Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SADO can borrow in the U.S. for 9%. while BUGI has to pay to borrow in the U.S. BUGI can borrow in Australia for 7%.

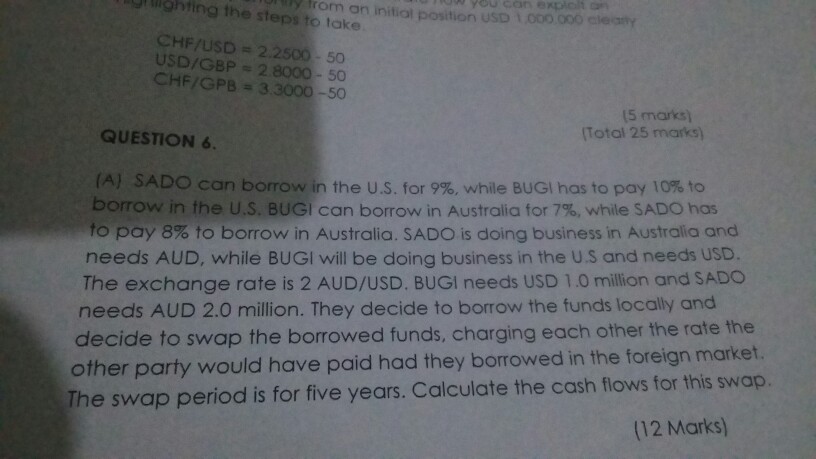

SADO can borrow in the U.S. for 9%. while BUGI has to pay to borrow in the U.S. BUGI can borrow in Australia for 7%. while SADO has to pay 8% to borrow in Australia. SADO is doing business in Austral a and needs AUD, while BUGI will be doing business in the U.S and needs USD. The exchange rate is 2 AUD/USD. BUGI needs USD 1.0 million and SADO needs AUD 2.0 million. They decide to borrow the funds, charging each other the rate the other party would have paid had they borrowed in the foreign market. The swap period is for five years. Calculate the cash flows for this swap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started