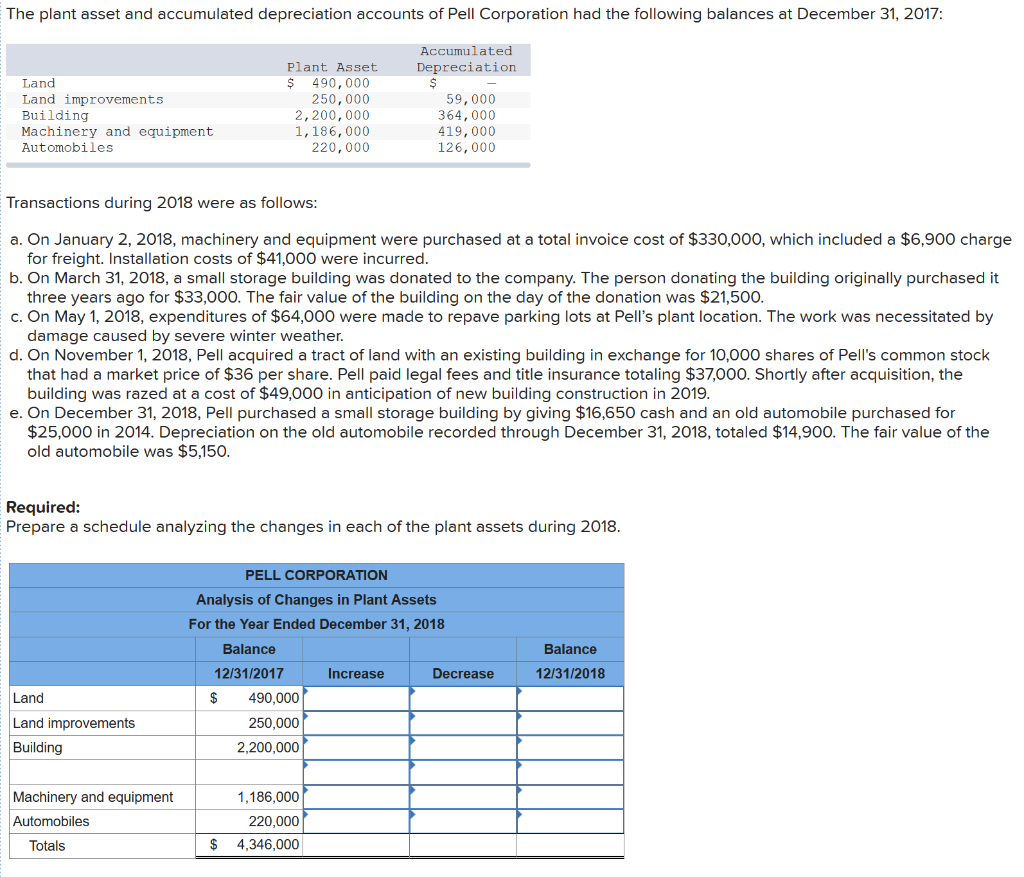

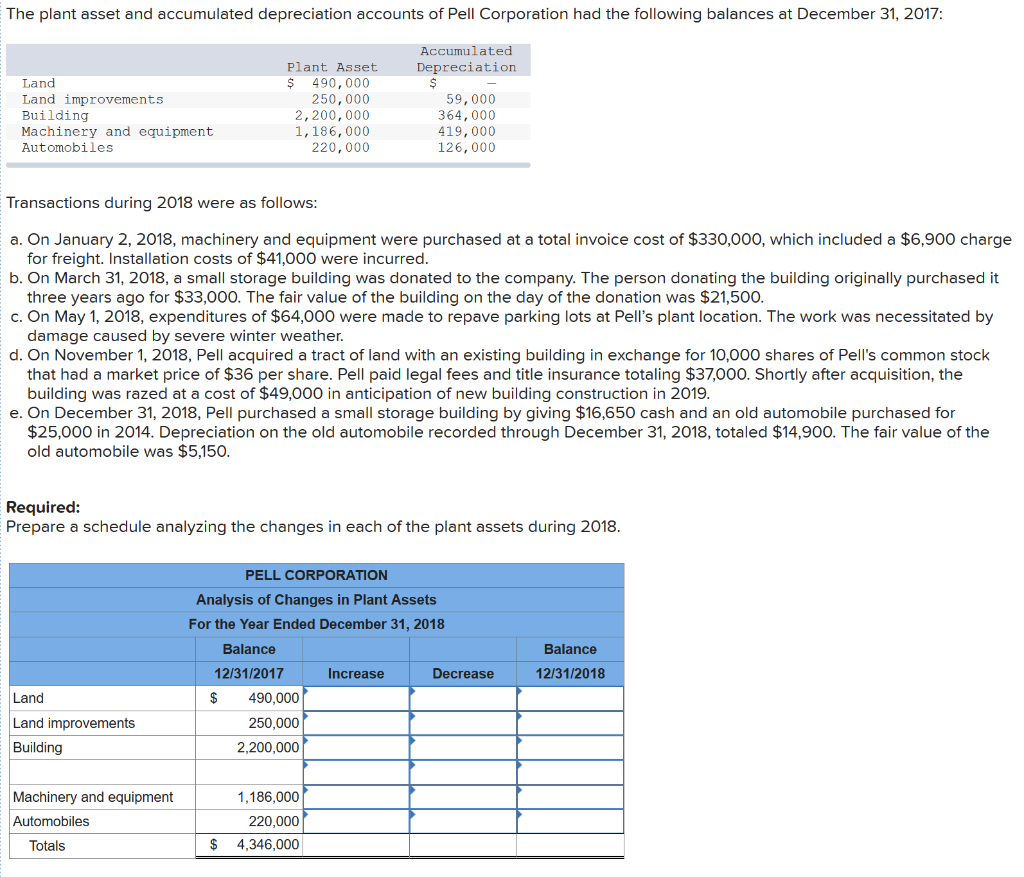

The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2017 Accumulated Depreciation Plant Asset Land Land improvements Building Machinery and equipment Automobiles $ 490, 000 250, 000 2,200, 000 1,186,000 220,000 59,000 364,000 419,000 126,000 Transactions during 2018 were as follows: a. On January 2, 2018, machinery and equipment were purchased at a total invoice cost of $330,000, which included a $6,900 charge b. On March 31, 2018, a small storage building was donated to the company. The person donating the building originally purchased it c. On May 1, 2018, expenditures of $64,000 were made to repave parking lots at Pell's plant location. The work was necessitated by d. On November 1, 2018, Pell acquired a tract of land with an existing building in exchange for 10,000 shares of Pell's common stock e. On December 31, 2018, Pell purchased a small storage building by giving $16,650 cash and an old automobile purchased for for freight. Installation costs of $41,000 were incurred three years ago for $33,000. The fair value of the building on the day of the donation was $21,500 damage caused by severe winter weather. that had a market price of $36 per share. Pell paid legal fees and title insurance totaling $37,000. Shortly after acquisition, the building was razed at a cost of $49,000 in anticipation of new building construction in 2019 $25,000 in 2014. Depreciation on the old automobile recorded through December 31, 2018, totaled $14,900. The fair value of the old automobile was $5,150 Required: Prepare a schedule analyzing the changes in each of the plant assets during 2018 PELL CORPORATION Analysis of Changes in Plant Assets For the Year Ended December 31, 2018 Balance Balance 12/31/2017 Increase Decrease 12/31/2018 Land Land improvements Building 490,000 250,000 2,200,000 Machinery and equipment 1,186,000 220,000 $ 4,346,000 Automobiles Totals The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2017 Accumulated Depreciation Plant Asset Land Land improvements Building Machinery and equipment Automobiles $ 490, 000 250, 000 2,200, 000 1,186,000 220,000 59,000 364,000 419,000 126,000 Transactions during 2018 were as follows: a. On January 2, 2018, machinery and equipment were purchased at a total invoice cost of $330,000, which included a $6,900 charge b. On March 31, 2018, a small storage building was donated to the company. The person donating the building originally purchased it c. On May 1, 2018, expenditures of $64,000 were made to repave parking lots at Pell's plant location. The work was necessitated by d. On November 1, 2018, Pell acquired a tract of land with an existing building in exchange for 10,000 shares of Pell's common stock e. On December 31, 2018, Pell purchased a small storage building by giving $16,650 cash and an old automobile purchased for for freight. Installation costs of $41,000 were incurred three years ago for $33,000. The fair value of the building on the day of the donation was $21,500 damage caused by severe winter weather. that had a market price of $36 per share. Pell paid legal fees and title insurance totaling $37,000. Shortly after acquisition, the building was razed at a cost of $49,000 in anticipation of new building construction in 2019 $25,000 in 2014. Depreciation on the old automobile recorded through December 31, 2018, totaled $14,900. The fair value of the old automobile was $5,150 Required: Prepare a schedule analyzing the changes in each of the plant assets during 2018 PELL CORPORATION Analysis of Changes in Plant Assets For the Year Ended December 31, 2018 Balance Balance 12/31/2017 Increase Decrease 12/31/2018 Land Land improvements Building 490,000 250,000 2,200,000 Machinery and equipment 1,186,000 220,000 $ 4,346,000 Automobiles Totals