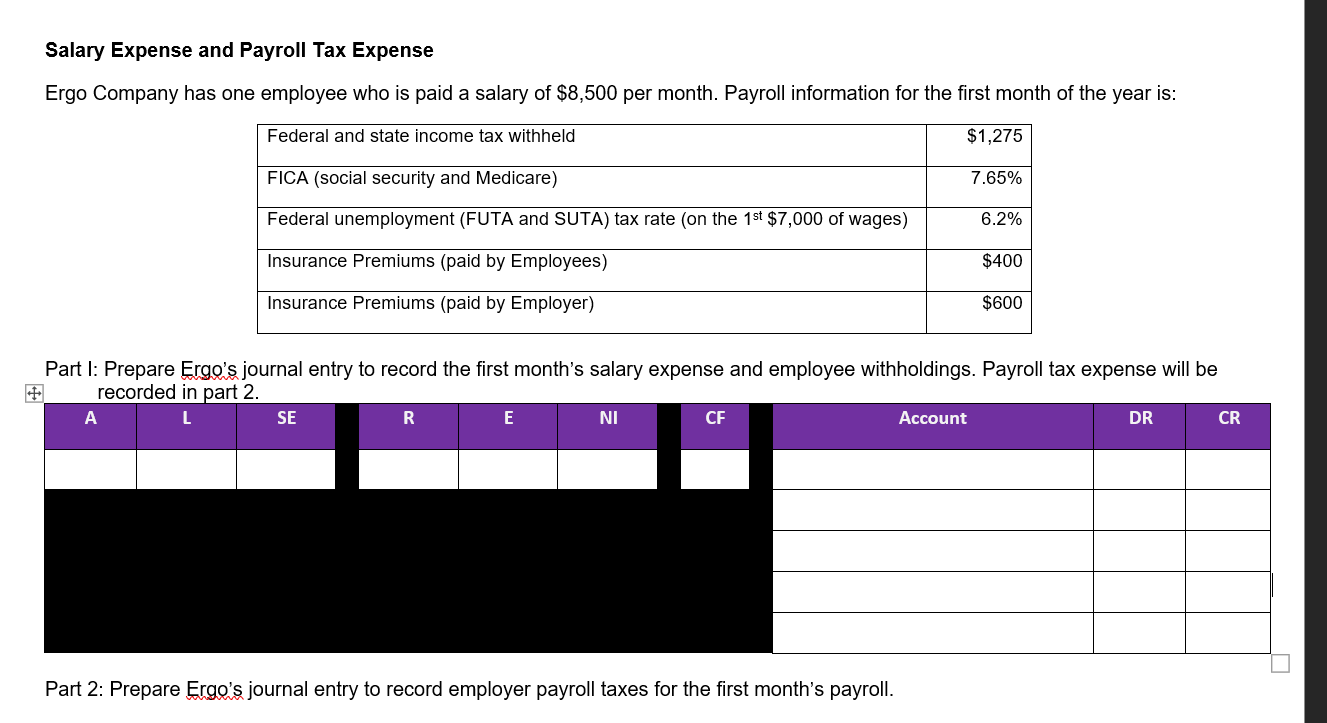

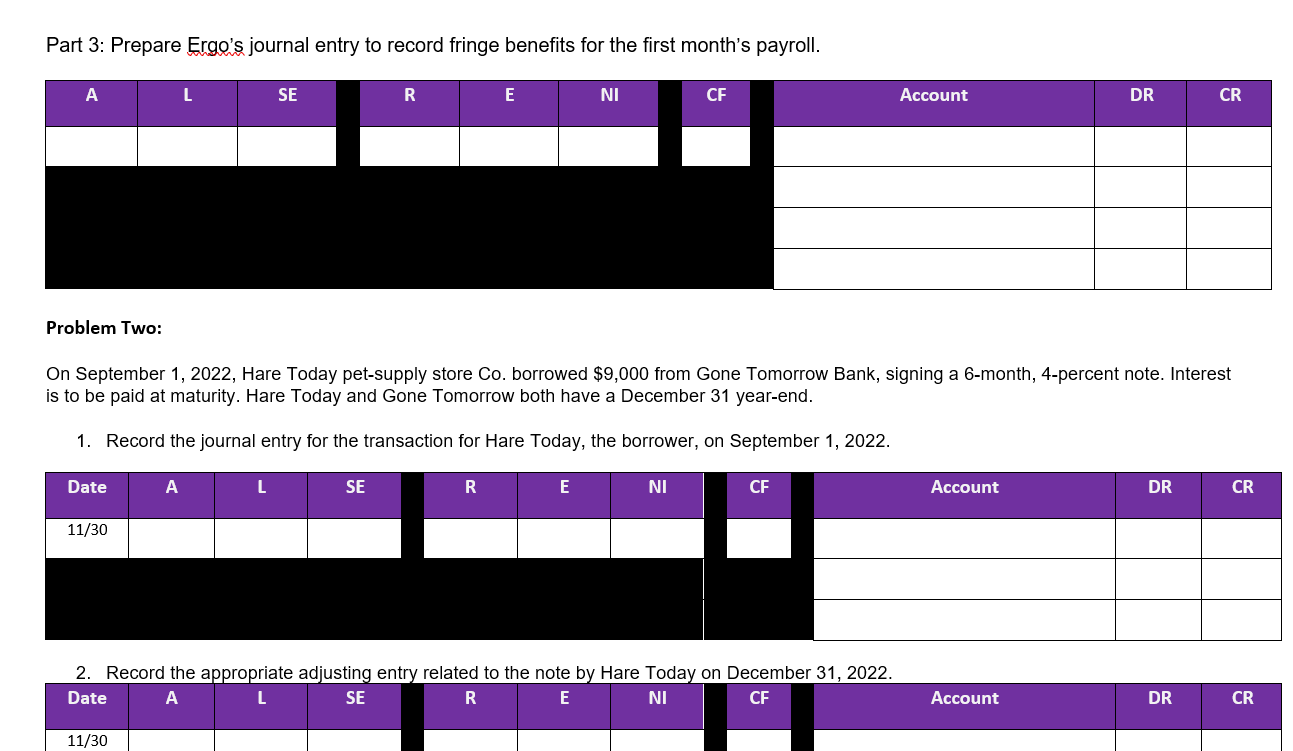

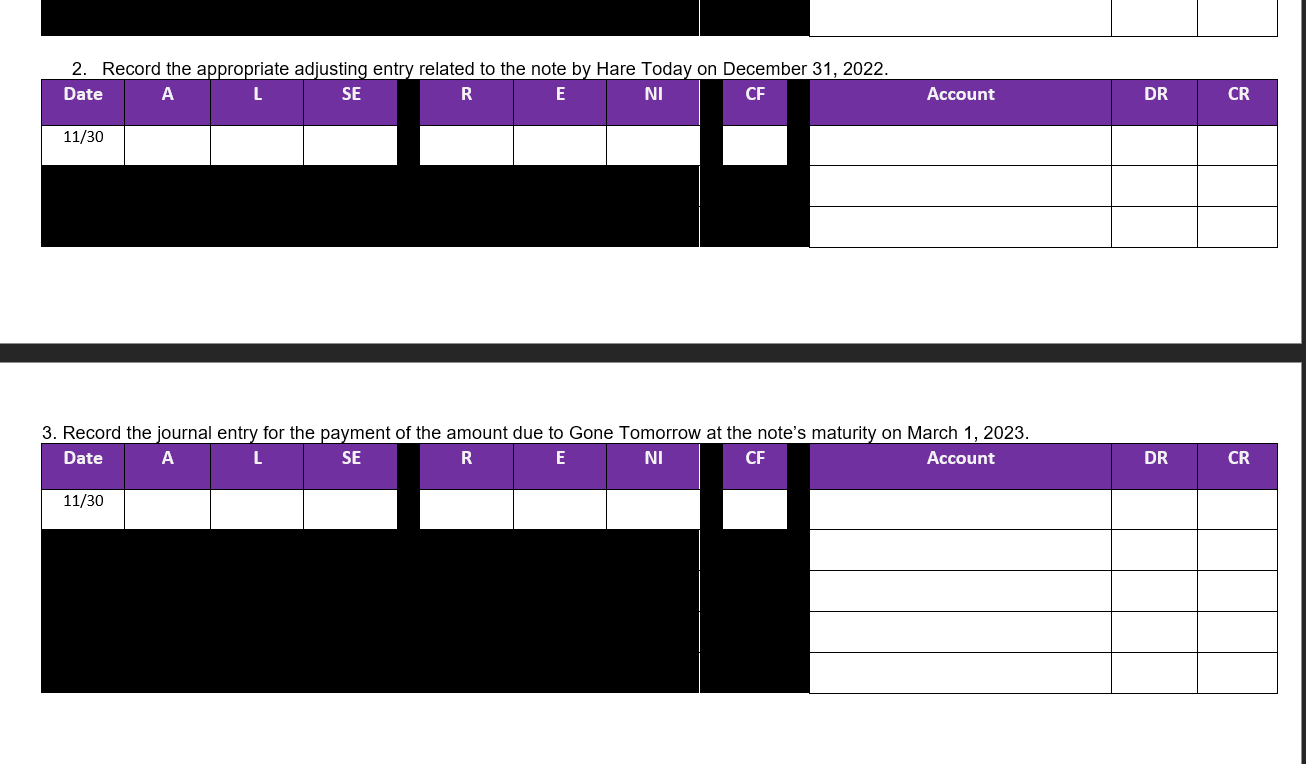

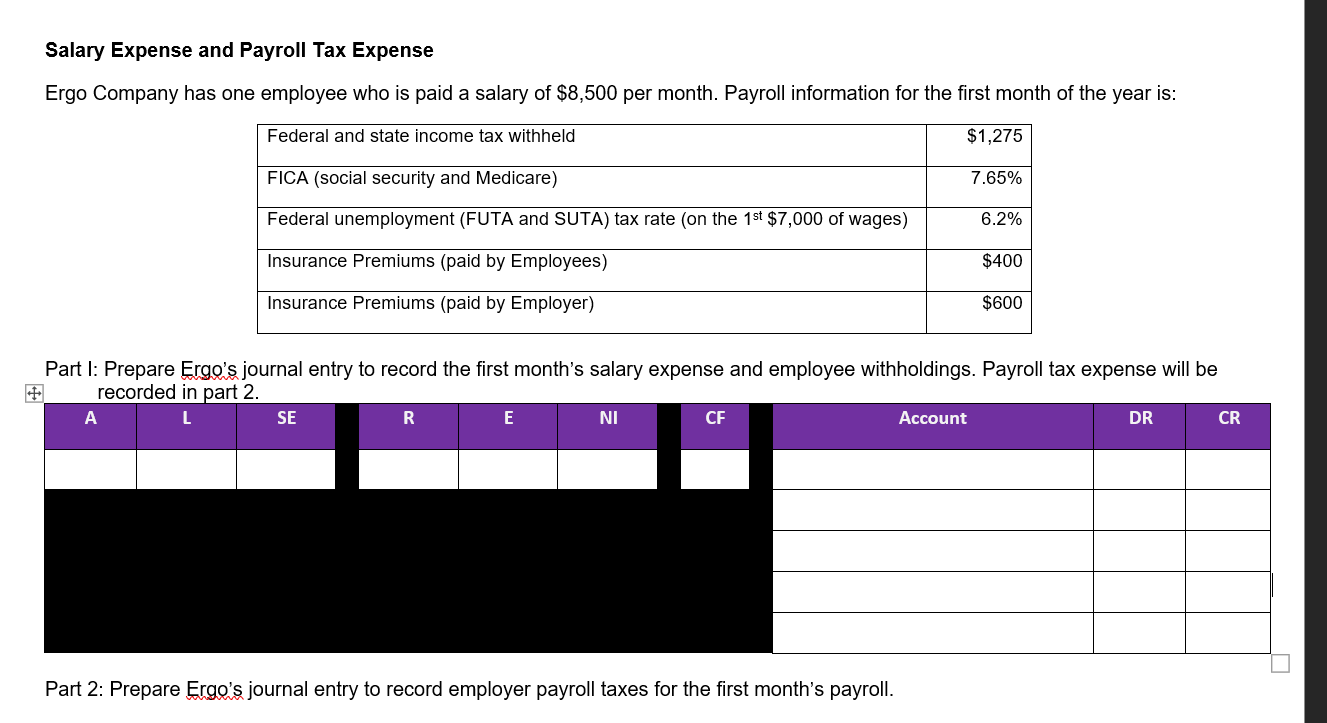

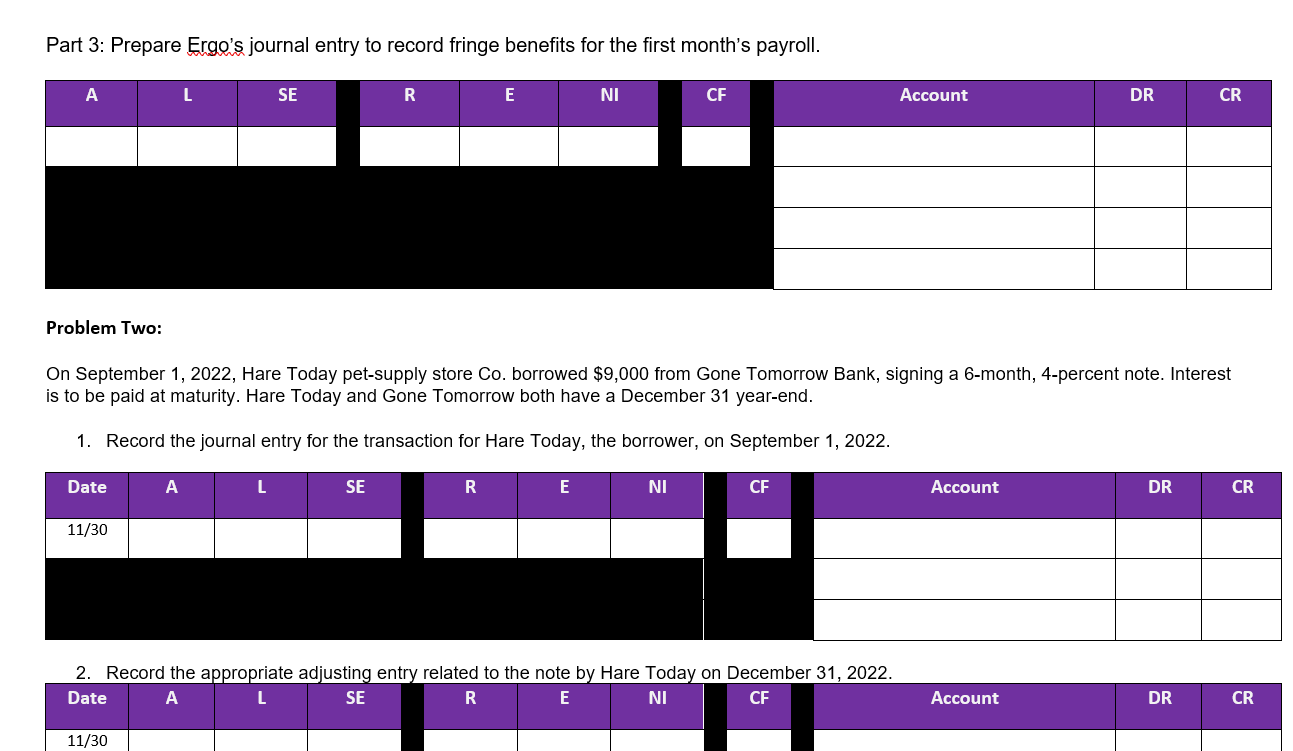

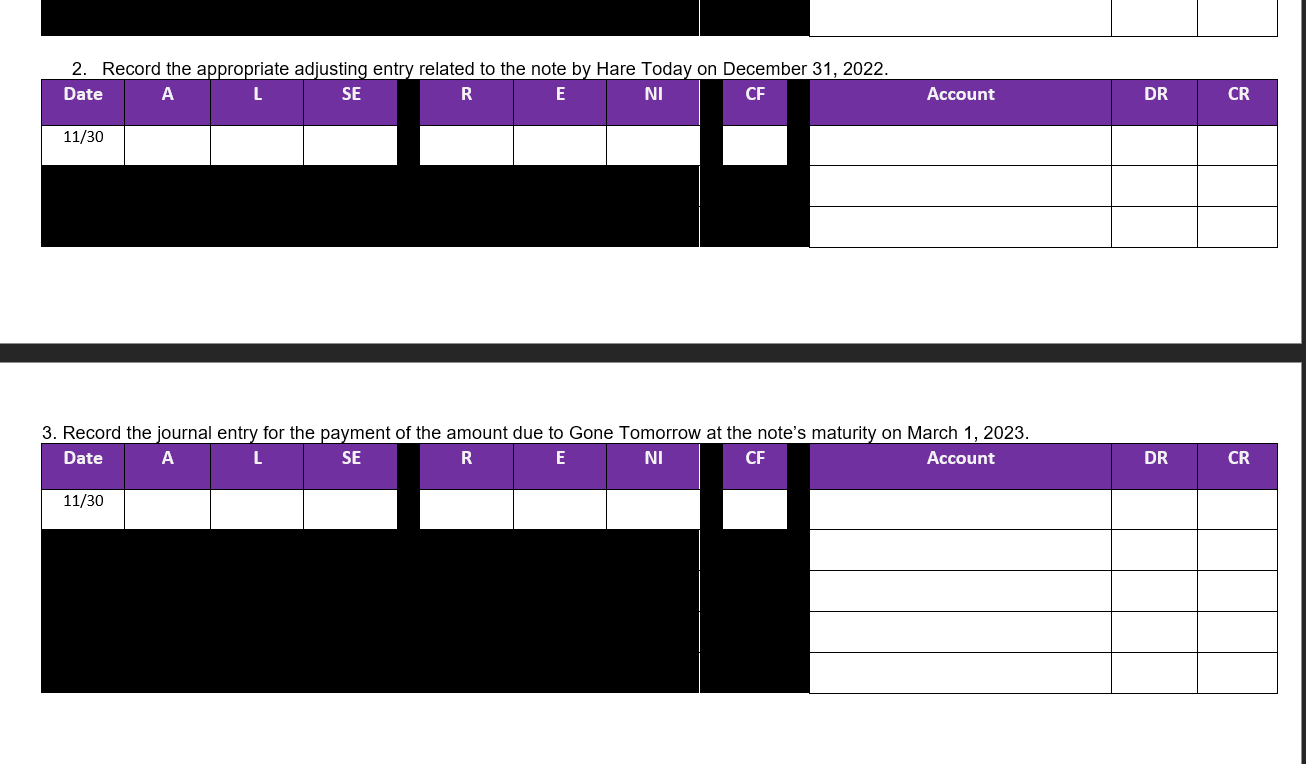

Salary Expense and Payroll Tax Expense Ergo Company has one employee who is paid a salary of $8,500 per month. Payroll information for the first month of the year is: Federal and state income tax withheld $1,275 FICA (social security and Medicare) 7.65% Federal unemployment (FUTA and SUTA) tax rate on the 1st $7,000 of wages) 6.2% Insurance Premiums (paid by Employees) $400 Insurance Premiums (paid by Employer) $600 Part I: Prepare Erge's journal entry to record the first month's salary expense and employee withholdings. Payroll tax expense will be recorded in part 2. A L SE R E NI CF Account DR CR Part 2: Prepare Ergo's journal entry to record employer payroll taxes for the first month's payroll. Part 3: Prepare Ergo's journal entry to record fringe benefits for the first month's payroll. L SE R E NI CF Account DR CR Problem Two: On September 1, 2022, Hare Today pet-supply store Co. borrowed $9,000 from Gone Tomorrow Bank, signing a 6-month, 4-percent note. Interest is to be paid at maturity. Hare Today and Gone Tomorrow both have a December 31 year-end. 1. Record the journal entry for the transaction for Hare Today, the borrower, on September 1, 2022. Date L SE R E NI CF Account DR CR 11/30 2. Record the appropriate adjusting entry related to the note by Hare Today on December 31, 2022. Date A SE R E NI CF Account DR CR 11/30 2. Record the appropriate adjusting entry related to the note by Hare Today on December 31, 2022. Date SE R E NI CF Account DR CR 11/30 3. Record the journal entry for the payment of the amount due to Gone Tomorrow at the note's maturity on March 1, 2023. Date A SE R E NI CF Account DR CR 11/30 Salary Expense and Payroll Tax Expense Ergo Company has one employee who is paid a salary of $8,500 per month. Payroll information for the first month of the year is: Federal and state income tax withheld $1,275 FICA (social security and Medicare) 7.65% Federal unemployment (FUTA and SUTA) tax rate on the 1st $7,000 of wages) 6.2% Insurance Premiums (paid by Employees) $400 Insurance Premiums (paid by Employer) $600 Part I: Prepare Erge's journal entry to record the first month's salary expense and employee withholdings. Payroll tax expense will be recorded in part 2. A L SE R E NI CF Account DR CR Part 2: Prepare Ergo's journal entry to record employer payroll taxes for the first month's payroll. Part 3: Prepare Ergo's journal entry to record fringe benefits for the first month's payroll. L SE R E NI CF Account DR CR Problem Two: On September 1, 2022, Hare Today pet-supply store Co. borrowed $9,000 from Gone Tomorrow Bank, signing a 6-month, 4-percent note. Interest is to be paid at maturity. Hare Today and Gone Tomorrow both have a December 31 year-end. 1. Record the journal entry for the transaction for Hare Today, the borrower, on September 1, 2022. Date L SE R E NI CF Account DR CR 11/30 2. Record the appropriate adjusting entry related to the note by Hare Today on December 31, 2022. Date A SE R E NI CF Account DR CR 11/30 2. Record the appropriate adjusting entry related to the note by Hare Today on December 31, 2022. Date SE R E NI CF Account DR CR 11/30 3. Record the journal entry for the payment of the amount due to Gone Tomorrow at the note's maturity on March 1, 2023. Date A SE R E NI CF Account DR CR 11/30