Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sage Cosmetics Co. purchased machinery on December 31, 2024, paying $54,600.00 down and agreeing to pay the balance in four equal installments of $59,200.00 payable

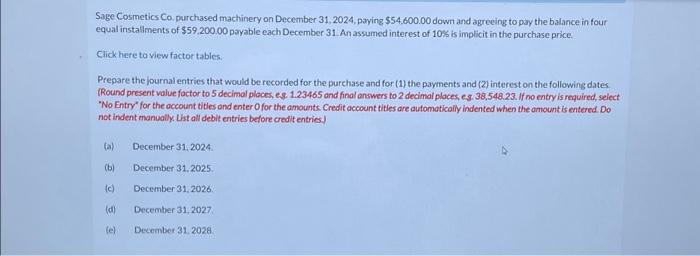

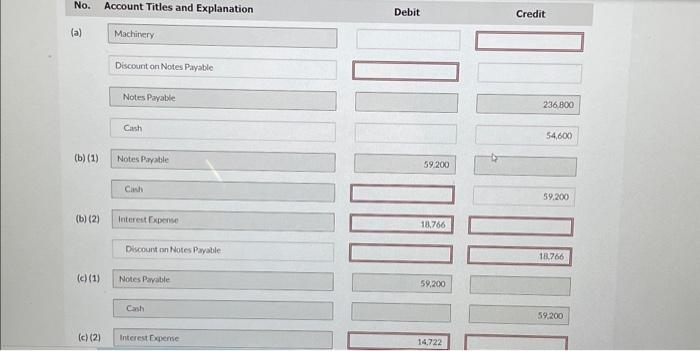

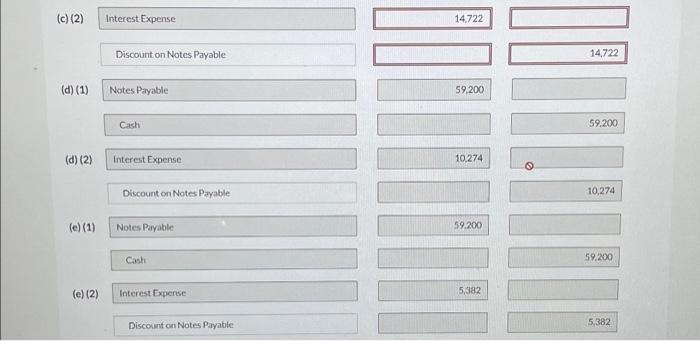

Sage Cosmetics Co. purchased machinery on December 31, 2024, paying $54,600.00 down and agreeing to pay the balance in four equal installments of $59,200.00 payable each December 31. An assumed interest of 10% is implicit in the purchase price. Click here to view factor tables. Prepare the journal entries that would be recorded for the purchase and for (1) the payments and (2) interest on the following dates. (Round present value factor to 5 decimal places, e.g. 1.23465 and final answers to 2 decimal places, e.g. 38,548.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) (a) (b) (c) (d) (e) December 31, 2024. December 31, 2025. December 31, 2026. December 31, 2027. December 31, 2028.

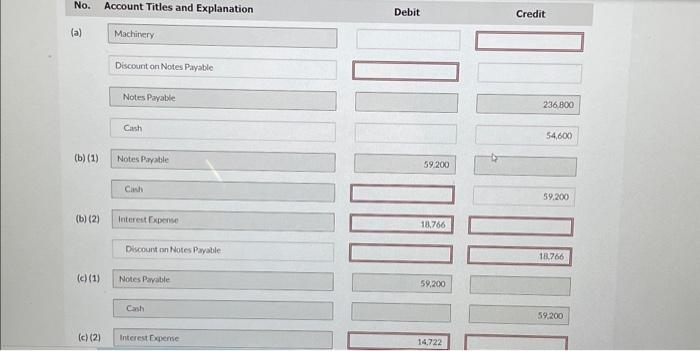

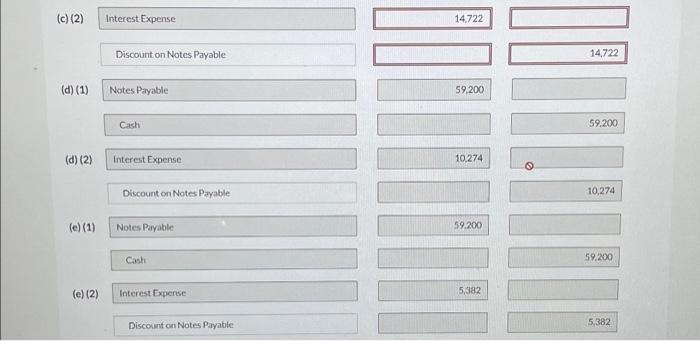

No. Account Titles and Explanation Debit Credit (a) Machinery Discount on Notes Payable Notes Payable Cash (b) (1) Notes Pirable Cavh 59.200 236,800 54,600 (b) (2) Interest Lxponse 18.766 Discount on Notes Paysble 18766 (c) (1) Notes Parable 59,200 59.200 Cash (c) (2) Interest Doperse 14,722 Sage Cosmetics Co. purchased machinery on December 31, 2024, paying, $54.600.00 down and agreeing to pay the balance in four equal installments of $59,200.00 payable each December 31 . An assumed interest of 10% is implicit in the purchase price. Click here to view factor tables. Prepare the journal entries that would be recorded for the purchase and for (1) the payments and (2) interest on the following dates (Round present value foctor to 5 decimal places, eg. 1.23465 and final answers to 2 decimal places. es. 38,548.23. If no entry is reepuired, seiect "No Entry' for the occount titles and enter 0 for the amounts. Credit account tities are automotically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries) (a) December 31,2024. (b) December 31.2025 . (c) December 31,2026 . (d) December 31, 2027. (e) Decenber 31, 2028 (c) (2) Interest Expense 14,722 Discount on Notes Payable 14,722 (d) (1) Notes Payable 59,200 Cash Cash 59,200 (d) (2) Interest Expense Discount on Notes Payable 10,274 (e) (1) Notes Payable 59.200 Cash (e) (2) Interest Expense Discount on Notes Payable 5,382

No. Account Titles and Explanation Debit Credit (a) Machinery Discount on Notes Payable Notes Payable Cash (b) (1) Notes Pirable Cavh 59.200 236,800 54,600 (b) (2) Interest Lxponse 18.766 Discount on Notes Paysble 18766 (c) (1) Notes Parable 59,200 59.200 Cash (c) (2) Interest Doperse 14,722 Sage Cosmetics Co. purchased machinery on December 31, 2024, paying, $54.600.00 down and agreeing to pay the balance in four equal installments of $59,200.00 payable each December 31 . An assumed interest of 10% is implicit in the purchase price. Click here to view factor tables. Prepare the journal entries that would be recorded for the purchase and for (1) the payments and (2) interest on the following dates (Round present value foctor to 5 decimal places, eg. 1.23465 and final answers to 2 decimal places. es. 38,548.23. If no entry is reepuired, seiect "No Entry' for the occount titles and enter 0 for the amounts. Credit account tities are automotically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries) (a) December 31,2024. (b) December 31.2025 . (c) December 31,2026 . (d) December 31, 2027. (e) Decenber 31, 2028 (c) (2) Interest Expense 14,722 Discount on Notes Payable 14,722 (d) (1) Notes Payable 59,200 Cash Cash 59,200 (d) (2) Interest Expense Discount on Notes Payable 10,274 (e) (1) Notes Payable 59.200 Cash (e) (2) Interest Expense Discount on Notes Payable 5,382

Sage Cosmetics Co. purchased machinery on December 31, 2024, paying $54,600.00 down and agreeing to pay the balance in four equal installments of $59,200.00 payable each December 31. An assumed interest of 10% is implicit in the purchase price. Click here to view factor tables. Prepare the journal entries that would be recorded for the purchase and for (1) the payments and (2) interest on the following dates. (Round present value factor to 5 decimal places, e.g. 1.23465 and final answers to 2 decimal places, e.g. 38,548.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) (a) (b) (c) (d) (e) December 31, 2024. December 31, 2025. December 31, 2026. December 31, 2027. December 31, 2028.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started