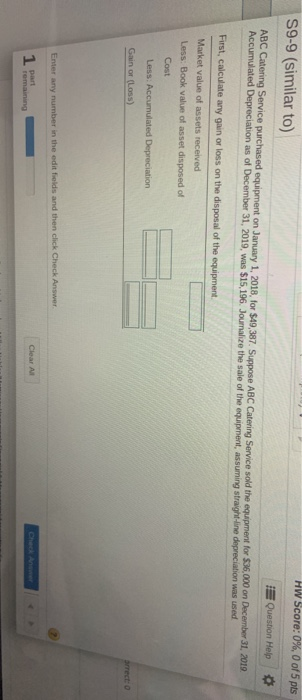

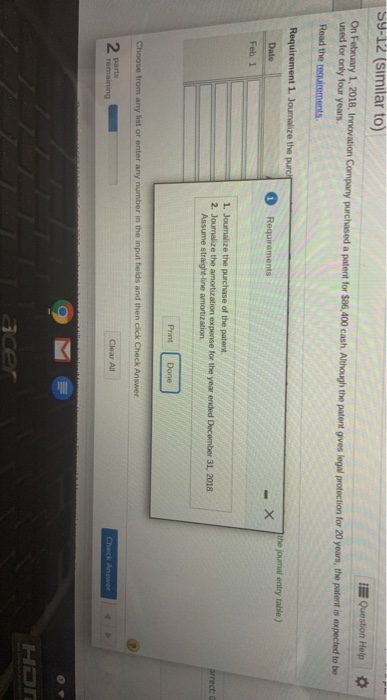

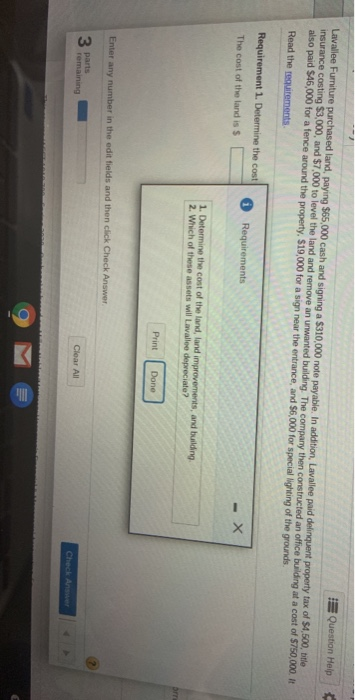

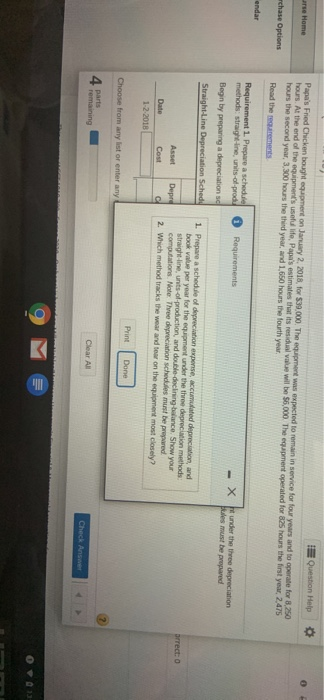

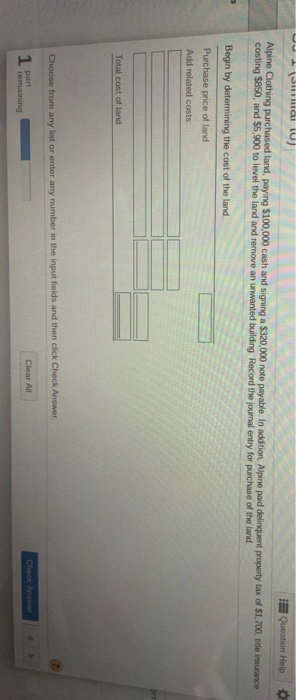

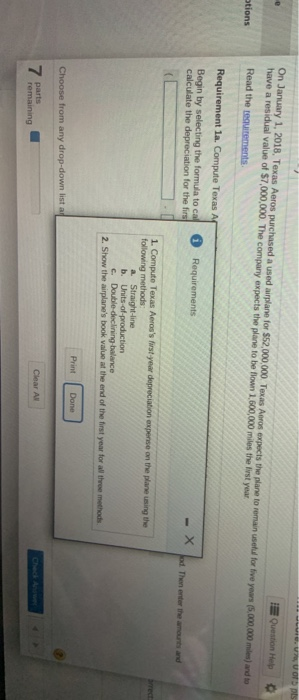

S9-9 (similar to) HW Score: 0%, 0 of 5 pts Question Help ABC Catering Service purchased equipment on January 1, 2018, for $49,387. Suppose ABC Catering Service sold the equipment for $36.000 on December 31, 2019 Accumulated Depreciation as of December 31, 2019, was $15, 196. Joumalize the sale of the equipment, assuming straight-line depreciation was used First, calculate any gain or loss on the disposal of the equipment Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) co Enter any number in the edit fields and then click Check Answer 59-12 (similar to) IE Question Help On February 1, 2018, Innovation Company purchased a patent for $86,400 cash. Although the patent gives legal protection for 20 years, the patent is expected to be used for only four years. Read the requirements Requirement 1. Joumalize the purc the journal entry thble.) Date 1 Requirement Feb. 1 1. Journalize the purchase of the patent 2. Joumalize the amortization expense for the year ended December 31, 2018 Assume straight line amortization Orrect: Print Done Choose from any list or enter any number in the input fields and then click Check Answer 2 remaining parts Clear All Check Answer HON acer Question Help Lavallee Furniture purchased land, paying $55,000 cash and signing a $310,000 note payable. In addition, Lavallee paid delinquent property tax of $4,500, title insurance costing $3.000, and $7,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $750,000. It also paid $46,000 for a fence around the property. $19,000 for a sign near the entrance, and $6,000 for special lighting of the grounds. Read the requirements Requirement 1. Determine the cost The cost of the land is $ 1 Requirements 1. Determine the cost of the land, and improvements, and building 2. Which of these assets will Lavallee depreciate? Print Done Enter any number in the edit fields and then click Check Answer 3 parts Clear All Check Answer Question Help urte Home Papa's Fried Chicken bought agment on January 2 2018 for $39.000. The equipment was expected to remain service for four years and to operate for 8.250 hours. At the end of the equipments useful life, Papa's estimates that its residual value will be $6.000 The equipment operated for hours the year 24 hours the second year, 3,300 hours the third year, and 1,650 hours the fourth year O archase Options Read the requirements endar Requirement Prepare a schedule methods straight-line, units-of-prod 1 Requirements - X under the three depreciabon pues must be prepared Begin by preparing a depreciations Straight-Line Depreciation Scheda 1. Prepare a schedule of depreciation expense accumulated depreciation and book value per year for the equipment under the three depreciation methods straight line units of production, and double-dechnung balance. Show your computations Note: The depreciation schedules must be prepared 2. Which method tracks the wear and tear on the equipment most closely? orrect: 0 Cost Date 1-2 2018 Print Done Choose from any list or enter any 4 remaining Clear All Check Answer 9 M J inai ) E Question Help Alpine Clothing purchased land, paying $100,000 cash and signing a $320,000 note payable. In addition, Alpine paid delinquent property tax of $1,700, title insurance costing $850, and 55,900 to level the land and remove an unwanted building. Record the journal entry for purchase of the land Begin by determining the cost of the land. Purchase price of land Add related costs: Total cost of land Choose from any list of enter any number in the input fields and then click Check Answer part Clear All Check Answer - remaining On January 1, 2018. Texas Aeros purchased a used airplane for $52,000,000 Texas Aros expects the plane to remain use have a residual value of 57,000,000. The company expects the plane to be flown 1,600,000 miles the lost your Question Helbe Stions Read the tuitements for five years 5.000.000 m aande Requirement la Compute Texas A Begin by selecting the formula to cal calculate the depreciation for the firs Requirements 1. Compute Texas Aeros's first year depreciation expense on the plane using the following methods a Straight-line b. Units of production C. Double-declining buwance 2. Show the airplane's book value at the end of the first year for all three methods Print Done Choose from any drop-down lista 7 parts remaining Clear All