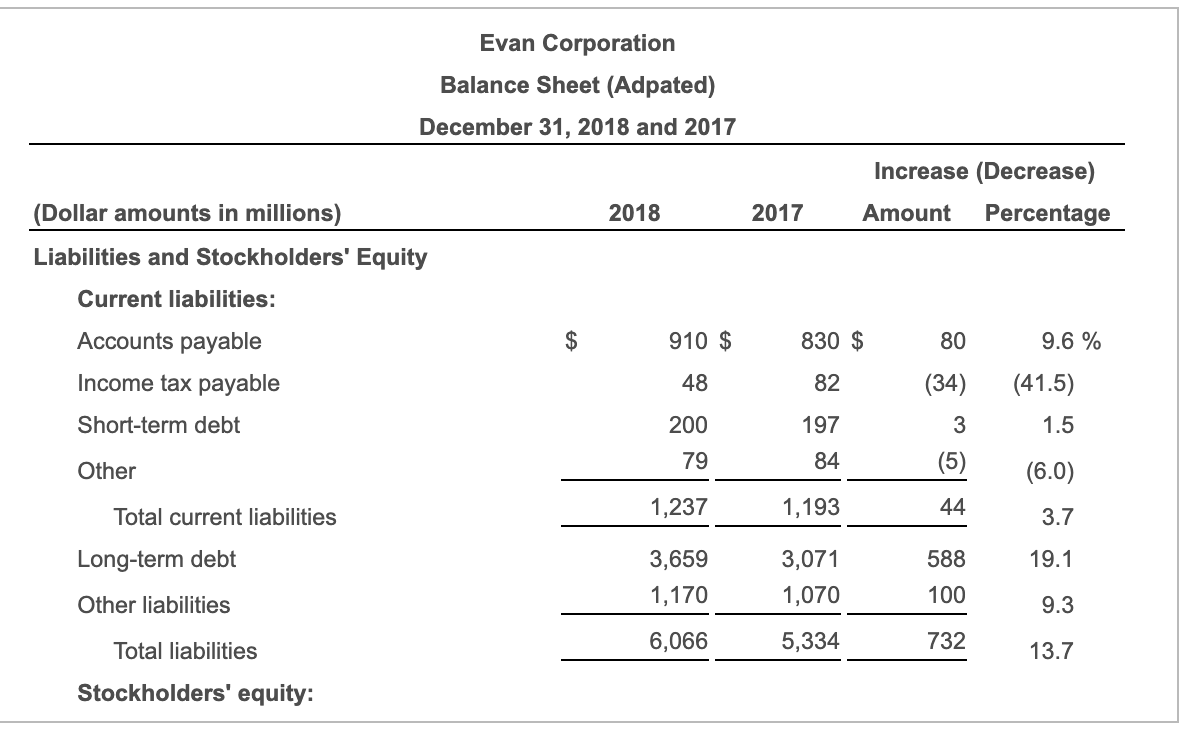

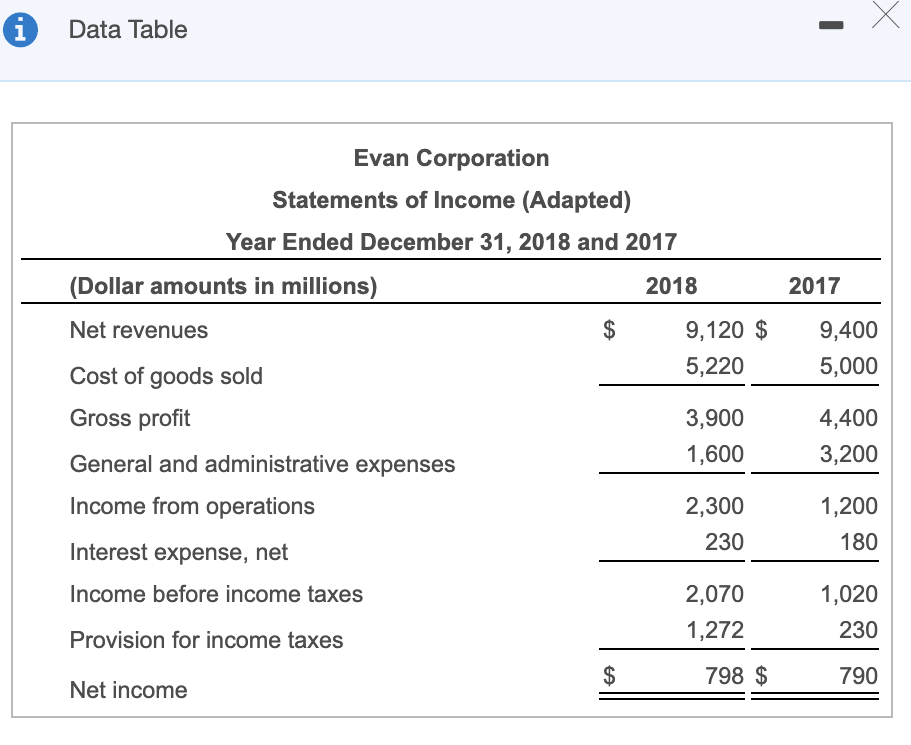

S12-8 (similar to) Question Help The financial statements of Evan Corporation follow: (Click the icon to view the assets section of the balance sheet.) 1. Calculate the company's debt ratio at December 31, 2018. 2. Calculate the company's times-interest-earned ratio for 2018. For operating income, use income from operations. 3. Is Evan's ability to pay liabilities and interest expense strong or weak? Comment on the value of each ratio calculated for questions 1 and 2. (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) 1. Calculate the company's debt ratio at December 31, 2018. Select the formula and then enter the amounts to calculate the debt ratio. (Enter currency amounts in millions as given in the question. Enter the debt ratio as a decimal to two places. X.XX.) Debt ratio = Evan Corportion Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Assets Current assets: $ 1,270 $ 1,000 $ 270 27.0 % 16 40 (60.0) (50.0) 160 320 (24) (160) 80 (148) 156 105.3 76 372 Cash and cash equivalents Short-term investments Receivables, net Inventories Prepaid expenses and other assets Total current assets Property, plant, and equipment, net Intangible assets Other assets 224 (39.8) 1,826 1,808 18 1.0 3,768 3,380 388 11.5 818 262 32.0 1,080 790 780 10 1.3 $ $ 7,464 $ 6,786 $ 678 Total assets 10.0 % Evan Corporation Balance Sheet (Adpated) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Liabilities and Stockholders' Equity Current liabilities: Accounts payable Income tax payable Short-term debt $ 910 $ 830 $ 80 9.6 % 48 82 (41.5) 200 197 (34) 3 (5) 1.5 Other 79 84 (6.0) 1,237 Total current liabilities 1,193 44 3.7 Long-term debt 588 19.1 3,659 1,170 3,071 1,070 100 Other liabilities 9.3 Total liabilities 6,066 5,334 732 13.7 Stockholders' equity: X i Data Table 2017 $ 9,400 5,000 Evan Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 (Dollar amounts in millions) 2018 Net revenues 9,120 $ 5,220 Cost of goods sold Gross profit 3,900 General and administrative expenses 1,600 Income from operations 2,300 230 Interest expense, net Income before income taxes 2,070 Provision for income taxes 1,272 $ 798 $ Net income 4,400 3,200 1,200 180 1,020 230 CA 790