Answered step by step

Verified Expert Solution

Question

1 Approved Answer

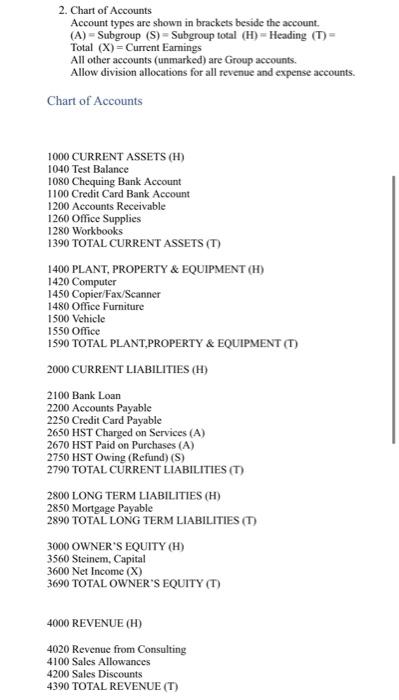

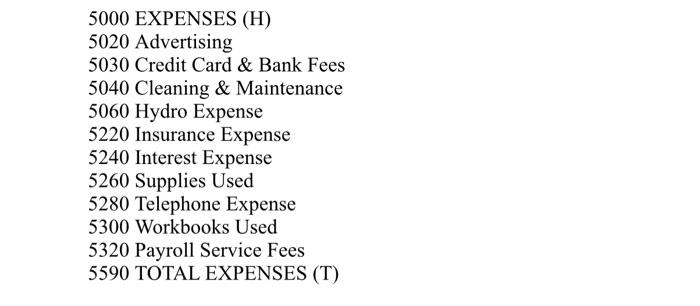

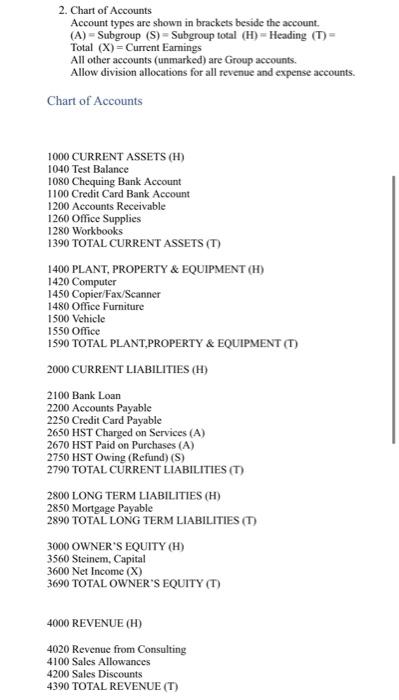

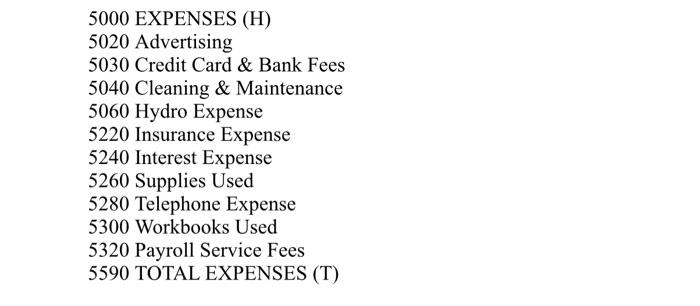

sage 50 2. Chart of Accounts Account types are shown in brackets beside the account (A) - Subgroup (S) = Subgroup total (H) Heading (1)

sage 50

2. Chart of Accounts Account types are shown in brackets beside the account (A) - Subgroup (S) = Subgroup total (H) Heading (1) - Total (X) = Current Earnings All other accounts (unmarked) are Group accounts. Allow division allocations for all revenue and expense accounts. Chart of Accounts 1000 CURRENT ASSETS (H) 1040 Test Balance 1080 Chequing Bank Account 1100 Credit Card Bank Account 1200 Accounts Receivable 1260 Office Supplies 1280 Workbooks 1390 TOTAL CURRENT ASSETS (T) 1400 PLANT, PROPERTY & EQUIPMENT (H) 1420 Computer 1450 Copier/Fax/Scanner 1480 Office Furniture 1500 Vehicle 1550 Office 1590 TOTAL PLANT,PROPERTY & EQUIPMENT (T) 2000 CURRENT LIABILITIES (H) 2100 Bank Loan 2200 Accounts Payable 2250 Credit Card Payable 2650 HST Charged on Services (A) 2670 HST Paid on Purchases (A) 2750 HST Owing (Refund) (S) 2790 TOTAL CURRENT LIABILITIES (T) 2800 LONG TERM LIABILITIES (H) 2850 Mortgage Payable 2890 TOTAL LONG TERM LIABILITIES (T) 3000 OWNER'S EQUITY (H) 3560 Steinem, Capital 3600 Net Income (X) 3690 TOTAL OWNER'S EQUITY (T) 4000 REVENUE (HD) 4020 Revenue from Consulting 4100 Sales Allowances 4200 Sales Discounts 4390 TOTAL REVENUE (T) 5000 EXPENSES (H) 5020 Advertising 5030 Credit Card & Bank Fees 5040 Cleaning & Maintenance 5060 Hydro Expense 5220 Insurance Expense 5240 Interest Expense 5260 Supplies Used 5280 Telephone Expense 5300 Workbooks Used 5320 Payroll Service Fees 5590 TOTAL EXPENSES (T) 2. Chart of Accounts Account types are shown in brackets beside the account (A) - Subgroup (S) = Subgroup total (H) Heading (1) - Total (X) = Current Earnings All other accounts (unmarked) are Group accounts. Allow division allocations for all revenue and expense accounts. Chart of Accounts 1000 CURRENT ASSETS (H) 1040 Test Balance 1080 Chequing Bank Account 1100 Credit Card Bank Account 1200 Accounts Receivable 1260 Office Supplies 1280 Workbooks 1390 TOTAL CURRENT ASSETS (T) 1400 PLANT, PROPERTY & EQUIPMENT (H) 1420 Computer 1450 Copier/Fax/Scanner 1480 Office Furniture 1500 Vehicle 1550 Office 1590 TOTAL PLANT,PROPERTY & EQUIPMENT (T) 2000 CURRENT LIABILITIES (H) 2100 Bank Loan 2200 Accounts Payable 2250 Credit Card Payable 2650 HST Charged on Services (A) 2670 HST Paid on Purchases (A) 2750 HST Owing (Refund) (S) 2790 TOTAL CURRENT LIABILITIES (T) 2800 LONG TERM LIABILITIES (H) 2850 Mortgage Payable 2890 TOTAL LONG TERM LIABILITIES (T) 3000 OWNER'S EQUITY (H) 3560 Steinem, Capital 3600 Net Income (X) 3690 TOTAL OWNER'S EQUITY (T) 4000 REVENUE (HD) 4020 Revenue from Consulting 4100 Sales Allowances 4200 Sales Discounts 4390 TOTAL REVENUE (T) 5000 EXPENSES (H) 5020 Advertising 5030 Credit Card & Bank Fees 5040 Cleaning & Maintenance 5060 Hydro Expense 5220 Insurance Expense 5240 Interest Expense 5260 Supplies Used 5280 Telephone Expense 5300 Workbooks Used 5320 Payroll Service Fees 5590 TOTAL EXPENSES (T)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started