Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sage Hill Inc. owns 2 5 % of the common shares of Sheffield Corp. The other 7 5 % of the shares are owned by

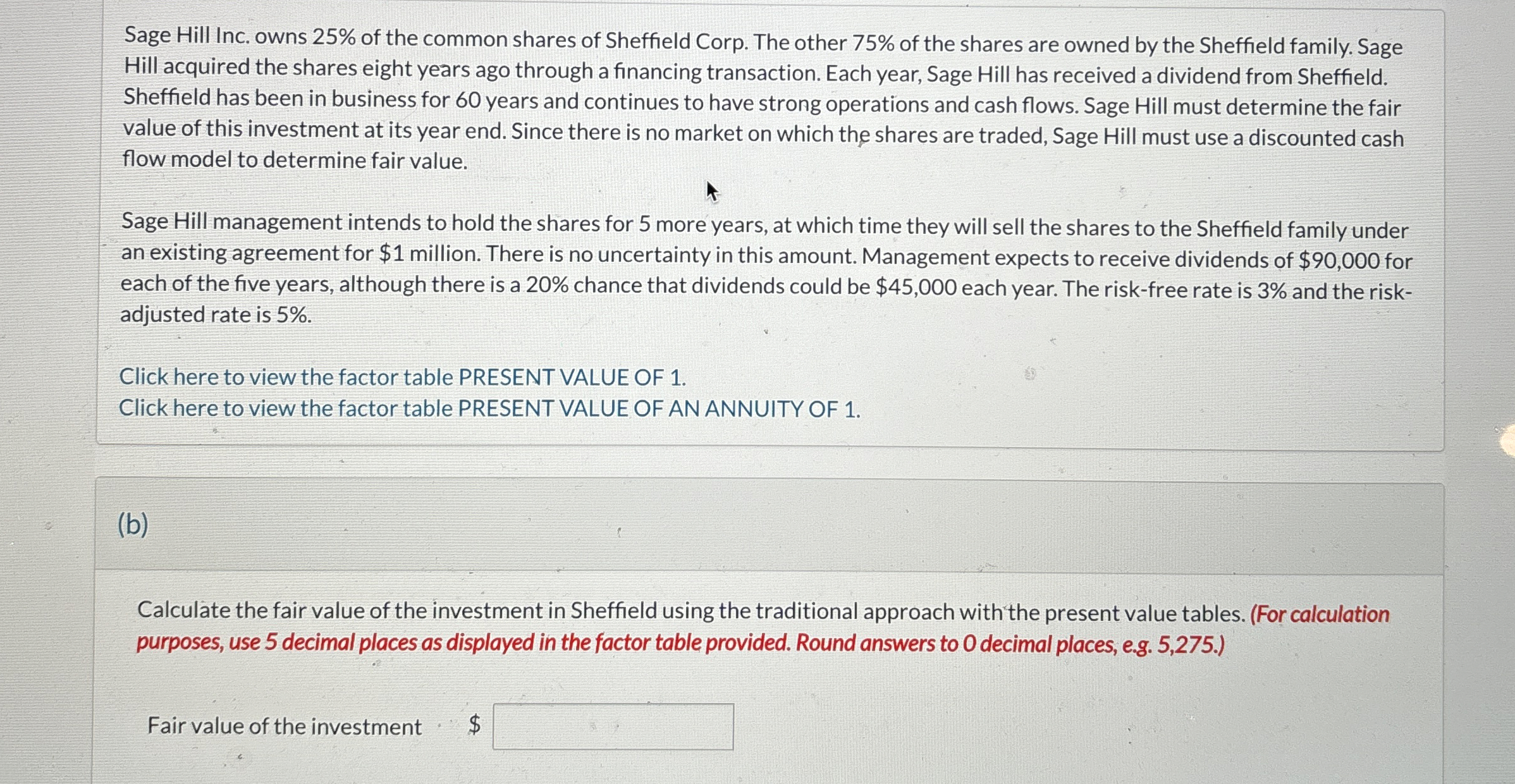

Sage Hill Inc. owns of the common shares of Sheffield Corp. The other of the shares are owned by the Sheffield family. Sage

Hill acquired the shares eight years ago through a financing transaction. Each year, Sage Hill has received a dividend from Sheffield.

Sheffield has been in business for years and continues to have strong operations and cash flows. Sage Hill must determine the fair

value of this investment at its year end. Since there is no market on which the shares are traded, Sage Hill must use a discounted cash

flow model to determine fair value.

Sage Hill management intends to hold the shares for more years, at which time they will sell the shares to the Sheffield family under

an existing agreement for $ million. There is no uncertainty in this amount. Management expects to receive dividends of $ for

each of the five years, although there is a chance that dividends could be $ each year. The riskfree rate is and the risk

adjusted rate is

Click here to view the factor table PRESENT VALUE OF

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF

b

Calculate the fair value of the investment in Sheffield using the traditional approach with the present value tables. For calculation

purposes, use decimal places as displayed in the factor table provided. Round answers to decimal places, eg

Fair value of the investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started