Question

Sag, Inc. has the following information relating to its defined benefit plan as of December 31: Projected benefit obligation $5,000,000 Unrecognized prior service cost

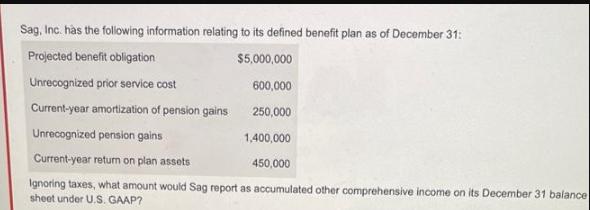

Sag, Inc. has the following information relating to its defined benefit plan as of December 31: Projected benefit obligation $5,000,000 Unrecognized prior service cost 600,000 Current-year amortization of pension gains 250,000 Unrecognized pension gains 1,400,000 Current-year return on plan assets 450,000 Ignoring taxes, what amount would Sag report as accumulated other comprehensive income on its December 31 balance sheet under U.S. GAAP?

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine the accumulated other comprehensive income AOCI amount reporte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

16th Edition

324376375, 0324375743I, 978-0324376371, 9780324375749, 978-0324312140

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App