Answered step by step

Verified Expert Solution

Question

1 Approved Answer

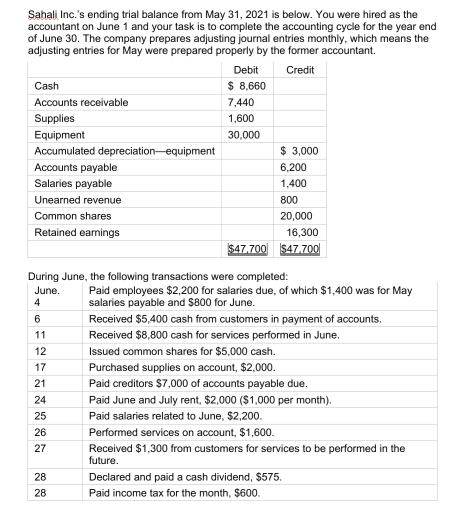

Sahali Inc.'s ending trial balance from May 31, 2021 is below. You were hired as the accountant on June 1 and your task is

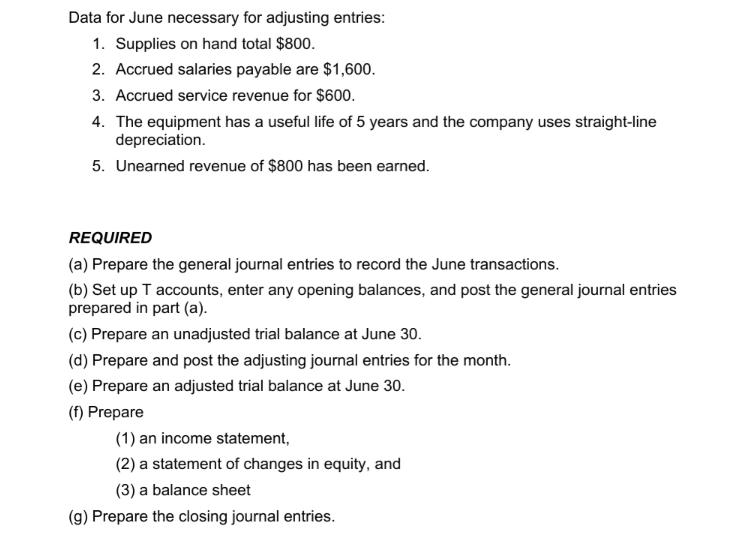

Sahali Inc.'s ending trial balance from May 31, 2021 is below. You were hired as the accountant on June 1 and your task is to complete the accounting cycle for the year end of June 30. The company prepares adjusting journal entries monthly, which means the adjusting entries for May were prepared properly by the former accountant. Credit Cash Accounts receivable Supplies Equipment Accumulated depreciation-equipment Accounts payable Salaries payable Unearned revenue Common shares Retained earnings 11 12 17 21 24 25 26 27 Debit $ 8,660 7,440 1,600 30,000 During June, the following transactions were completed: June. 4 6 28 28 $ 3,000 6,200 1,400 800 20,000 16,300 $47.700 $47.700 Paid employees $2,200 for salaries due, of which $1,400 was for May salaries payable and $800 for June. Received $5,400 cash from customers in payment of accounts. Received $8,800 cash for services performed in June. Issued common shares for $5,000 cash. Purchased supplies on account, $2,000. Paid creditors $7,000 of accounts payable due. Paid June and July rent, $2,000 ($1,000 per month). Paid salaries related to June, $2,200. Performed services on account, $1,600. Received $1,300 from customers for services to be performed in the future. Declared and paid a cash dividend, $575. Paid income tax for the month, $600. Data for June necessary for adjusting entries: 1. Supplies on hand total $800. 2. Accrued salaries payable are $1,600. 3. Accrued service revenue for $600. 4. The equipment has a useful life of 5 years and the company uses straight-line depreciation. 5. Unearned revenue of $800 has been earned. REQUIRED (a) Prepare the general journal entries to record the June transactions. (b) Set up T accounts, enter any opening balances, and post the general journal entries prepared in part (a). (c) Prepare an unadjusted trial balance at June 30. (d) Prepare and post the adjusting journal entries for the month. (e) Prepare an adjusted trial balance at June 30. (f) Prepare (1) an income statement, (2) a statement of changes in equity, and (3) a balance sheet (g) Prepare the closing journal entries.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a General Journal Entries for June transactions June 4 Salaries Expense2200 Salaries Payable1400 Cash800 June 6 Cash5400 Accounts Receivable5400 June ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started