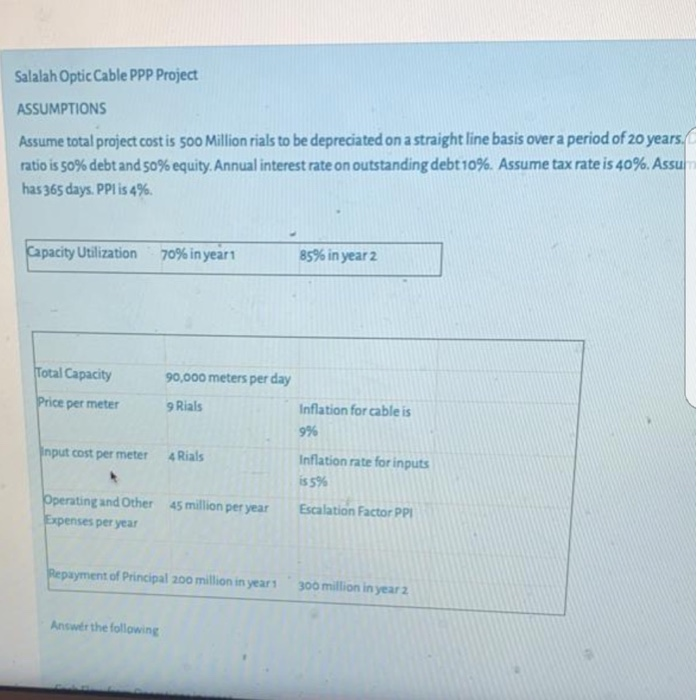

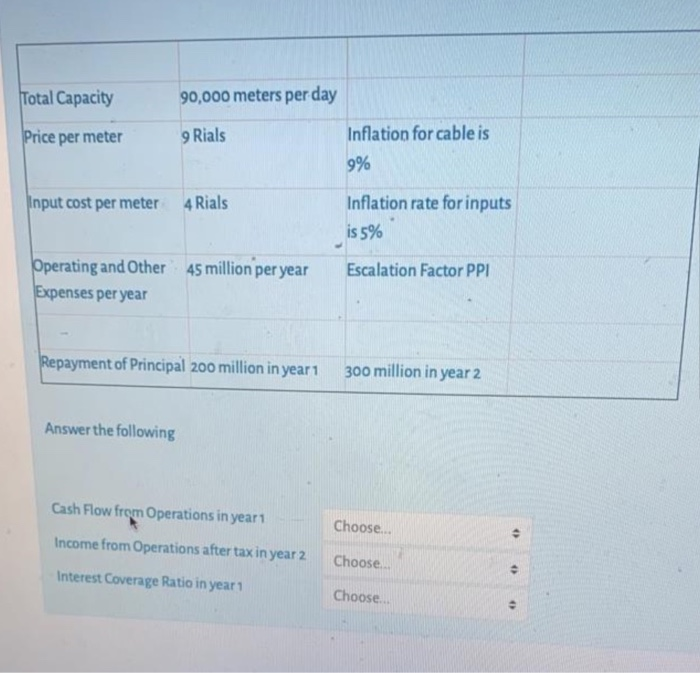

Salalah Optic Cable PPP Project ASSUMPTIONS Assume total project cost is 500 Million rials to be depreciated on a straight line basis over a period of 20 years. ratio is 50% debt and 50% equity. Annual interest rate on outstanding debt 10%. Assume tax rate is 40%. Assu has 365 days. PPL is 4%. Capacity Utilization 70% in year 85% in year 2 Total Capacity 90,000 meters per day 9 Rials Price per meter Inflation for cable is 9% Input cost per meter 4 Rials Inflation rate for inputs is 5% Escalation Factor PPI Operating and Other 45 million per year Expenses per year Repayment of Principal 200 million in year 1 300 million in year 2 Answer the following Total Capacity 90,000 meters per day Price per meter 9 Rials Inflation for cable is 9% Input cost per meter 4 Rials Inflation rate for inputs is 5% Operating and Other 45 million per year Expenses per year Escalation Factor PPI Repayment of Principal 200 million in year 1 300 million in year 2 Answer the following Cash Flow from Operations in year1 Choose... ( Income from Operations after tax in year 2 Choose Interest Coverage Ratio in year 1 . . Choose Salalah Optic Cable PPP Project ASSUMPTIONS Assume total project cost is 500 Million rials to be depreciated on a straight line basis over a period of 20 years. ratio is 50% debt and 50% equity. Annual interest rate on outstanding debt 10%. Assume tax rate is 40%. Assu has 365 days. PPL is 4%. Capacity Utilization 70% in year 85% in year 2 Total Capacity 90,000 meters per day 9 Rials Price per meter Inflation for cable is 9% Input cost per meter 4 Rials Inflation rate for inputs is 5% Escalation Factor PPI Operating and Other 45 million per year Expenses per year Repayment of Principal 200 million in year 1 300 million in year 2 Answer the following Total Capacity 90,000 meters per day Price per meter 9 Rials Inflation for cable is 9% Input cost per meter 4 Rials Inflation rate for inputs is 5% Operating and Other 45 million per year Expenses per year Escalation Factor PPI Repayment of Principal 200 million in year 1 300 million in year 2 Answer the following Cash Flow from Operations in year1 Choose... ( Income from Operations after tax in year 2 Choose Interest Coverage Ratio in year 1 . . Choose