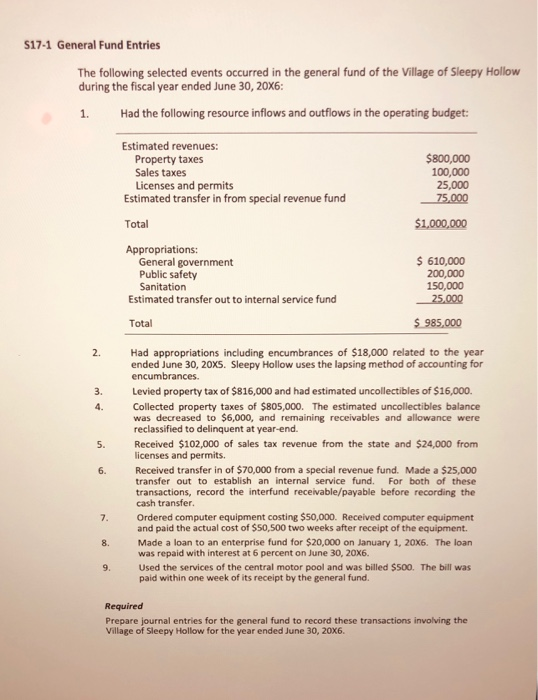

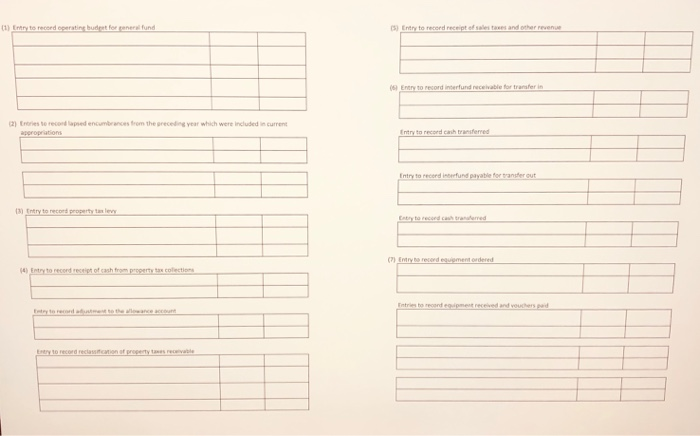

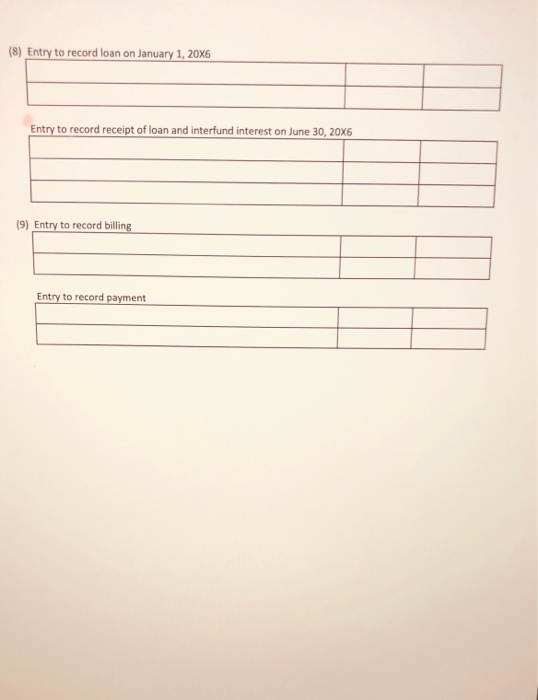

S17-1 General Fund Entries The following selected events occurred in the general fund of the Village of Sleepy Hollow during the fiscal year ended June 30, 20X6: 1. Had the following resource inflows and outflows in the operating budget: $800,000 100,000 25,000 75,000 $1,000,000 Estimated revenues: Property taxes Sales taxes Licenses and permits Estimated transfer in from special revenue fund Total Appropriations: General government Public safety Sanitation Estimated transfer out to internal service fund Total $ 610,000 200,000 150,000 25,000 $ 985,000 2. 3. 5. Had appropriations including encumbrances of $18,000 related to the year ended June 30, 20XS. Sleepy Hollow uses the lapsing method of accounting for encumbrances. Levied property tax of $816,000 and had estimated uncollectibles of $15,000. Collected property taxes of $805,000. The estimated uncollectibles balance was decreased to $6,000, and remaining receivables and allowance were reclassified to delinquent at year-end. Received $102,000 of sales tax revenue from the state and $24,000 from licenses and permits. Received transfer in of $70,000 from a special revenue fund. Made a $25,000 transfer out to establish an internal service fund. For both of these transactions, record the interfund receivable/payable before recording the cash transfer. Ordered computer equipment costing $50,000. Received computer equipment and paid the actual cost of $50,500 two weeks after receipt of the equipment. Made a loan to an enterprise fund for $20,000 on January 1, 20x6. The loan was repaid with interest at 6 percent on June 30, 20X6. Used the services of the central motor pool and was billed $500. The bill was paid within one week of its receipt by the general fund. 6. 7. 8. 9. Required Prepare journal entries for the general fund to record these transactions involving the Village of Sleepy Hollow for the year ended June 30, 20X6. (1) Entry to record operating burat for refund 5) Entry to reconcepts and other revenue Encoderlund receivable for transferin 2) tries to recorded encumbrances from the preceding year which were included in current appropriations Entry to record transferred Entry to recordifundate for transfer out Intry to record property deve Baby to record cared (1) Entry to recordement ordered 14 Entry to record receipt of shortcom Entries to recordement received and vouchers pad try to read the account Ryto record relation (8) Entry to record loan on January 1, 20X6 Entry to record receipt of loan and interfund interest on June 30, 20X6 (9) Entry to record billing Entry to record payment S17-1 General Fund Entries The following selected events occurred in the general fund of the Village of Sleepy Hollow during the fiscal year ended June 30, 20X6: 1. Had the following resource inflows and outflows in the operating budget: $800,000 100,000 25,000 75,000 $1,000,000 Estimated revenues: Property taxes Sales taxes Licenses and permits Estimated transfer in from special revenue fund Total Appropriations: General government Public safety Sanitation Estimated transfer out to internal service fund Total $ 610,000 200,000 150,000 25,000 $ 985,000 2. 3. 5. Had appropriations including encumbrances of $18,000 related to the year ended June 30, 20XS. Sleepy Hollow uses the lapsing method of accounting for encumbrances. Levied property tax of $816,000 and had estimated uncollectibles of $15,000. Collected property taxes of $805,000. The estimated uncollectibles balance was decreased to $6,000, and remaining receivables and allowance were reclassified to delinquent at year-end. Received $102,000 of sales tax revenue from the state and $24,000 from licenses and permits. Received transfer in of $70,000 from a special revenue fund. Made a $25,000 transfer out to establish an internal service fund. For both of these transactions, record the interfund receivable/payable before recording the cash transfer. Ordered computer equipment costing $50,000. Received computer equipment and paid the actual cost of $50,500 two weeks after receipt of the equipment. Made a loan to an enterprise fund for $20,000 on January 1, 20x6. The loan was repaid with interest at 6 percent on June 30, 20X6. Used the services of the central motor pool and was billed $500. The bill was paid within one week of its receipt by the general fund. 6. 7. 8. 9. Required Prepare journal entries for the general fund to record these transactions involving the Village of Sleepy Hollow for the year ended June 30, 20X6. (1) Entry to record operating burat for refund 5) Entry to reconcepts and other revenue Encoderlund receivable for transferin 2) tries to recorded encumbrances from the preceding year which were included in current appropriations Entry to record transferred Entry to recordifundate for transfer out Intry to record property deve Baby to record cared (1) Entry to recordement ordered 14 Entry to record receipt of shortcom Entries to recordement received and vouchers pad try to read the account Ryto record relation (8) Entry to record loan on January 1, 20X6 Entry to record receipt of loan and interfund interest on June 30, 20X6 (9) Entry to record billing Entry to record payment