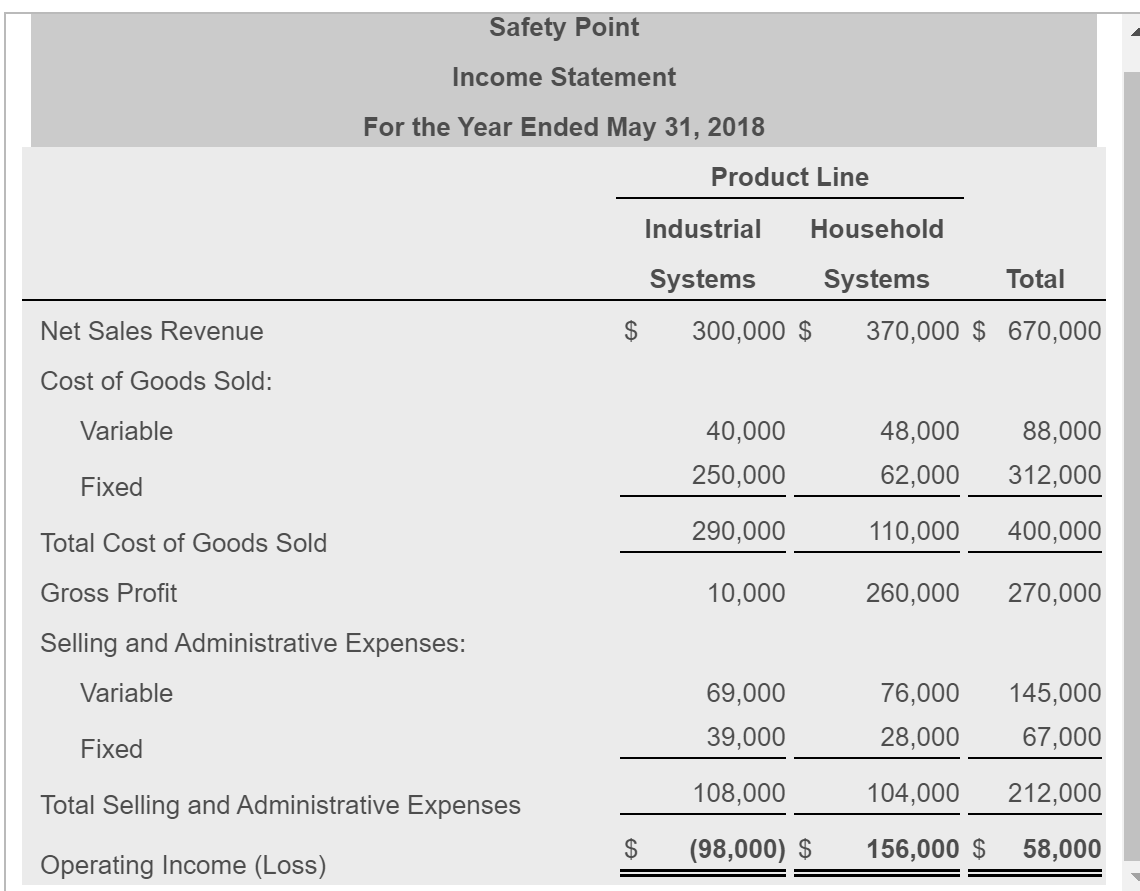

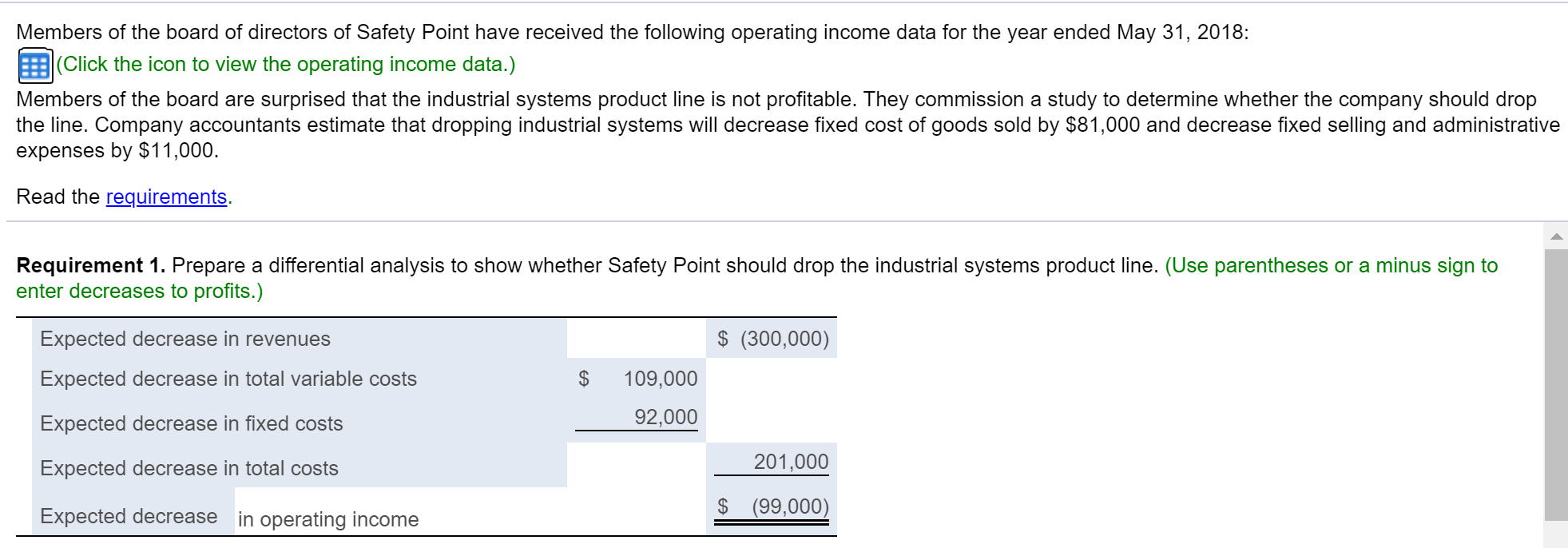

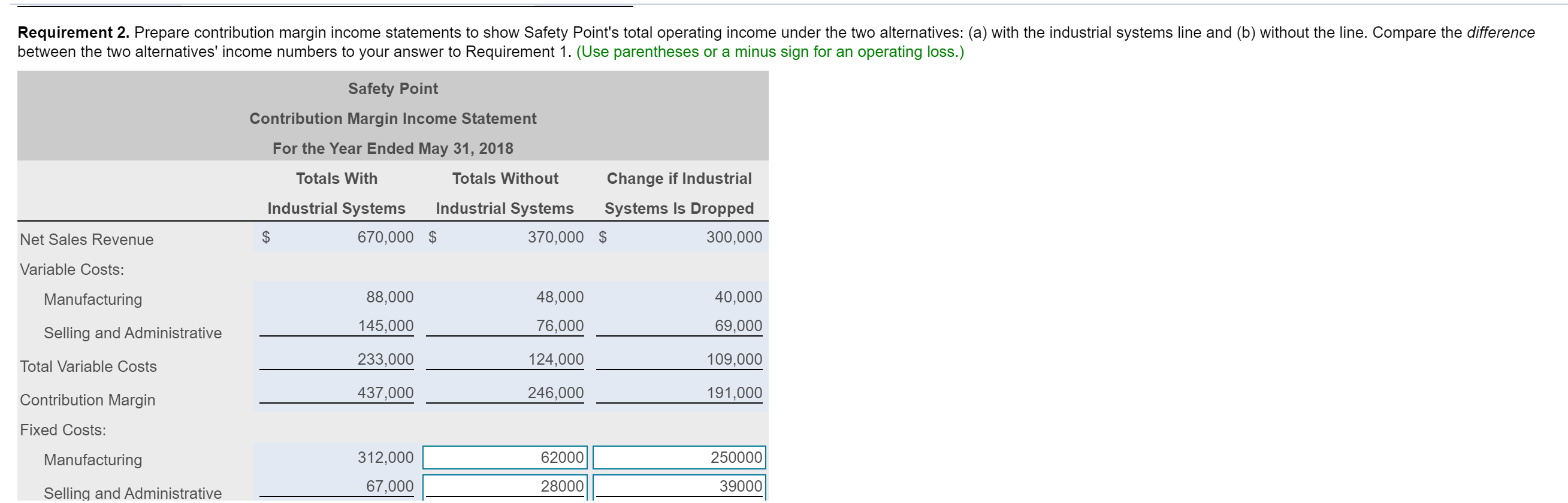

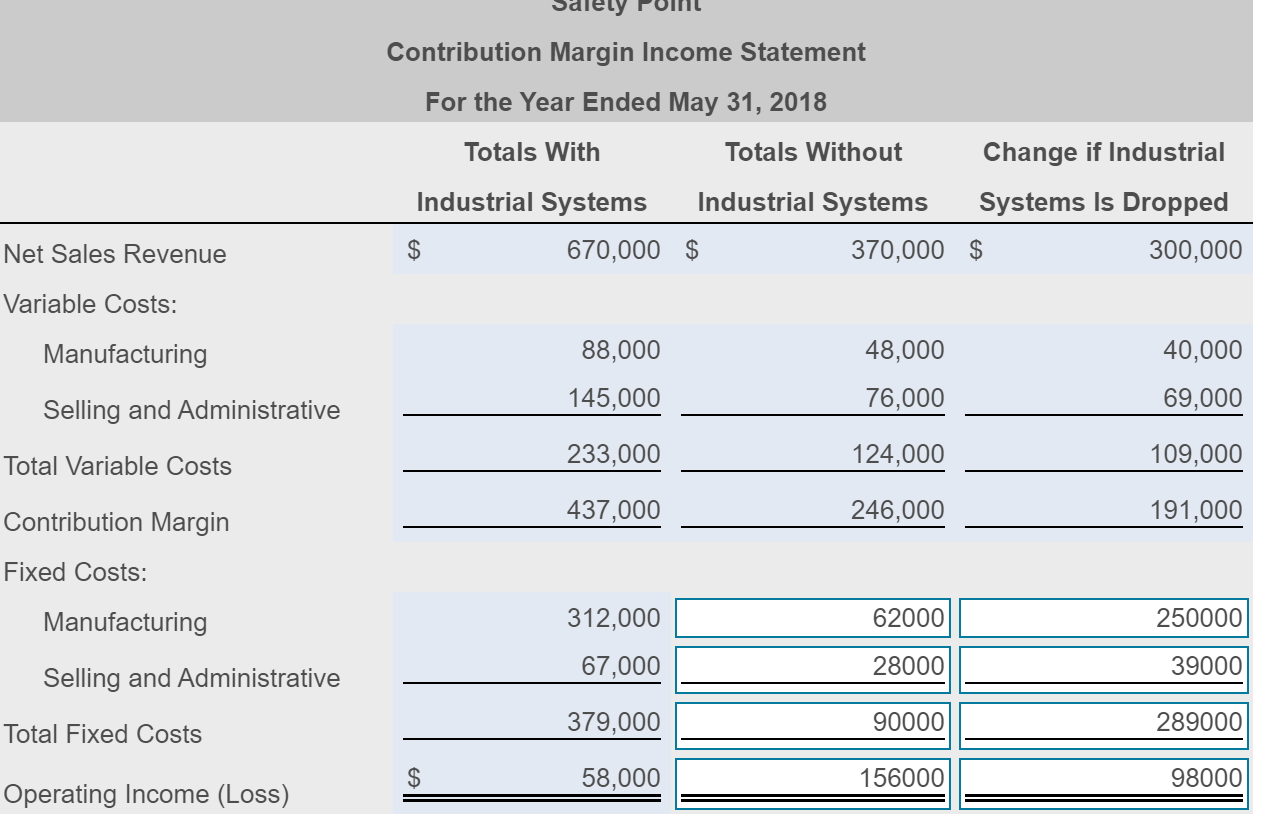

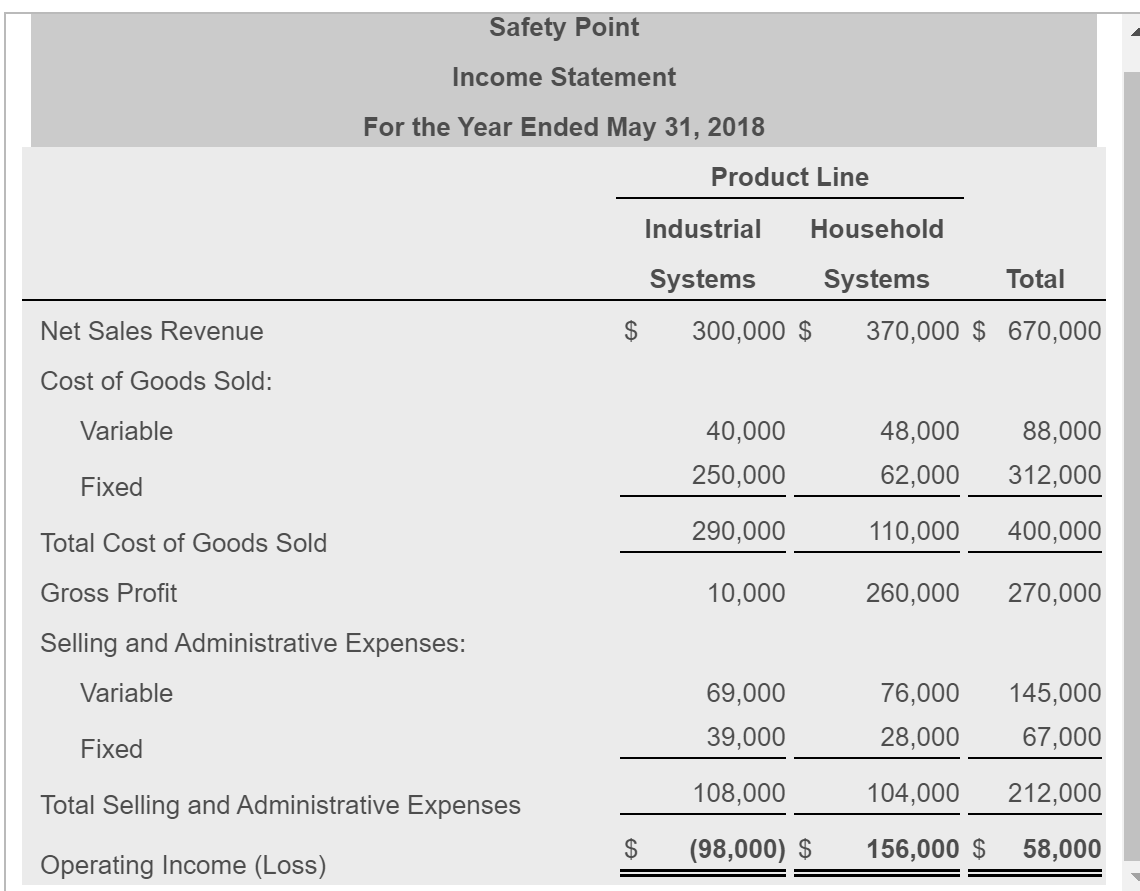

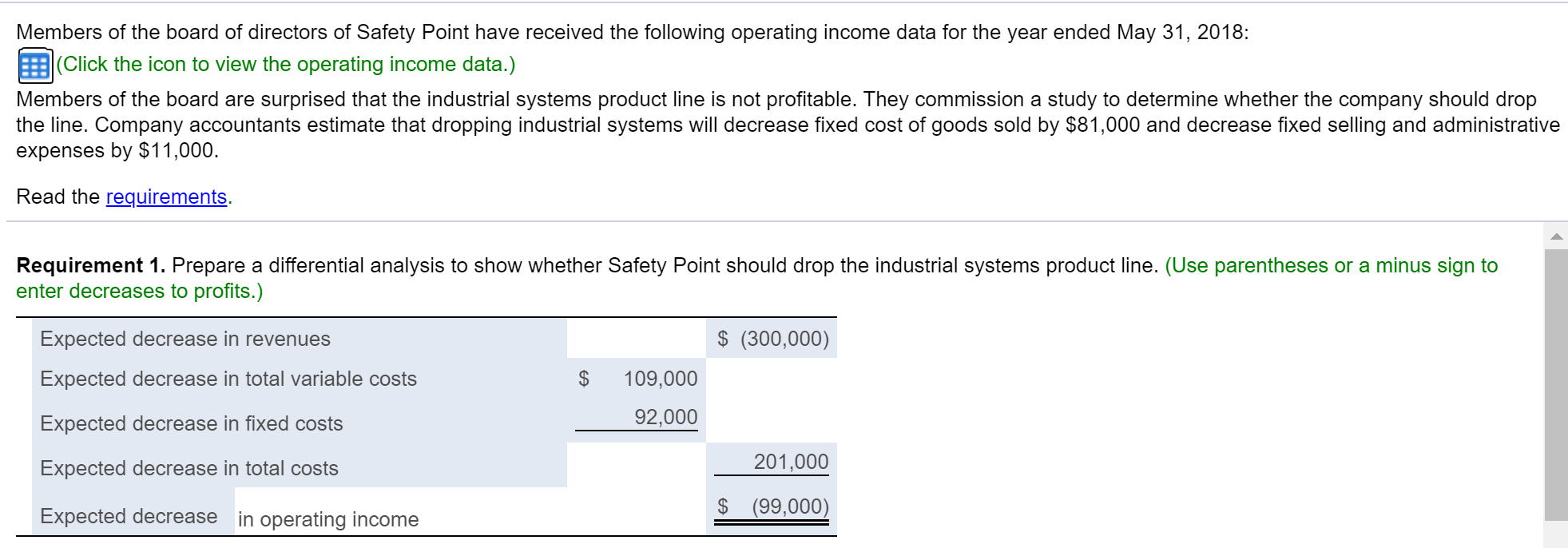

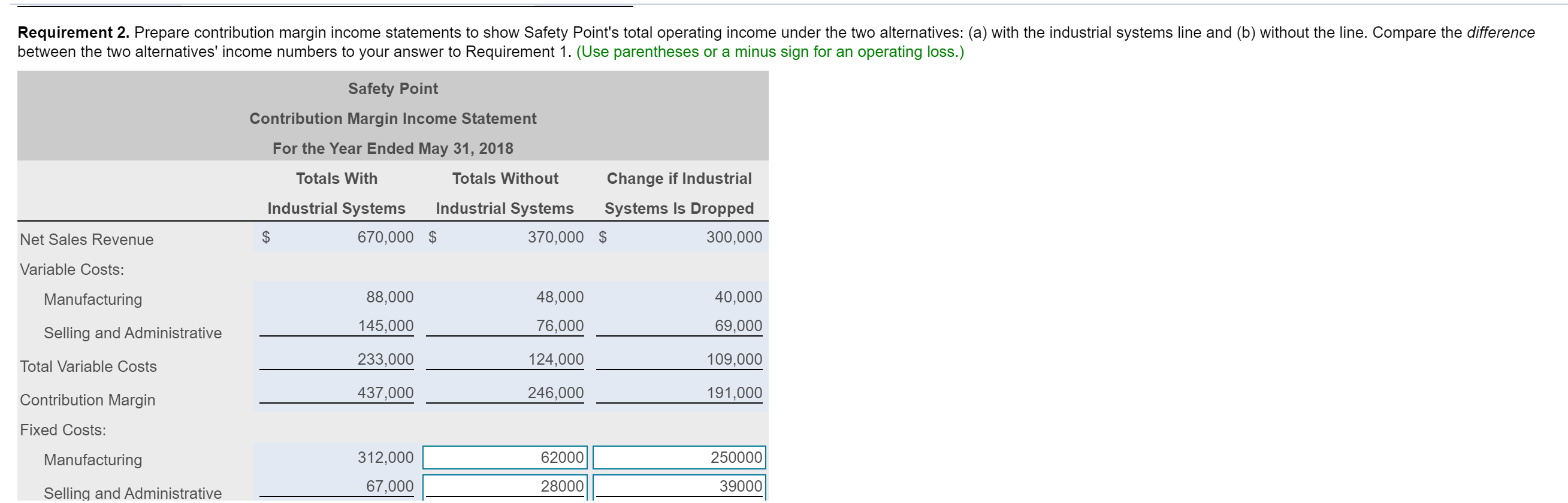

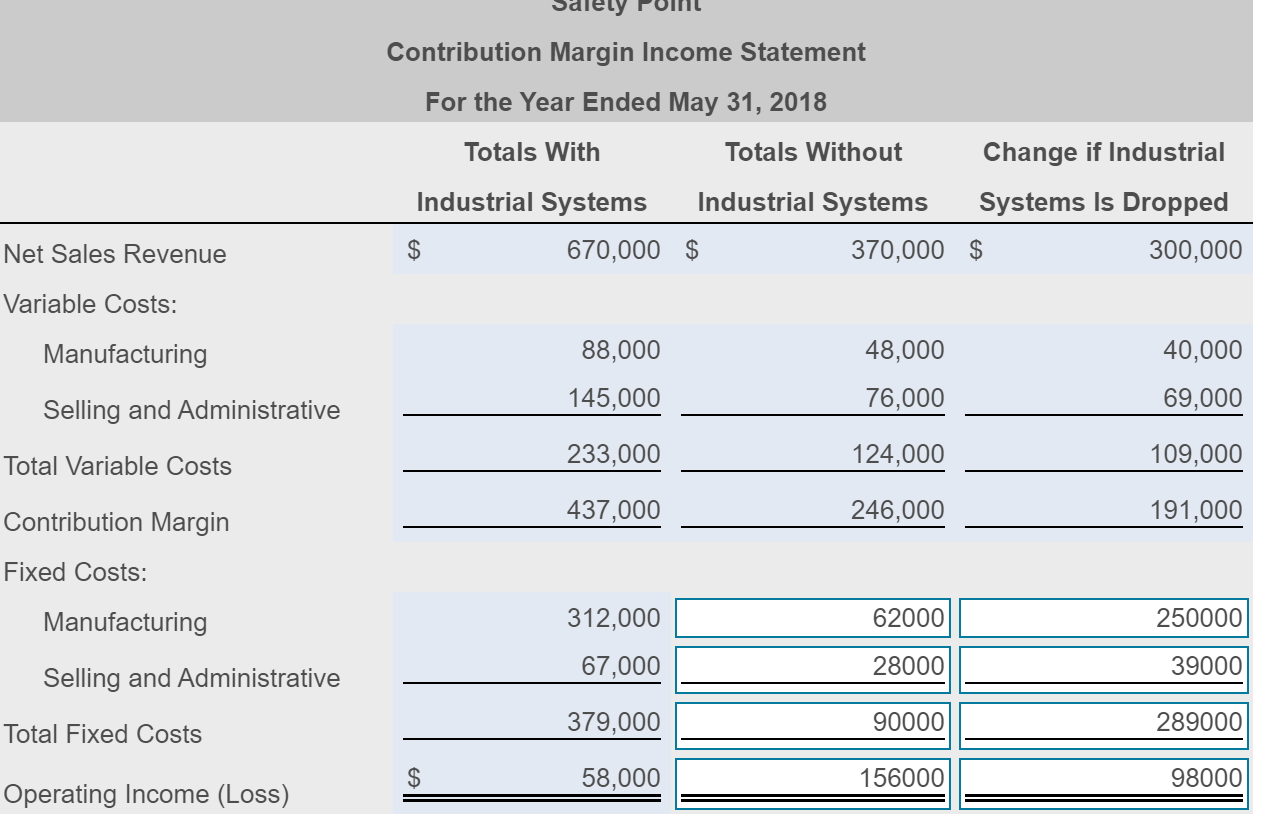

Safety Point Income Statement For the Year Ended May 31, 2018 Product Line Industrial Household Systems Systems Total Net Sales Revenue $ 300,000 $ 370,000 $ 670,000 Cost of Goods Sold: Variable 40,000 250,000 48,000 62,000 88,000 312,000 Fixed Total Cost of Goods Sold 290,000 110,000 400,000 Gross Profit 10,000 260,000 270,000 Selling and Administrative Expenses: Variable 69,000 39,000 76,000 28,000 145,000 67,000 Fixed Total Selling and Administrative Expenses 108,000 104,000 212,000 $ (98,000) $ 156,000 $ 58,000 Operating Income (Loss) Members of the board of directors of Safety Point have received the following operating income data for the year ended May 31, 2018: (Click the icon to view the operating income data.) Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $81,000 and decrease fixed selling and administrative expenses by $11,000. Read the requirements. Requirement 1. Prepare a differential analysis to show whether Safety Point should drop the industrial systems product line. (Use parentheses or a minus sign to enter decreases to profits.) Expected decrease in revenues $ (300,000) Expected decrease in total variable costs $ 109,000 92,000 Expected decrease in fixed costs Expected decrease in total costs 201,000 Expected decrease in operating income $ (99,000) Requirement 2. Prepare contribution margin income statements to show Safety Point's total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives' income numbers to your answer to Requirement 1. (Use parentheses or a minus sign for an operating loss.) Safety Point Contribution Margin Income Statement For the Year Ended May 31, 2018 Totals With Totals Without Change if Industrial Industrial Systems Industrial Systems Systems Is Dropped $ 670,000 $ 370,000 $ 300,000 Net Sales Revenue Variable Costs: Manufacturing 88,000 48,000 40,000 Selling and Administrative 145,000 76,000 69,000 Total Variable Costs 233,000 124,000 109,000 Contribution Margin 437,000 246,000 191,000 Fixed Costs: Manufacturing 62000 250000 312,000 67,000 28000 39000 Selling and Administrative Contribution Margin Income Statement For the Year Ended May 31, 2018 Totals With Totals Without Change if Industrial Industrial Systems Industrial Systems Systems Is Dropped $ 670,000 $ 370,000 $ 300,000 Net Sales Revenue Variable Costs: Manufacturing 48,000 40,000 88,000 145,000 76,000 69,000 Selling and Administrative Total Variable Costs 233,000 124,000 109,000 Contribution Margin 437,000 246,000 191,000 Fixed Costs: Manufacturing 312,000 62000 250000 67,000 28000 39000 Selling and Administrative 379,000 Total Fixed Costs 90000 289000 $ 58,000 156000 98000 Operating Income (Loss)