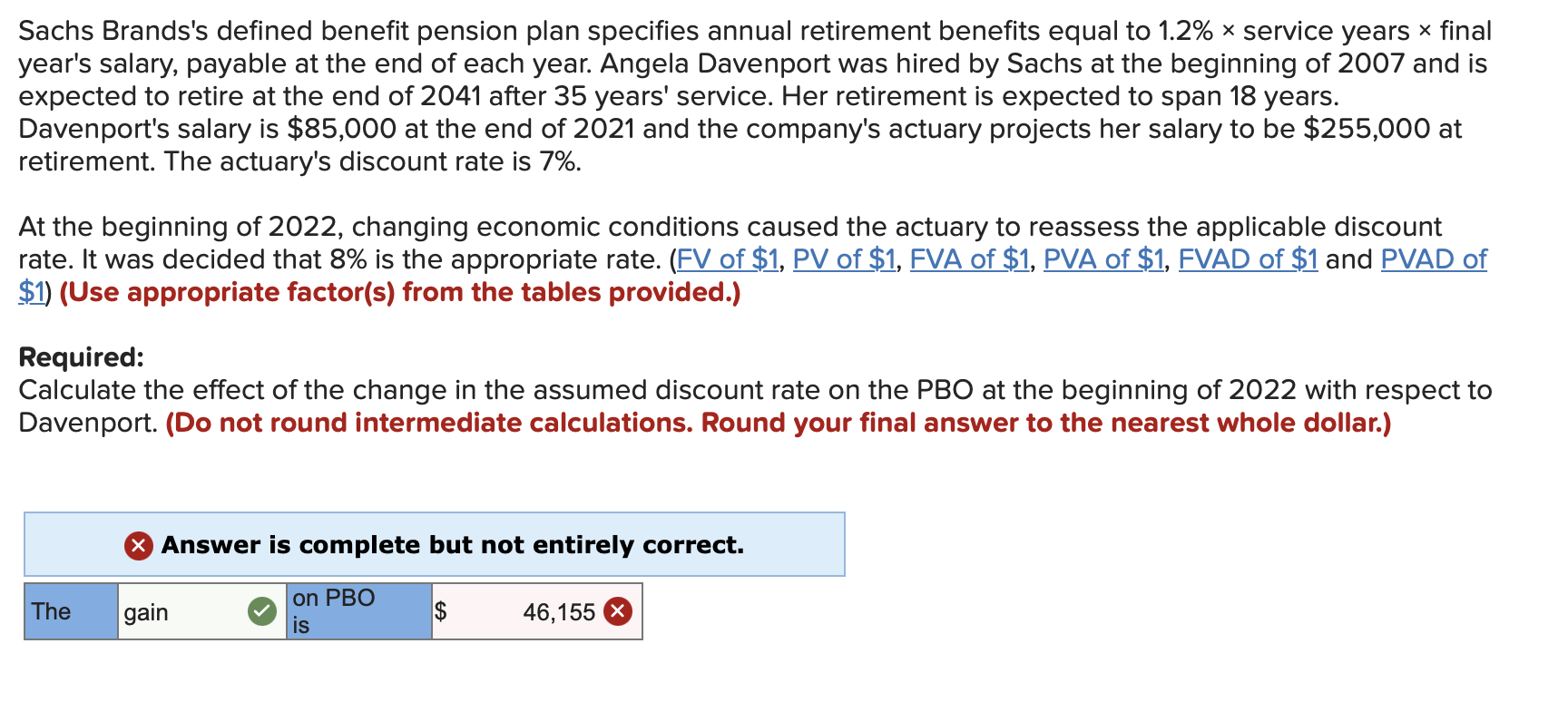

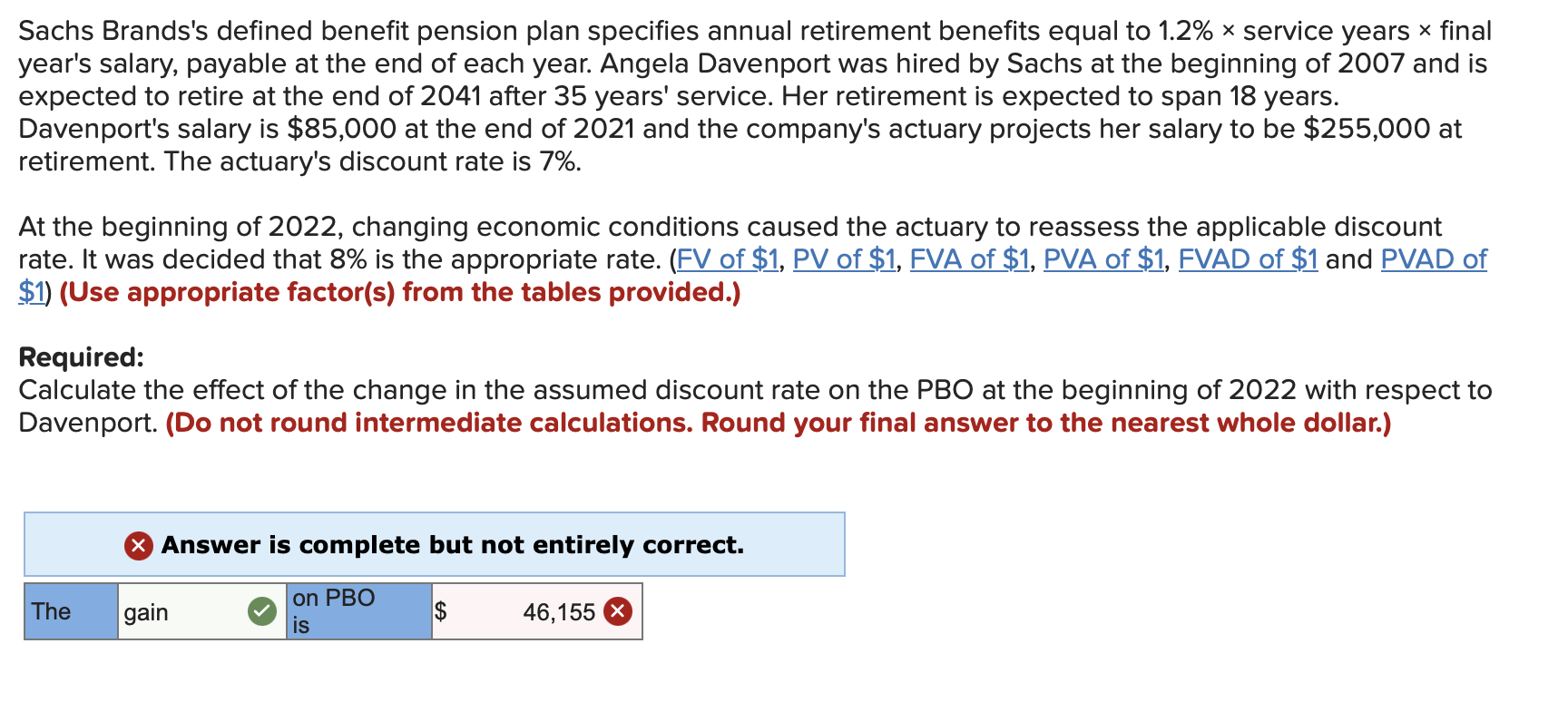

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% x service years * final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $85,000 at the end of 2021 and the company's actuary projects her salary to be $255,000 at retirement. The actuary's discount rate is 7%. At the beginning of 2022, changing economic conditions caused the actuary to reassess the applicable discount rate. It was decided that 8% is the appropriate rate. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the effect of the change in the assumed discount rate on the PBO at the beginning of 2022 with respect to Davenport. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) X Answer is complete but not entirely correct. The gain on PBO is $ 46,155 X Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% x service years * final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $85,000 at the end of 2021 and the company's actuary projects her salary to be $255,000 at retirement. The actuary's discount rate is 7%. At the beginning of 2022, changing economic conditions caused the actuary to reassess the applicable discount rate. It was decided that 8% is the appropriate rate. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the effect of the change in the assumed discount rate on the PBO at the beginning of 2022 with respect to Davenport. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) X Answer is complete but not entirely correct. The gain on PBO is $ 46,155 X