Answered step by step

Verified Expert Solution

Question

1 Approved Answer

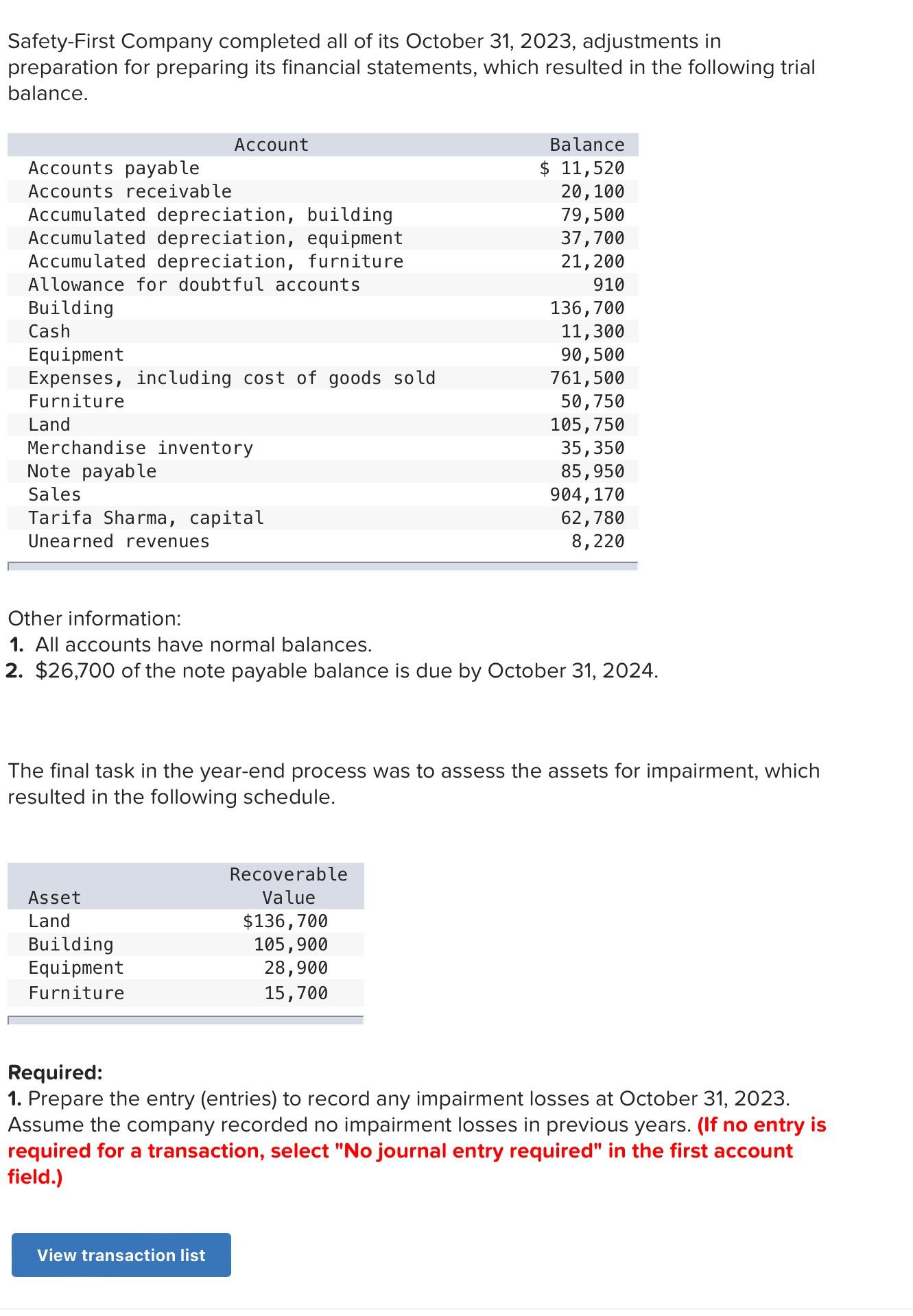

Safety-First Company completed all of its October 31, 2023, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance.

Safety-First Company completed all of its October 31, 2023, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance. Account Balance Accounts payable Accounts receivable $ 11,520 20,100 Accumulated depreciation, building 79,500 Accumulated depreciation, equipment 37,700 Accumulated depreciation, furniture Allowance for doubtful accounts 21,200 910 Building 136,700 Cash 11,300 Equipment 90,500 Expenses, including cost of goods sold 761,500 Furniture 50,750 Land 105,750 Merchandise inventory 35,350 Note payable 85,950 Sales Tarifa Sharma, capital Unearned revenues 904,170 62,780 8,220 Other information: 1. All accounts have normal balances. 2. $26,700 of the note payable balance is due by October 31, 2024. The final task in the year-end process was to assess the assets for impairment, which resulted in the following schedule. Recoverable Asset Value Land $136,700 Building 105,900 Equipment 28,900 Furniture 15,700 Required: 1. Prepare the entry (entries) to record any impairment losses at October 31, 2023. Assume the company recorded no impairment losses in previous years. (If no entry is required for a transaction, select "No journal entry required" in the first account field.) View transaction list

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started