Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Safely assume that mutual funds cannot borrow to invest, while hedge funds can borrow to invest. Theoretically the Security Market Line (SML) has an increasing

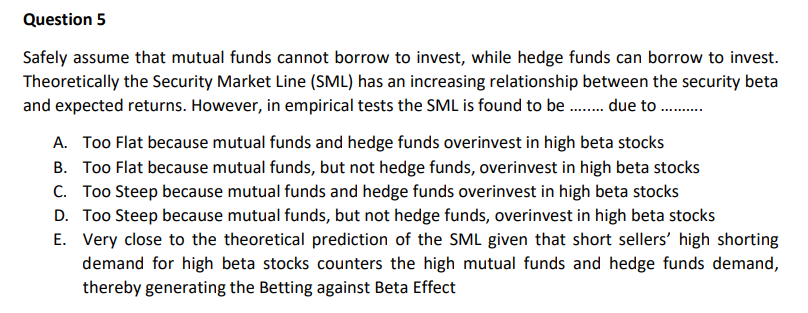

Safely assume that mutual funds cannot borrow to invest, while hedge funds can borrow to invest. Theoretically the Security Market Line (SML) has an increasing relationship between the security beta and expected returns. However, in empirical tests the SML is found to be due to .......... A. Too Flat because mutual funds and hedge funds overinvest in high beta stocks B. Too Flat because mutual funds, but not hedge funds, overinvest in high beta stocks C. Too Steep because mutual funds and hedge funds overinvest in high beta stocks D. Too Steep because mutual funds, but not hedge funds, overinvest in high beta stocks E. Very close to the theoretical prediction of the SML given that short sellers' high shorting demand for high beta stocks counters the high mutual funds and hedge funds demand, thereby generating the Betting against Beta Effect

Safely assume that mutual funds cannot borrow to invest, while hedge funds can borrow to invest. Theoretically the Security Market Line (SML) has an increasing relationship between the security beta and expected returns. However, in empirical tests the SML is found to be due to .......... A. Too Flat because mutual funds and hedge funds overinvest in high beta stocks B. Too Flat because mutual funds, but not hedge funds, overinvest in high beta stocks C. Too Steep because mutual funds and hedge funds overinvest in high beta stocks D. Too Steep because mutual funds, but not hedge funds, overinvest in high beta stocks E. Very close to the theoretical prediction of the SML given that short sellers' high shorting demand for high beta stocks counters the high mutual funds and hedge funds demand, thereby generating the Betting against Beta Effect Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started