Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S21-16 Translation Exposure [LO3] Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen solaris shows assets of 39,000 solaris, debt

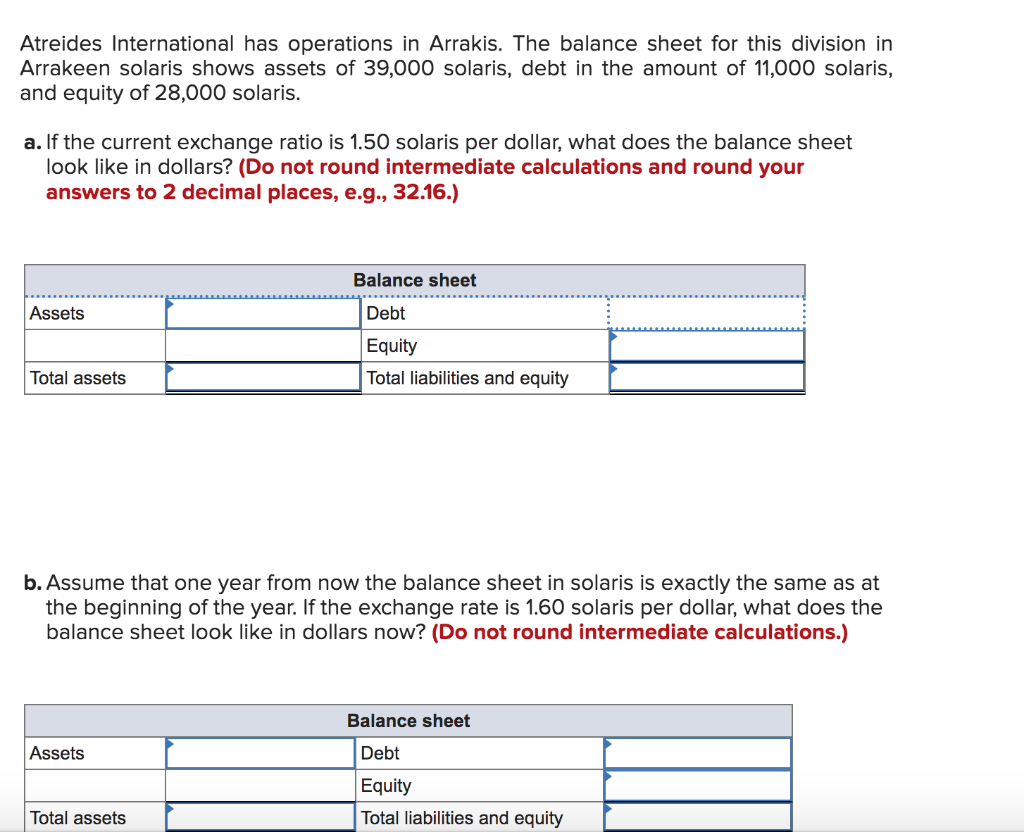

S21-16 Translation Exposure [LO3] Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen solaris shows assets of 39,000 solaris, debt in the amount of 11,000 solaris, and equity of 28,000 solaris. a. If the current exchange ratio is 1.50 solaris per dollar, what does the balance sheet look like in dollars? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started