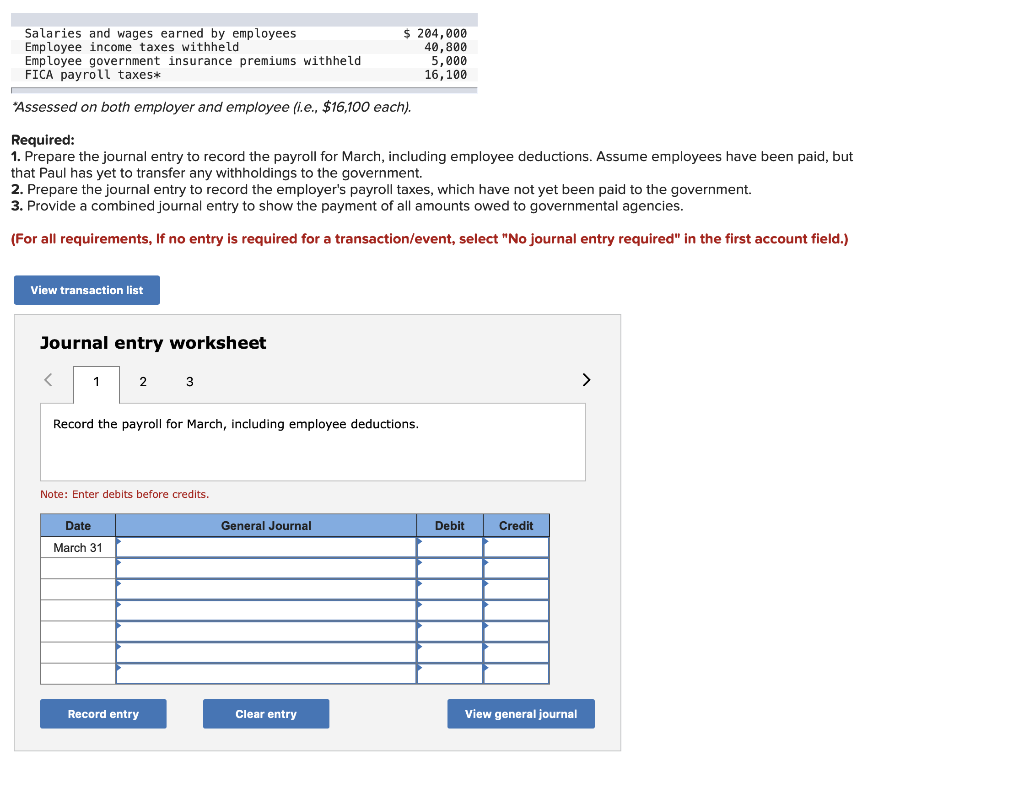

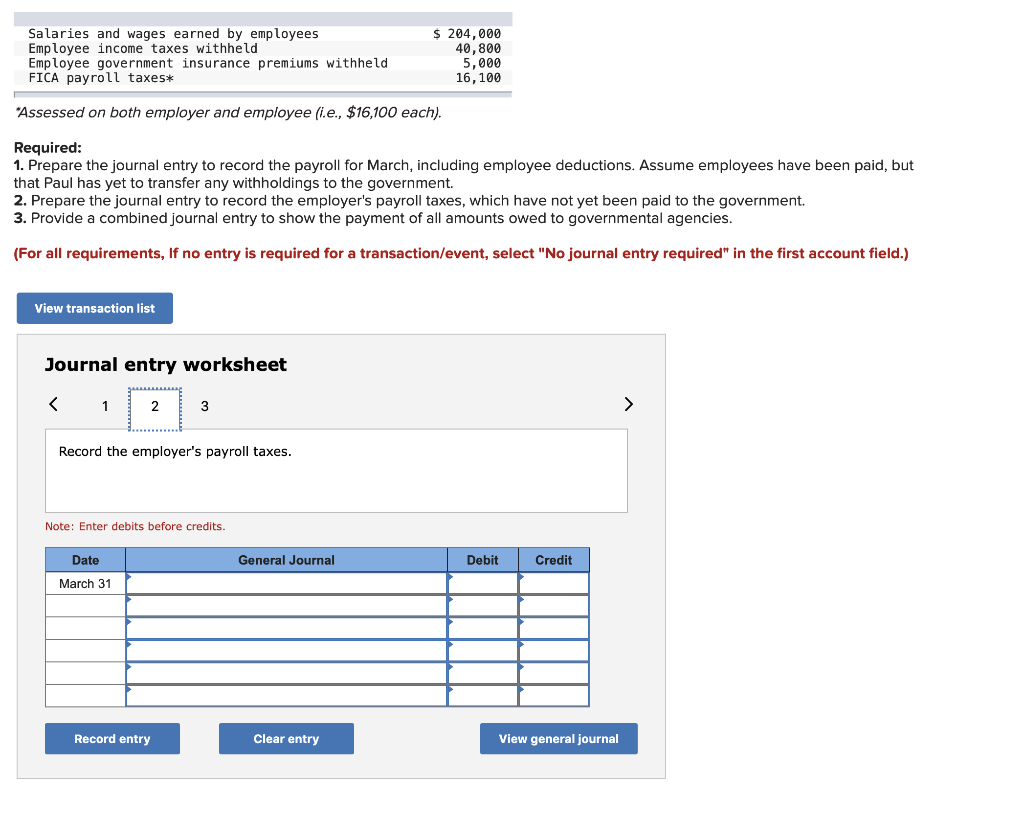

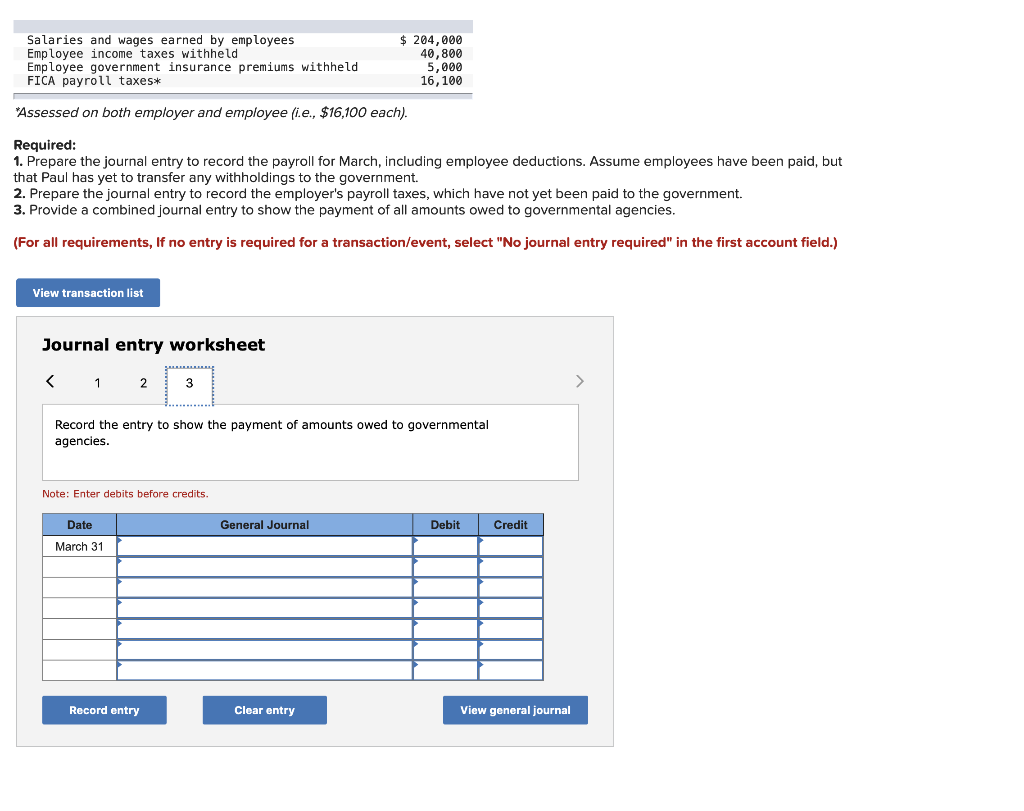

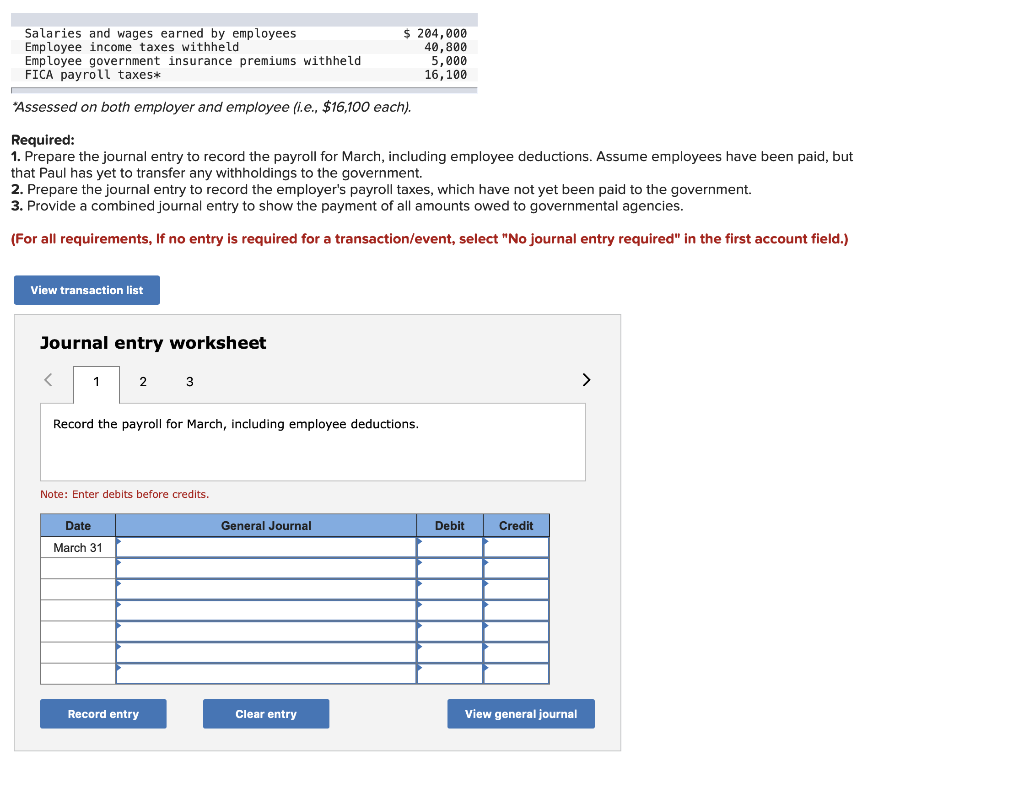

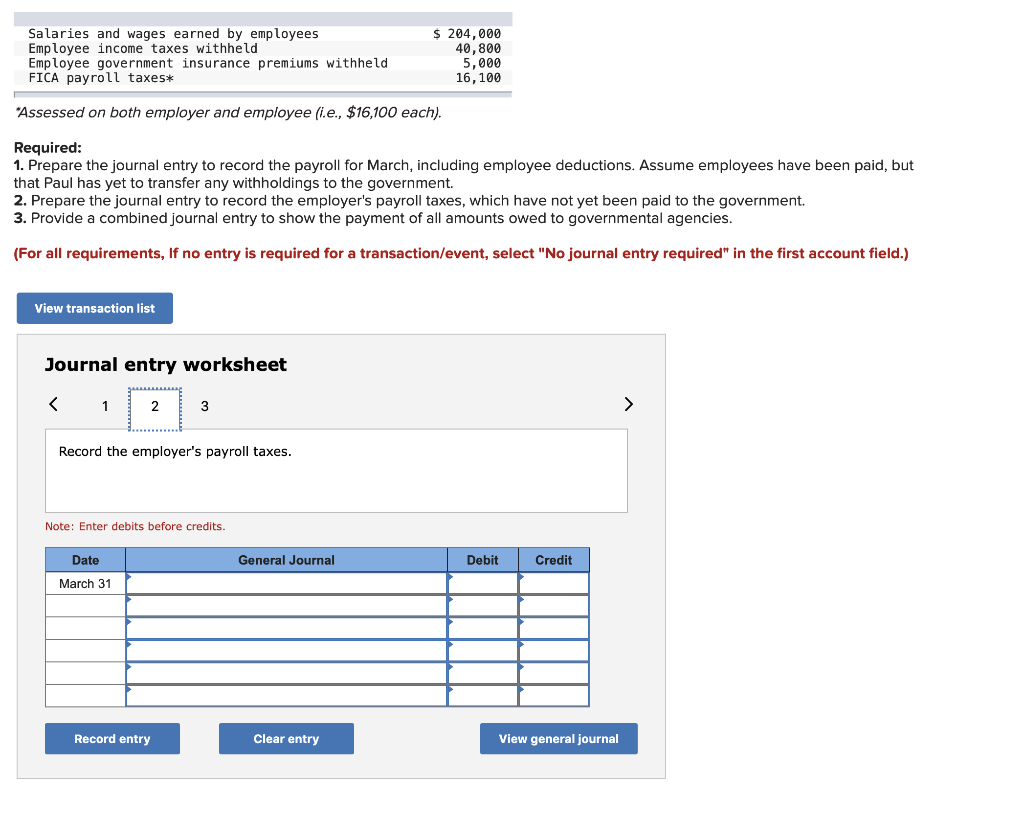

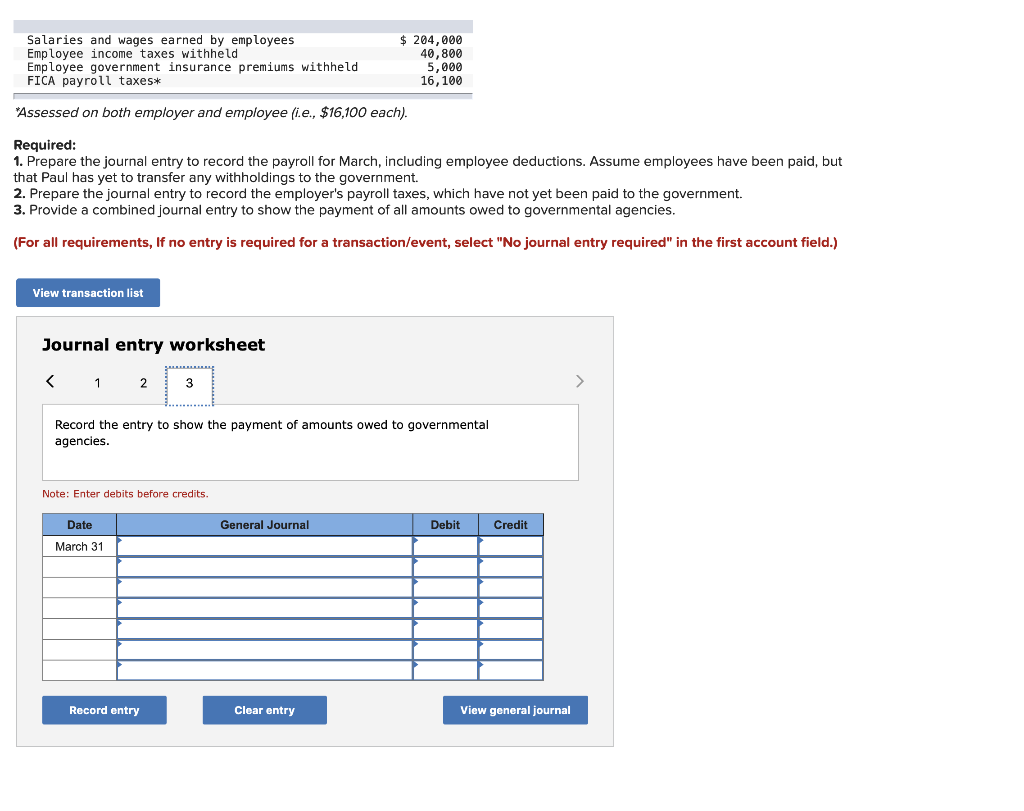

Salaries and wages earned by employees Employee income taxes withheld Employee government insurance premiums withheld FICA payroll taxes* $ 204,000 40,800 5,000 16,100 *Assessed on both employer and employee (i.e., $16,100 each). Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have been paid, but that Paul has yet to transfer any withholdings to the government. 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government. 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the payroll for March, including employee deductions. Note: Enter debits before credits. Date General Journal Debit Credit March 31 Record entry Clear entry View general journal Salaries and wages earned by employees Employee income taxes withheld Employee government insurance premiums withheld FICA payroll taxes* $ 204,000 40,800 5,000 16,100 "Assessed on both employer and employee (i.e., $16,100 each). Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have been paid, but that Paul has yet to transfer any withholdings to the government. 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government. 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the employer's payroll taxes. Note: Enter debits before credits. Date General Journal Debit Credit March 31 Record entry Clear entry View general journal Salaries and wages earned by employees Employee income taxes withheld Employee government insurance premiums withheld FICA payroll taxes* $ 204,000 40,800 5,000 16,100 *Assessed on both employer and employee (i.e., $16,100 each). Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have been paid, but that Paul has yet to transfer any withholdings to the government. 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government. 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry to show the payment of amounts owed to governmental agencies. Note: Enter debits before credits. Date General Journal Debit Credit March 31 Record entry Clear entry View general journal