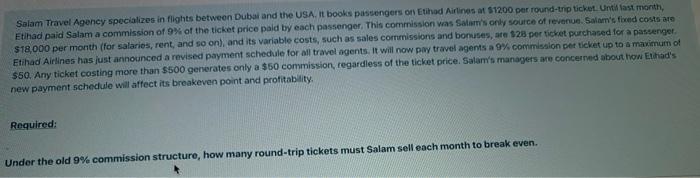

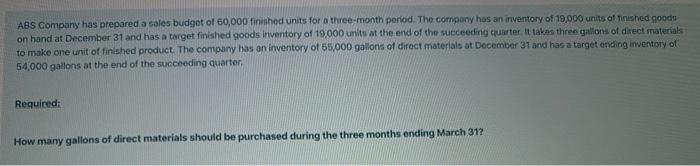

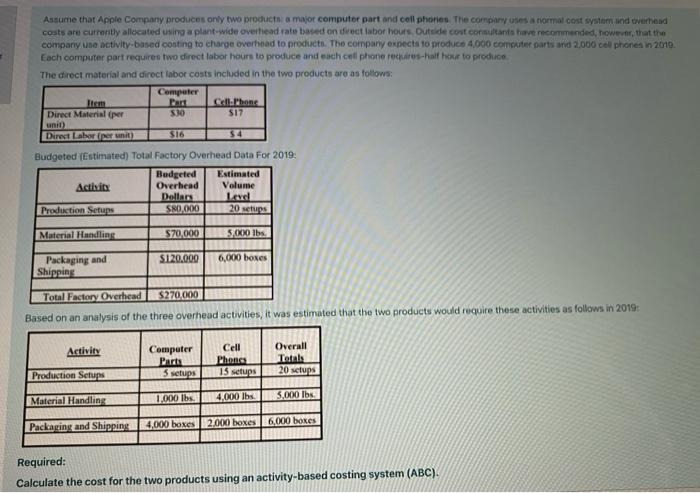

Salam Travel Agency specializes in flights between Dubai and the USA. It books passengers on Etihad Airlines at 51200 per round-trip ticket. Untilast month, Etihad paid Salam a commission of 9% of the ticket price paid by each passenger. This commission was Salam's only source of revenue Salam's fired costs are $18,000 per month (for salaries, rent, and so on), and its variable costs, such as sales commissions and bonuses, are 128 per ticket purchased for a passenger Etihad Airlines has just announced a revised payment schedule for all travel agents. It will now pay travel agents a 9% commission per ticket up to a maximum of $50. Any ticket costing more than $500 generates only a $50 commission, regardless of the ticket price. Salam's managers are concerned about how Etihad's new payment schedule will affect its breakeven point and profitability, Required: Under the old 9% commission structure, how many round-trip tickets must Salam sell each month to break even. ABS Company has prepared a sales budget of 60,000 finished units for a three-month period. The company has an inventory of 19,000 units of Tinished goodu on hand at December 31 and has a target finished goods inventory of 19,000 units at the end of the succeeding quarter It takes three gallons of direct materials to make one unit of finished product. The company has an inventory of 55,000 gallons of direct materials at December 31 and has a target ending inventory of 54,000 gallons at the end of the succeeding quarter Required: How many gallons of direct materials should be purchased during the three months ending March 317 Assume that Apple Company produces only two products, a major computer part and coll phones. The company uses a normal cost system and overhand costs are currently allocated using a plant-wide overhead rate based on direct labor hours Outside cost consultants have recommended, however, that the company une activity based conting to charge overhead to products. The company expects to produce 4.000 computer parts and 2,000 cell phones in 2010 Each computer part requires two direct labor hours to produce and each cell phone recies-half hour to produce The direct material and direct labor costs included in the two products are as follows: Computer Calahon Direct Material per S30 $17 unit) Direct Labar por unit) $16 $4 Budgeted (Estimated) Total Factory Overhead Data For 2019: Badgeted Estimated Activity Overhead Volume Dollars Production Setups SR0.000 20 seus Material Handling 570.000 SOKO lbs S120.000 6,000 boxes Packaging and Shipping Total Factory Overhead $270,000 Based on an analysis of the three overhead activities, it was estimated that the two products would require these activities as follows in 2019: Activity Computer Parts 5 setups Cell Phones 15 setups Overall Totals 20 setups Production Setups Material Handling 1.000 lbs 4.000 lbs 5,000 lbs Packaging and Shipping 4,000 boxes 2.000 boxes 6,000 boxes Required: Calculate the cost for the two products using an activity-based costing system (ABC). What are the Responsibility Accounting Center in the company and its types? Explain your