Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sage Inc. experienced the following transactions for Year 1, its first year of operations: Issued common stock for $120,000 cash. Purchased $195,000 of merchandise on

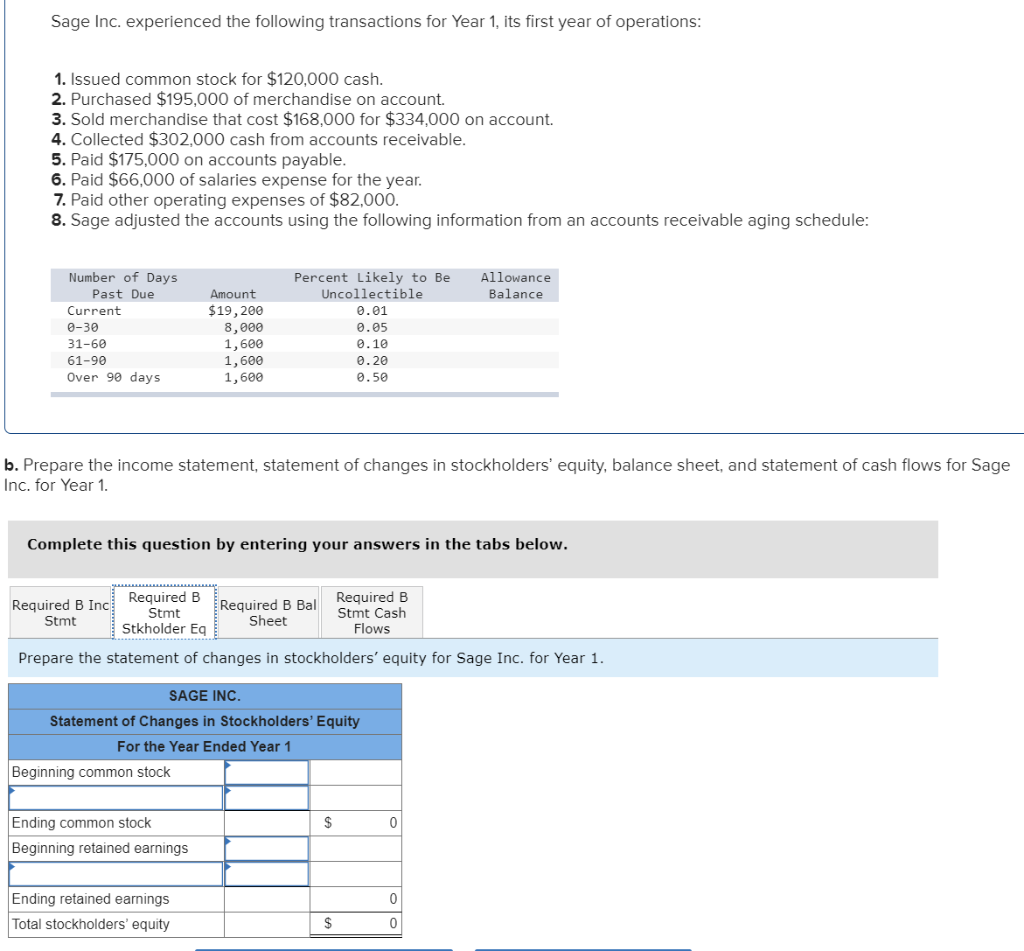

Sage Inc. experienced the following transactions for Year 1, its first year of operations:

- Issued common stock for $120,000 cash.

- Purchased $195,000 of merchandise on account.

- Sold merchandise that cost $168,000 for $334,000 on account.

- Collected $302,000 cash from accounts receivable.

- Paid $175,000 on accounts payable.

- Paid $66,000 of salaries expense for the year.

- Paid other operating expenses of $82,000.

- Sage adjusted the accounts using the following information from an accounts receivable aging schedule:

| Number of Days Past Due | Amount | Percent Likely to Be Uncollectible | Allowance Balance | ||

| Current | $ | 19,200 | 0.01 | ||

| 030 | 8,000 | 0.05 | |||

| 3160 | 1,600 | 0.10 | |||

| 6190 | 1,600 | 0.20 | |||

| Over 90 days | 1,600 | 0.50 | |||

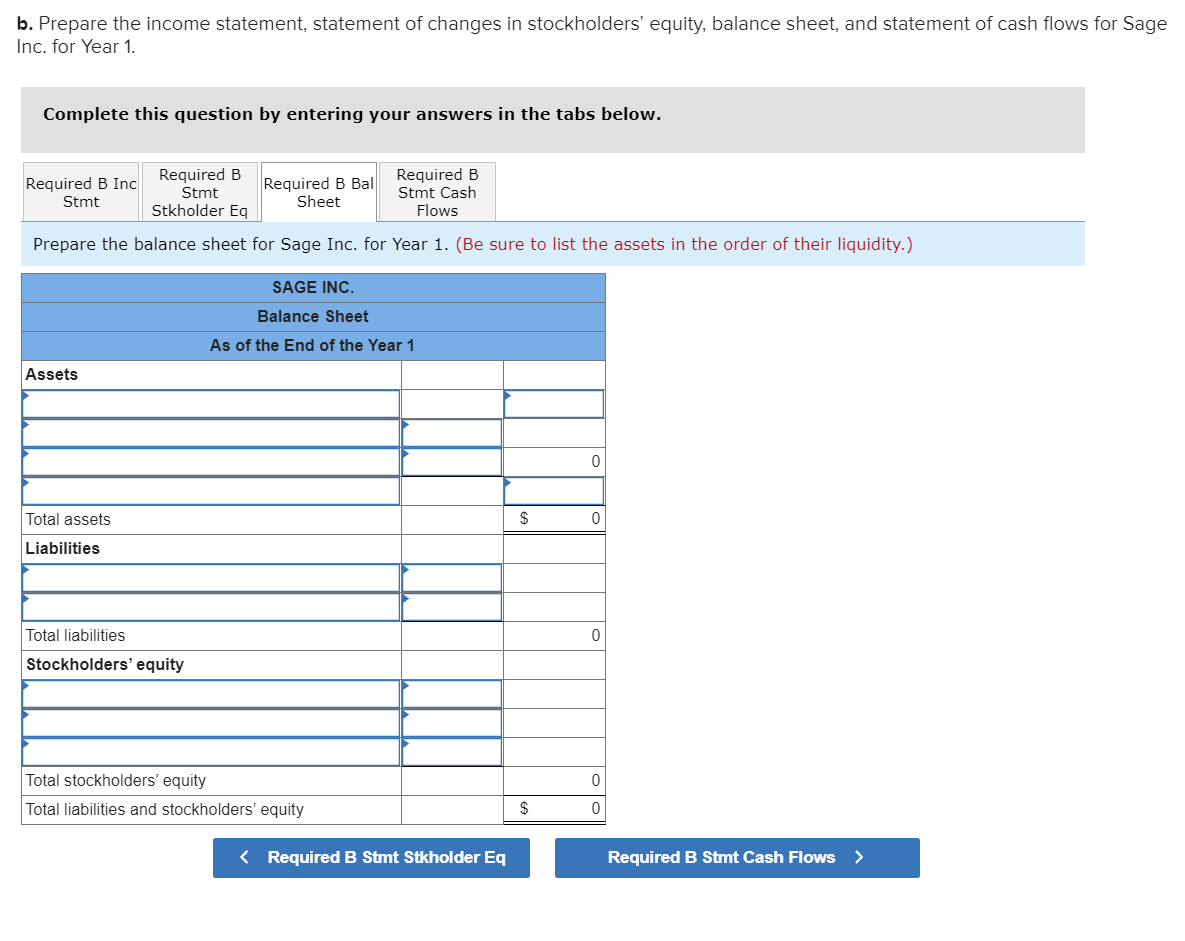

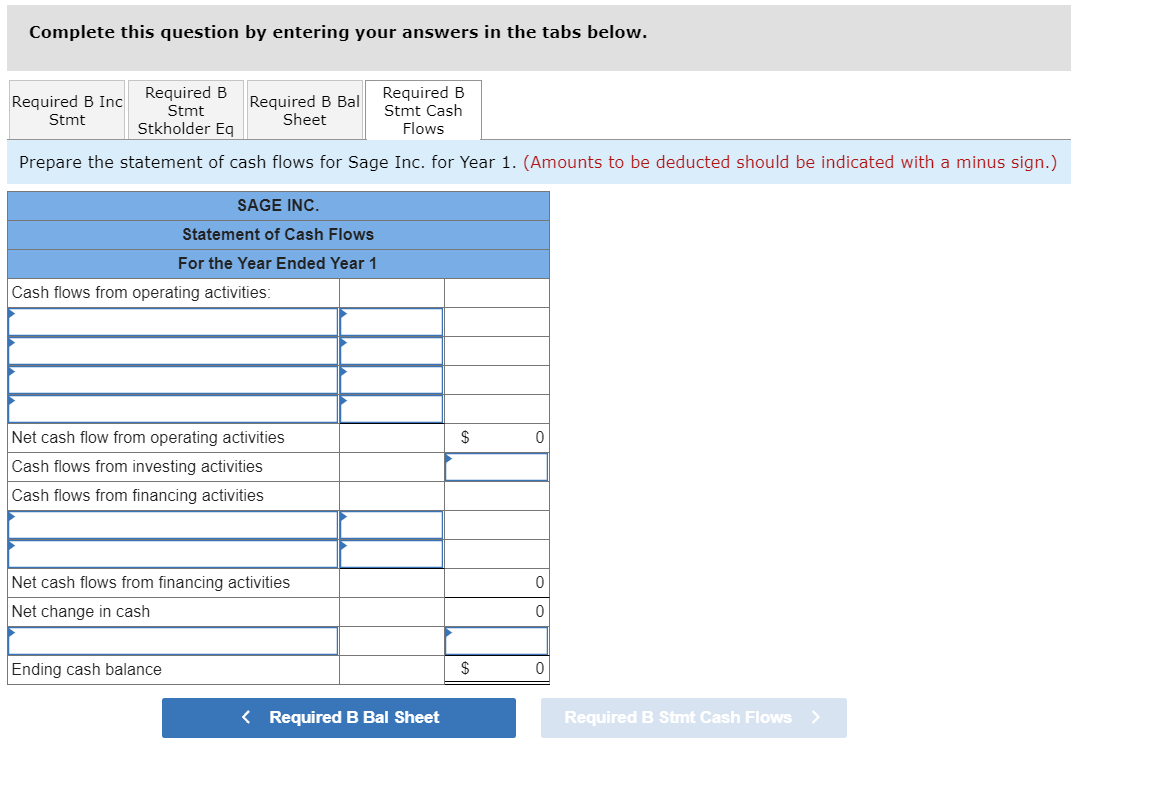

b. Prepare the income statement, statement of changes in stockholders equity, balance sheet, and statement of cash flows for Sage Inc. for Year 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started