Answered step by step

Verified Expert Solution

Question

1 Approved Answer

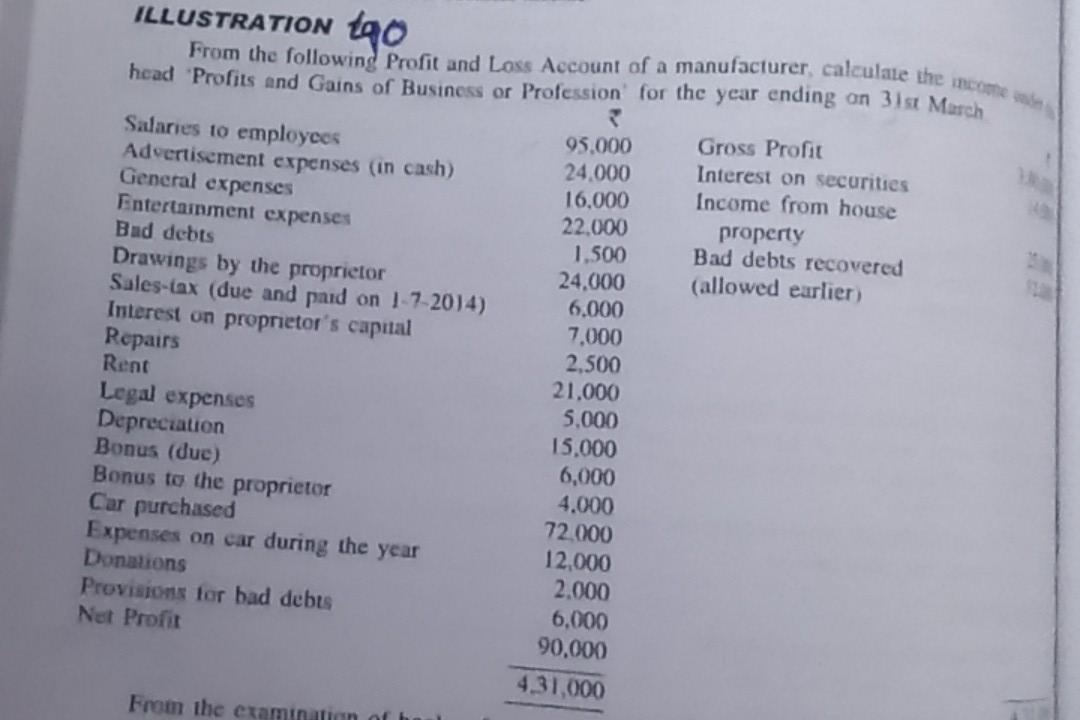

Salaries to employees Advertisement expenses (in cash) General expenses Entertainment expenses Bad debts Drawings by the proprietor Sales-lax (due and paid on 1-7-2014) Interest on

Salaries to employees Advertisement expenses (in cash) General expenses Entertainment expenses Bad debts Drawings by the proprietor Sales-lax (due and paid on 1-7-2014) Interest on proprietor's capital ILLUSTRATION tao From the following Profit and Loss Account of a manufacturer, calculate the income head Profits and Gains of Business or Profession for the year ending on 31st March 95.000 Gross Profit 24.000 Interest on securities 16.000 Income from house 22.000 property 1.500 Bad debts recovered 24.000 (allowed earlier 6.000 7.000 Repairs 2.500 Rent 21,000 Legal expenses 5.000 Depreciation 15.000 Bonus (due) 6,000 Bonus to the proprietor 4.000 Car purchased 72.000 Expenses on car during the year 12.000 Donations 2.000 Provisions for bad debts 6.000 Net Profit 90,000 4.31,000 From the examination

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started