Answered step by step

Verified Expert Solution

Question

1 Approved Answer

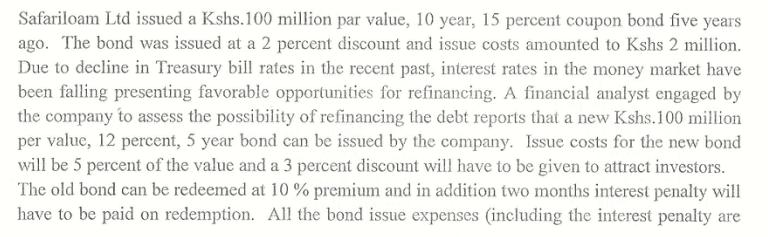

Safariloam Ltd issued a Kshs.100 million par value, 10 year, 15 percent coupon bond five years ago. The bond was issued at a 2

Safariloam Ltd issued a Kshs.100 million par value, 10 year, 15 percent coupon bond five years ago. The bond was issued at a 2 percent discount and issue costs amounted to Kshs 2 million. Due to decline in Treasury bill rates in the recent past, interest rates in the money market have been falling presenting favorable opportunities for refinancing. A financial analyst engaged by the company to assess the possibility of refinancing the debt reports that a new Kshs.100 million per value, 12 percent, 5 year bond can be issued by the company. Issue costs for the new bond will be 5 percent of the value and a 3 percent discount will have to be given to attract investors. The old bond can be redeemed at 10 % premium and in addition two months interest penalty will have to be paid on redemption. All the bond issue expenses (including the interest penalty are amortized on a straight line basis over the life of the bond and allowable for corporate tax purposes. The applicable corporation tax rate is 40 percent. Required: (a) Cash investment required for the refunding decision. (b) Annual cash benefits if any, from the refunding decision. (c) Explain, with appropriate calculation, whether it is worthwhile to replace the existing bond. (3 marks) (6 marks) (6 marks)

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Cash investment required for the refu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started