Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sabrina purchased a property in Central ten years ago. On 1 January 2020, Sabrina rented the property to Vincent for 3 years with the

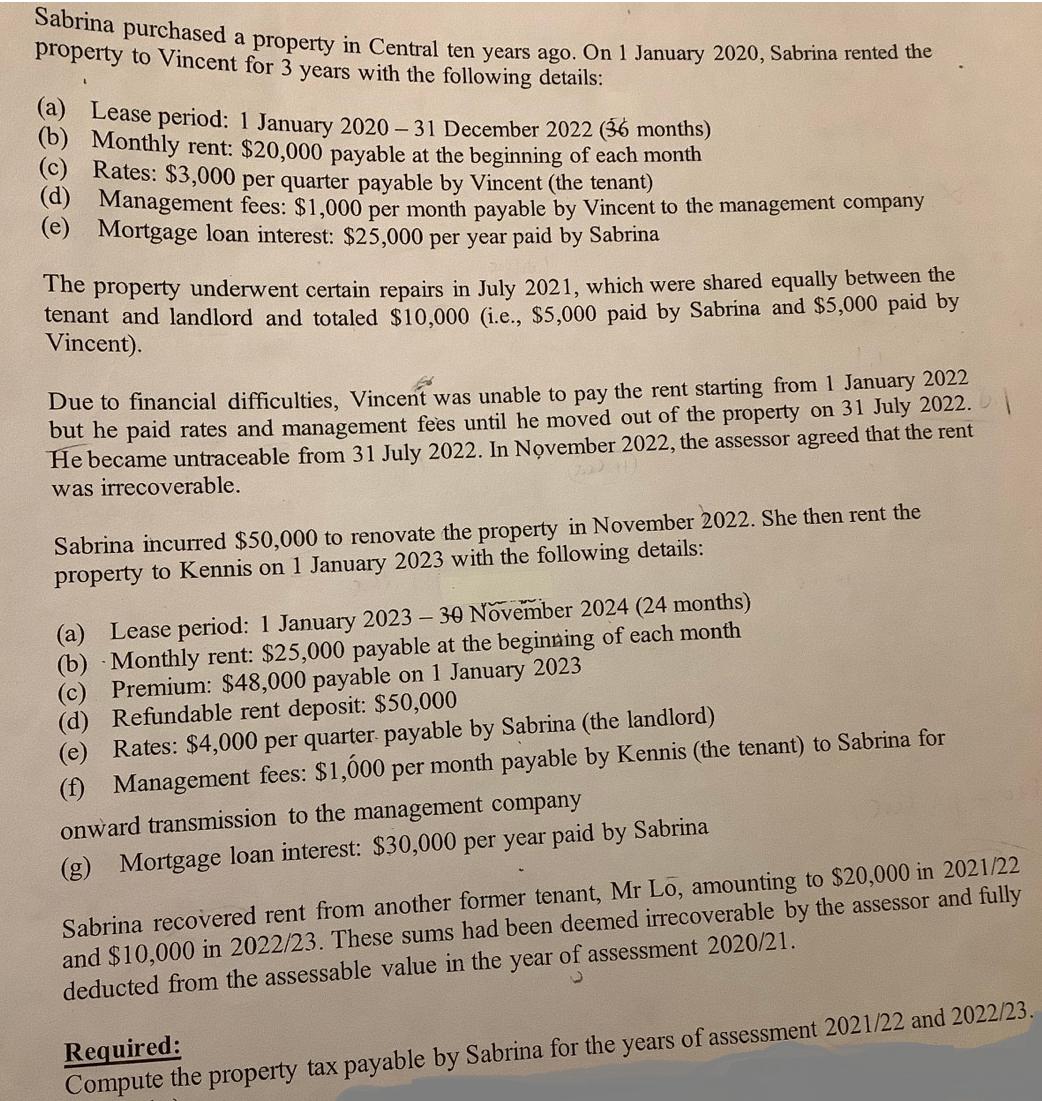

Sabrina purchased a property in Central ten years ago. On 1 January 2020, Sabrina rented the property to Vincent for 3 years with the following details: (a) Lease period: 1 January 2020-31 December 2022 (36 months) (b) Monthly rent: $20,000 payable at the beginning of each month (c) Rates: $3,000 per quarter payable by Vincent (the tenant) (d) Management fees: $1,000 per month payable by Vincent to the management company (e) Mortgage loan interest: $25,000 per year paid by Sabrina The property underwent certain repairs in July 2021, which were shared equally between the tenant and landlord and totaled $10,000 (i.e., $5,000 paid by Sabrina and $5,000 paid by Vincent). Due to financial difficulties, Vincent was unable to pay the rent starting from 1 January 2022 but he paid rates and management fees until he moved out of the property on 31 July 2022. He became untraceable from 31 July 2022. In November 2022, the assessor agreed that the rent was irrecoverable. Sabrina incurred $50,000 to renovate the property in November 2022. She then rent the property to Kennis on 1 January 2023 with the following details: (a) Lease period: 1 January 2023 - 30 November 2024 (24 months) (b) Monthly rent: $25,000 payable at the beginning of each month (c) Premium: $48,000 payable on 1 January 2023 (d) Refundable rent deposit: $50,000 (e) Rates: $4,000 per quarter payable by Sabrina (the landlord) (f) Management fees: $1,000 per month payable by Kennis (the tenant) to Sabrina for onward transmission to the management company (g) Mortgage loan interest: $30,000 per year paid by Sabrina Sabrina recovered rent from another former tenant, Mr Lo, amounting to $20,000 in 2021/22 and $10,000 in 2022/23. These sums had been deemed irrecoverable by the assessor and fully deducted from the assessable value in the year of assessment 2020/21. Required: J Compute the property tax payable by Sabrina for the years of assessment 2021/22 and 2022/23.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer To compute the property tax payable by Sabrina for the years of assessment 202122 and 202223 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started