Answered step by step

Verified Expert Solution

Question

1 Approved Answer

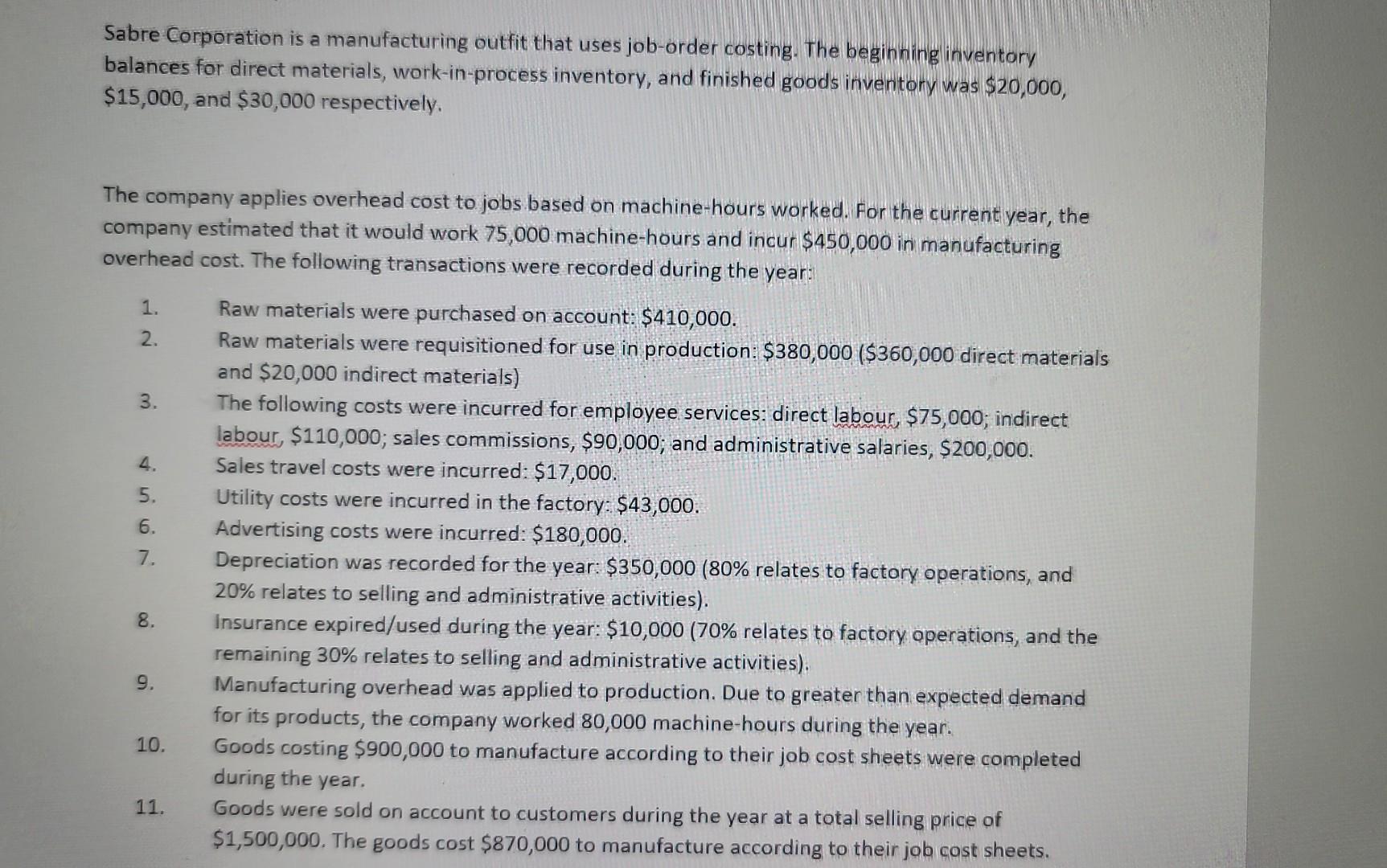

Sabre Corporation is a manufacturing outfit that uses job-order costing. The beginning inventory balances for direct materials, work-in-process inventory, and finished goods inventory was $20,000,

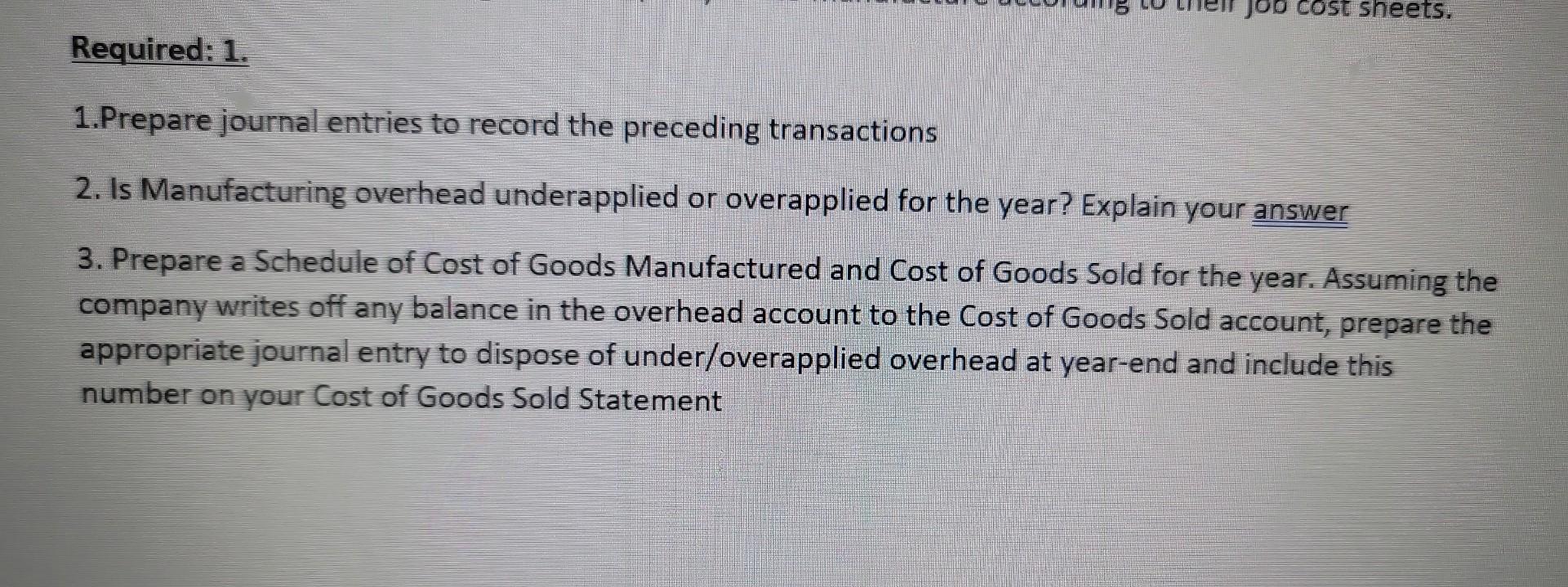

Sabre Corporation is a manufacturing outfit that uses job-order costing. The beginning inventory balances for direct materials, work-in-process inventory, and finished goods inventory was $20,000, $15,000, and $30,000 respectively. The company applies overhead cost to jobs based on machine-hours worked. For the current year, the company estimated that it would work 75,000 machine-hours and incur $450,000 in manufacturing overhead cost. The following transactions were recorded during the year: 1. Raw materials were purchased on account: $410,000. 2. Raw materials were requisitioned for use in production: $380,000($360,000 direct materials and $20,000 indirect materials) 3. The following costs were incurred for employee services: direct labour, $75,000; indirect labour, $110,000; sales commissions, $90,000; and administrative salaries, $200,000. 4. Sales travel costs were incurred: $17,000. 5. Utility costs were incurred in the factory: $43,000. 6. Advertising costs were incurred: $180,000. 7. Depreciation was recorded for the year: $350,000 (80\% relates to factory operations, and 20% relates to selling and administrative activities). 8. Insurance expired/used during the year: $10,000 (70\% relates to factory aperations, and the remaining 30% relates to selling and administrative activities). 9. Manufacturing overhead was applied to production. Due to greater than expected demand for its products, the company worked 80,000 machine-hours during the year. 10. Goods costing $900,000 to manufacture according to their job cost sheets were completed during the year. 11. Goods were sold on account to customers during the year at a total selling price of $1,500,000. The goods cost $870,000 to manufacture according to their job cost sheets. Required: 1. 1.Prepare journal entries to record the preceding transactions 2. Is Manufacturing overhead underapplied or overapplied for the year? Explain your answer 3. Prepare a Schedule of Cost of Goods Manufactured and Cost of Goods Sold for the year. Assuming the company writes off any balance in the overhead account to the Cost of Goods Sold account, prepare the appropriate journal entry to dispose of under/overapplied overhead at year-end and include this number on your Cost of Goods Sold Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started