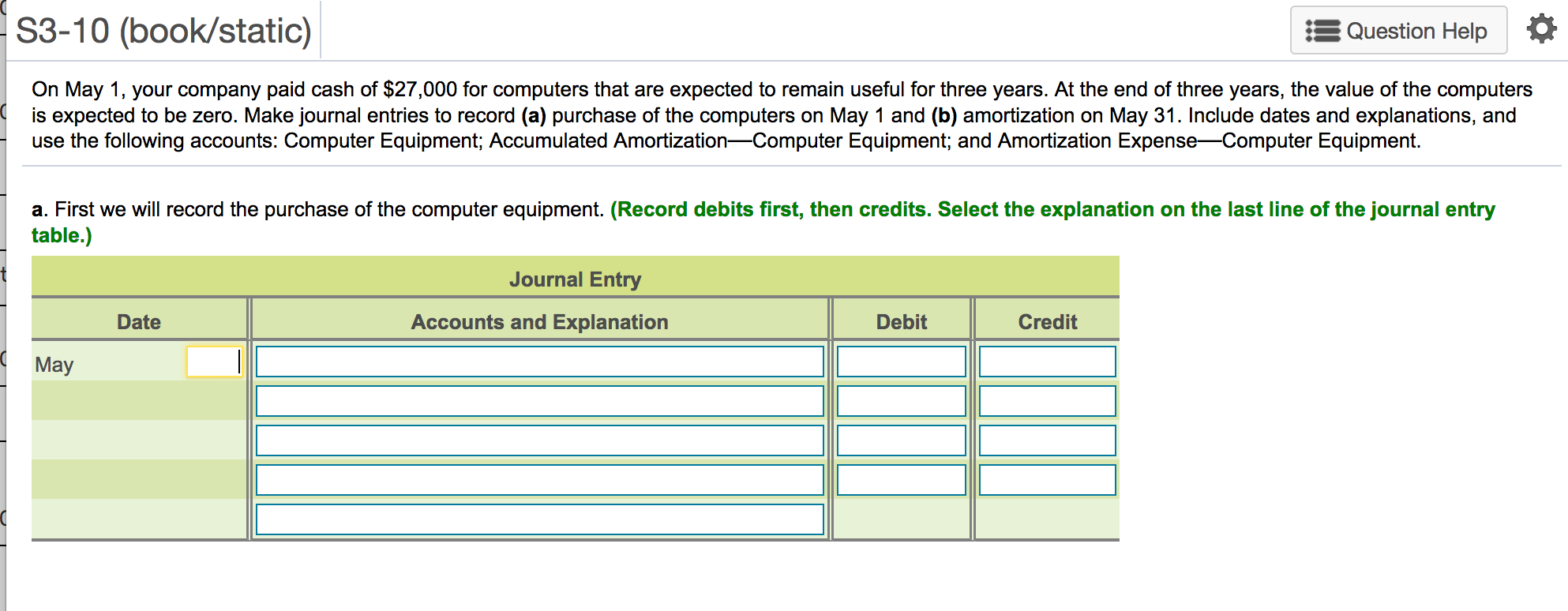

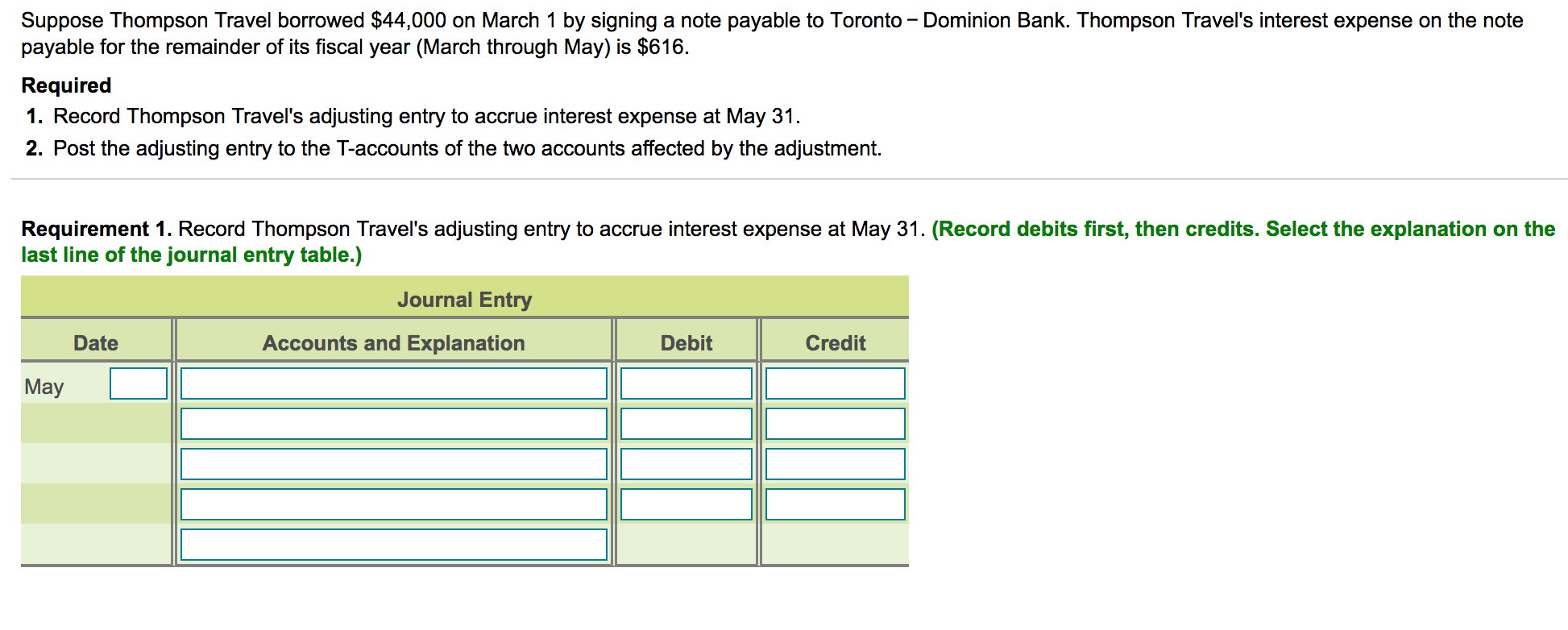

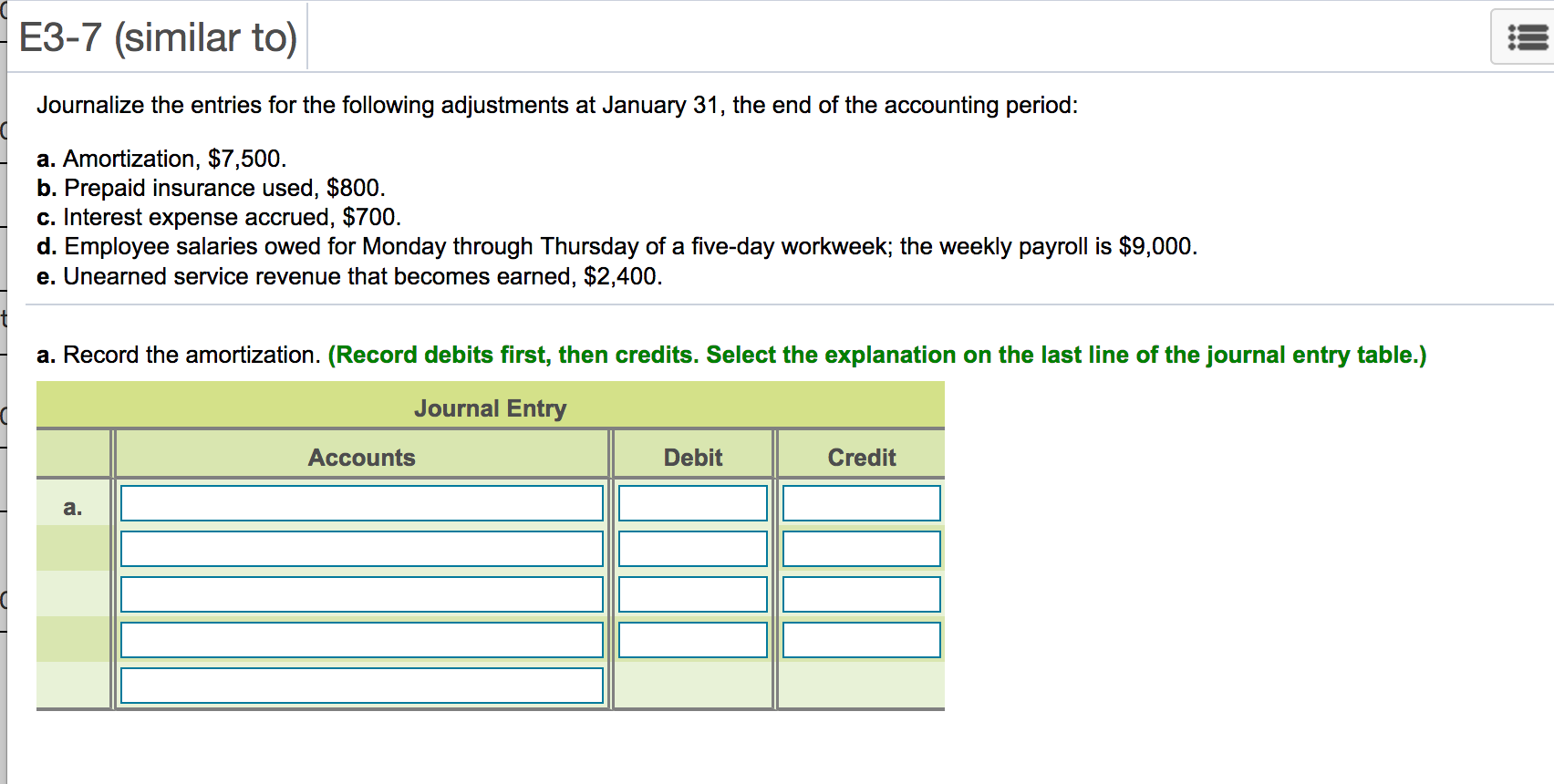

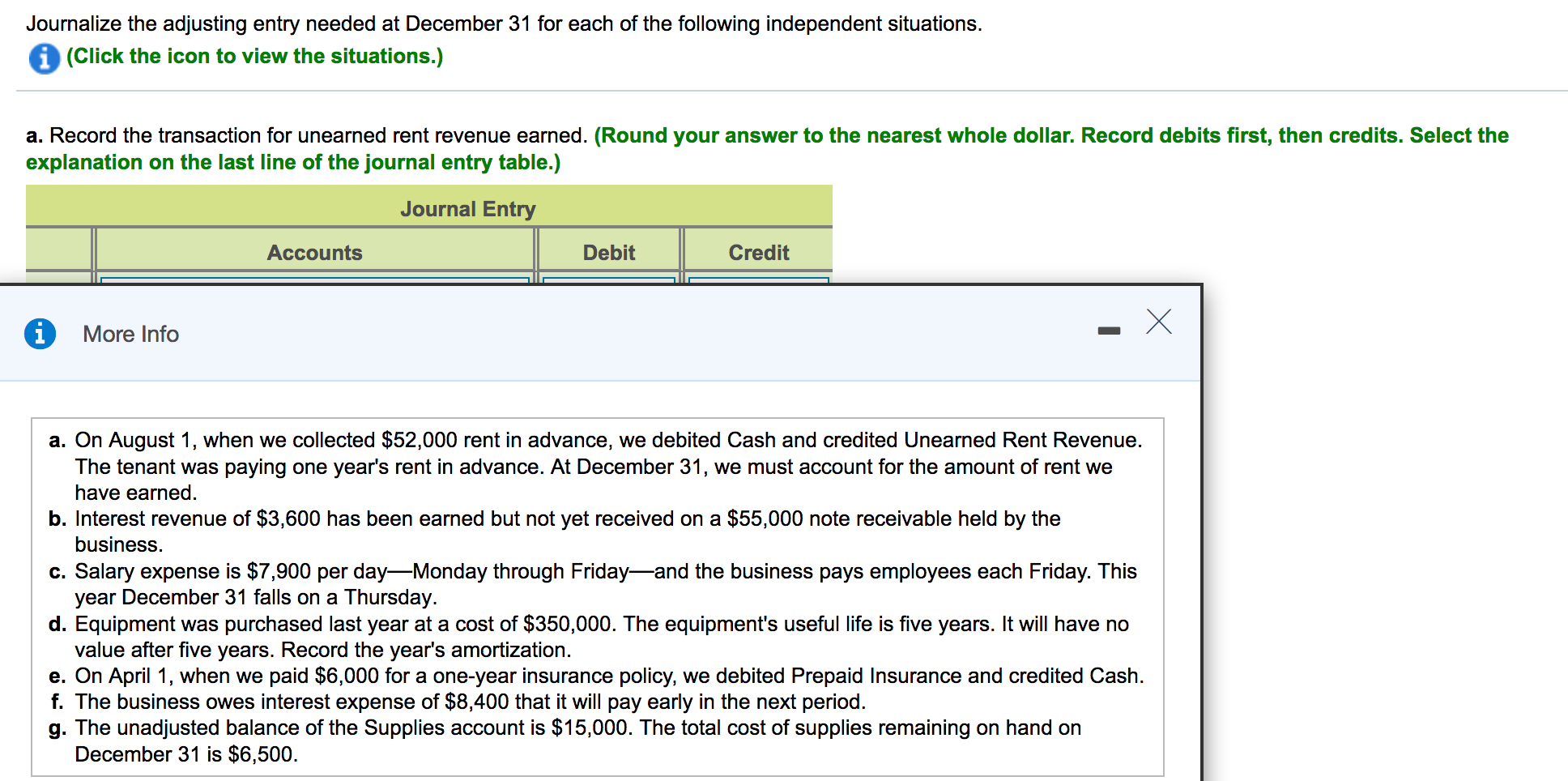

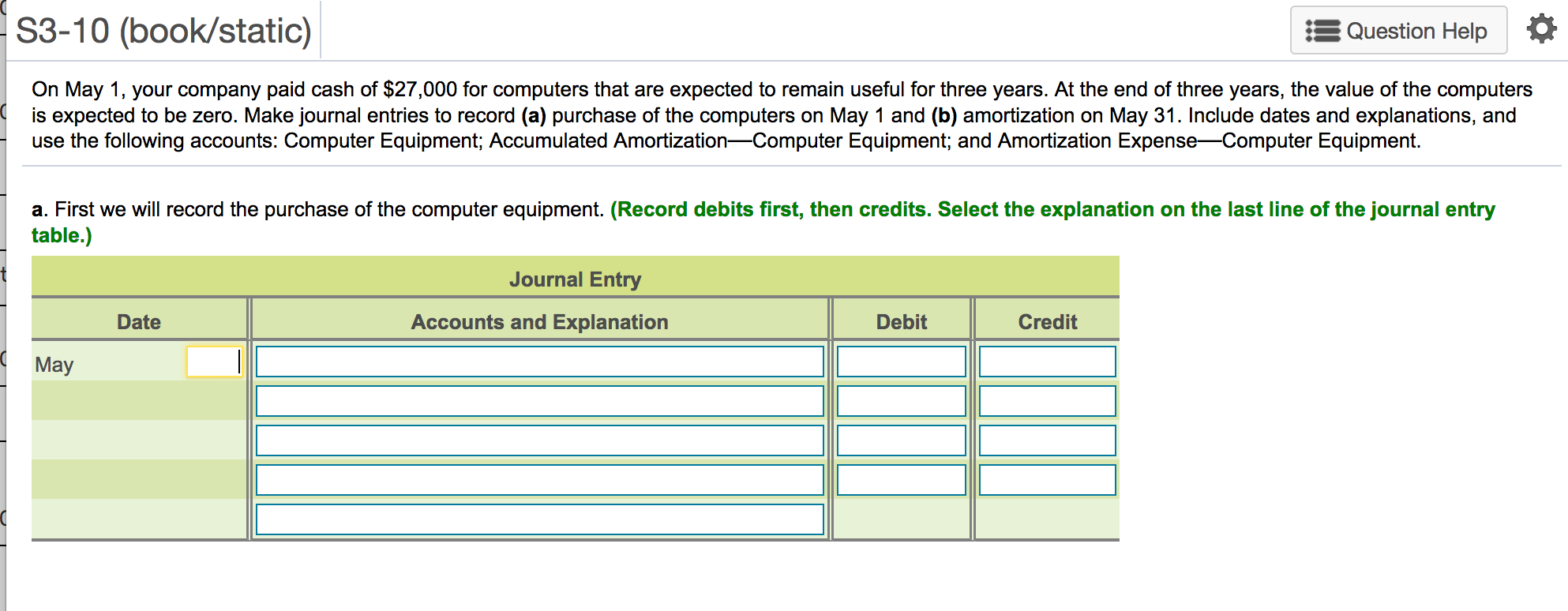

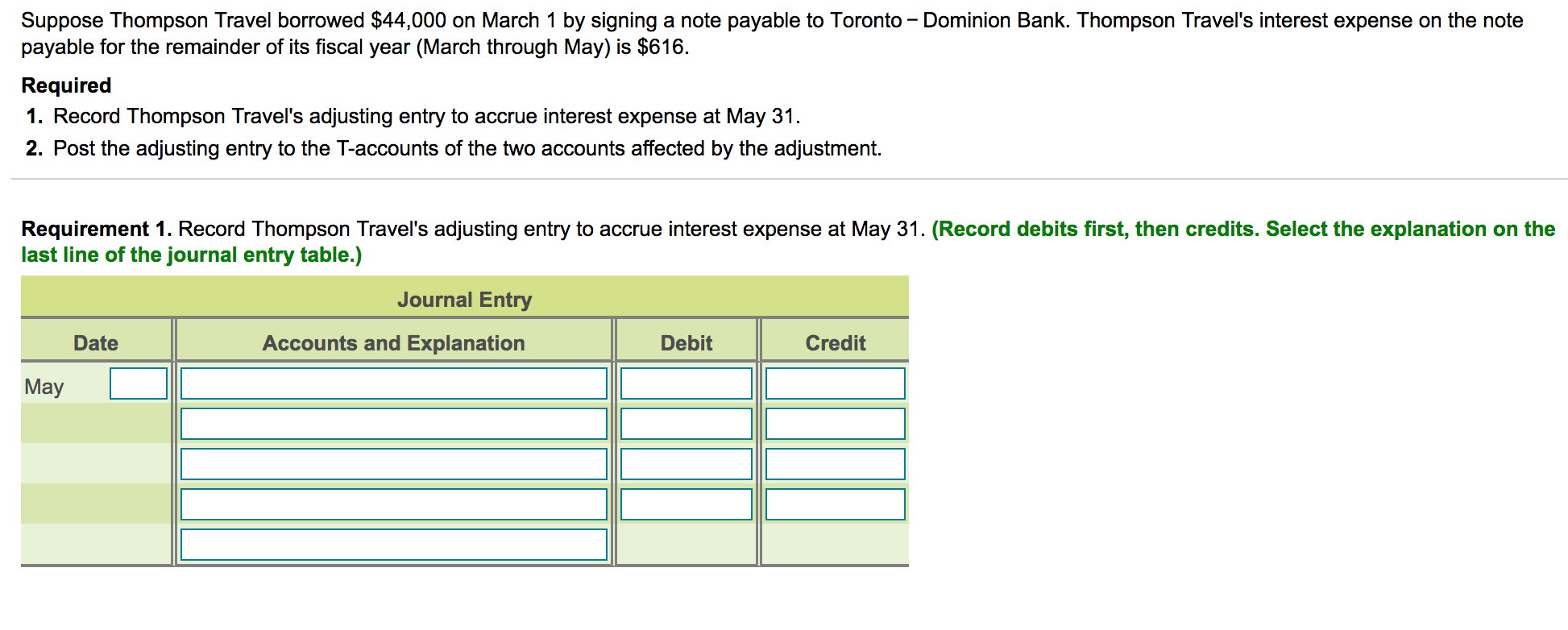

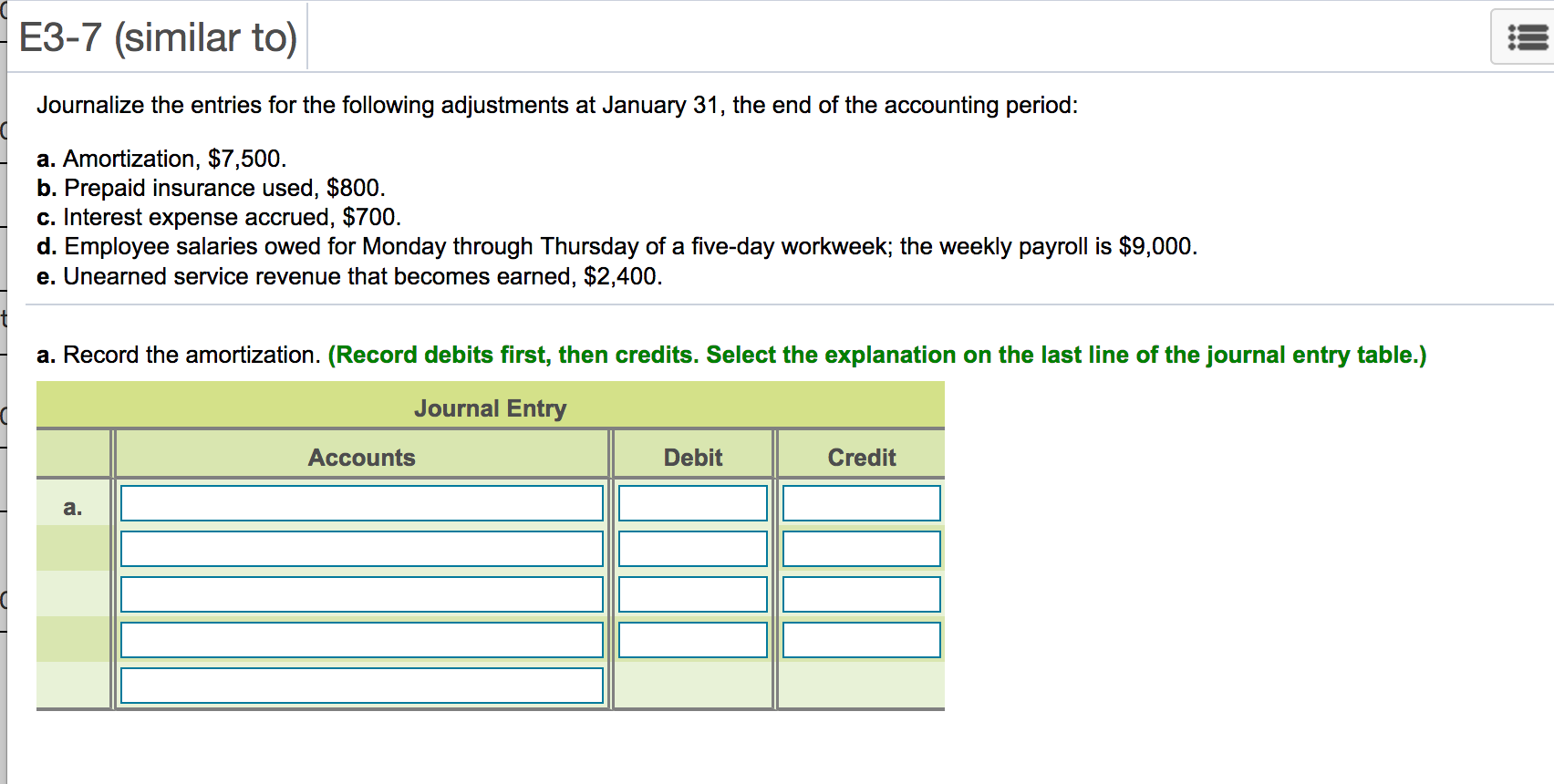

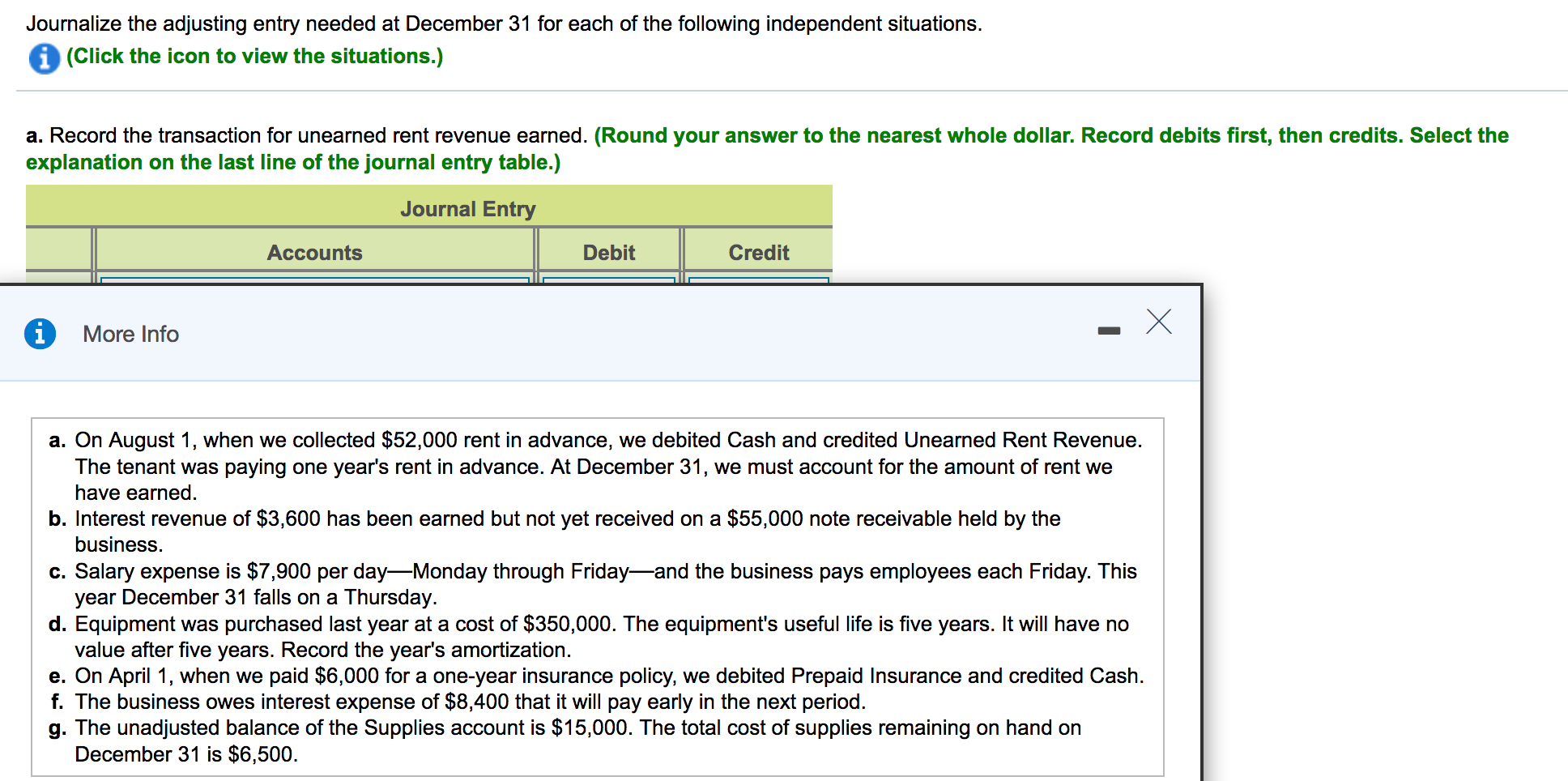

S3-10 (book/static) Question Help On May 1, your company paid cash of $27,000 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Make journal entries to record (a) purchase of the computers on May 1 and (b) amortization on May 31. Include dates and explanations, and use the following accounts: Computer Equipment; Accumulated AmortizationComputer Equipment; and Amortization ExpenseComputer Equipment. a. First we will record the purchase of the computer equipment. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journal Entry Date Accounts and Explanation Debit Credit May Suppose Thompson Travel borrowed $44,000 on March 1 by signing a note payable to Toronto - Dominion Bank. Thompson Travel's interest expense on the note payable for the remainder of its fiscal year (March through May) is $616. Required 1. Record Thompson Travel's adjusting entry to accrue interest expense at May 31. 2. Post the adjusting entry to the T-accounts of the two accounts affected by the adjustment. Requirement 1. Record Thompson Travel's adjusting entry to accrue interest expense at May 31. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journal Entry Date Accounts and Explanation Debit Credit May E3-7 (similar to) Journalize the entries for the following adjustments at January 31, the end of the accounting period: a. Amortization, $7,500. b. Prepaid insurance used, $800. c. Interest expense accrued, $700. d. Employee salaries owed for Monday through Thursday of a five-day workweek; the weekly payroll is $9,000. e. Unearned service revenue that becomes earned, $2,400. a. Record the amortization. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journal Entry Accounts Debit Credit a. Journalize the adjusting entry needed at December 31 for each of the following independent situations. (Click the icon to view the situations.) a. Record the transaction for unearned rent revenue earned. (Round your answer to the nearest whole dollar. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journal Entry Accounts Debit Credit i More Info - a. On August 1, when we collected $52,000 rent in advance, we debited Cash and credited Unearned Rent Revenue. The tenant was paying one year's rent in advance. At December 31, we must account for the amount of rent we have earned. b. Interest revenue of $3,600 has been earned but not yet received on a $55,000 note receivable held by the business. c. Salary expense is $7,900 per dayMonday through Fridayand the business pays employees each Friday. This year December 31 falls on a Thursday. d. Equipment was purchased last year at a cost of $350,000. The equipment's useful life is five years. It will have no value after five years. Record the year's amortization. e. On April 1, when we paid $6,000 for a one-year insurance policy, we debited Prepaid Insurance and credited Cash. f. The business owes interest expense of $8,400 that it will pay early in the next period. g. The unadjusted balance of the Supplies account is $15,000. The total cost of supplies remaining on hand on December 31 is $6,500