Answered step by step

Verified Expert Solution

Question

1 Approved Answer

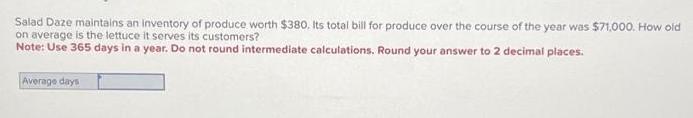

Salad Daze maintains an inventory of produce worth $380. Its total bill for produce over the course of the year was $71,000. How old

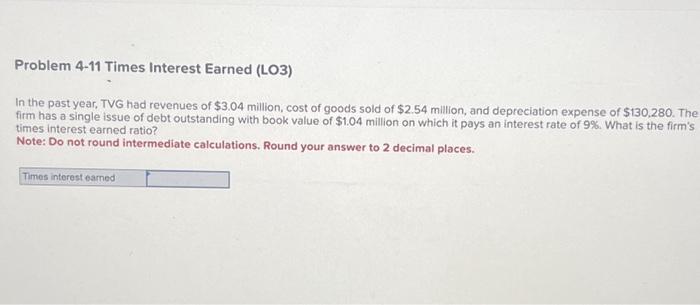

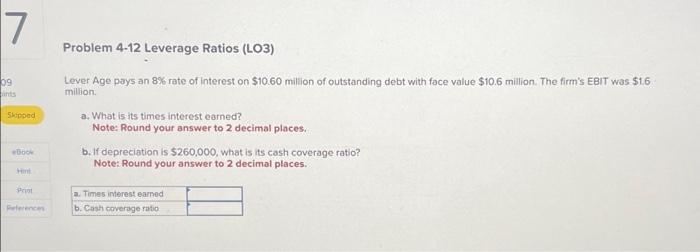

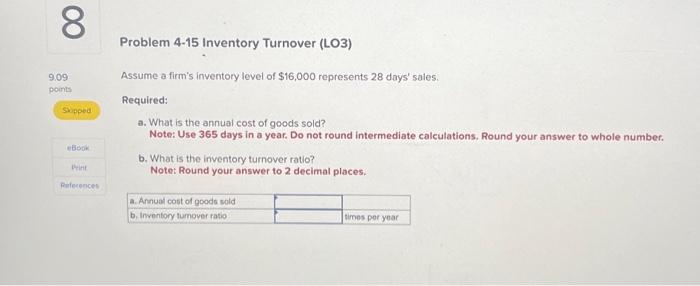

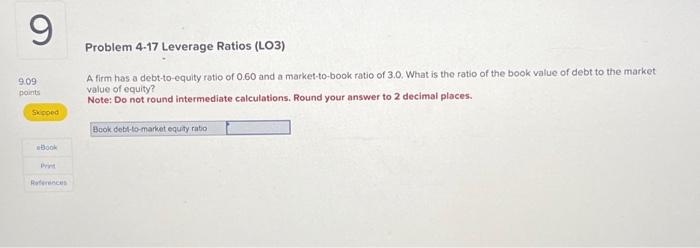

Salad Daze maintains an inventory of produce worth $380. Its total bill for produce over the course of the year was $71,000. How old on average is the lettuce it serves its customers? Note: Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places. Average days Problem 4-11 Times Interest Earned (LO3) In the past year, TVG had revenues of $3.04 million, cost of goods sold of $2.54 million, and depreciation expense of $130,280. The firm has a single issue of debt outstanding with book value of $1.04 million on which it pays an interest rate of 9%. What is the firm's times interest earned ratio? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Times interest earned 7 09 ints Skipped Book Hint Print References Problem 4-12 Leverage Ratios (LO3) Lever Age pays an 8% rate of interest on $10.60 million of outstanding debt with face value $10.6 million. The firm's EBIT was $1.6 million. a. What is its times interest earned? Note: Round your answer to 2 decimal places. b. If depreciation is $260,000, what is its cash coverage ratio? Note: Round your answer to 2 decimal places. a. Times interest earned b. Cash coverage ratio 8 9.09 points Skipped eBook Print References Problem 4-15 Inventory Turnover (LO3) Assume a firm's inventory level of $16,000 represents 28 days' sales. Required: a. What is the annual cost of goods sold? Note: Use 365 days in a year. Do not round intermediate calculations, Round your answer to whole number. b. What is the inventory turnover ratio? Note: Round your answer to 2 decimal places. a. Annual cost of goods sold i b. Inventory tumover ratio times per year 9 9.09 points Skipped Book References Problem 4-17 Leverage Ratios (LO3) A firm has a debt-to-equity ratio of 0.60 and a market-to-book ratio of 3.0. What is the ratio of the book value of debt to the market value of equity? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Book debt-to-market equity ratio

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Salad Daze Average Age of Lettuce Average age inventory valuetotal annual bill 365 Average age 38071...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started