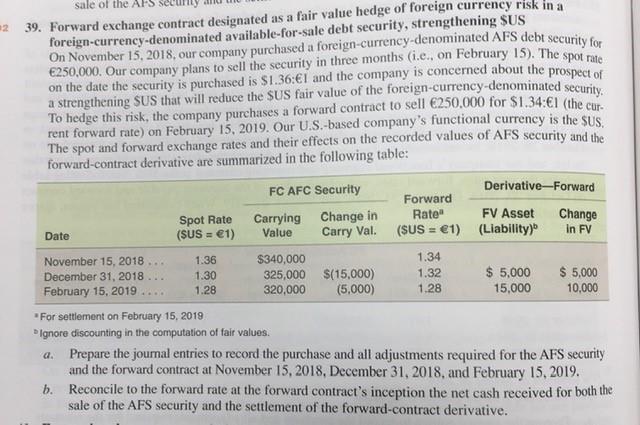

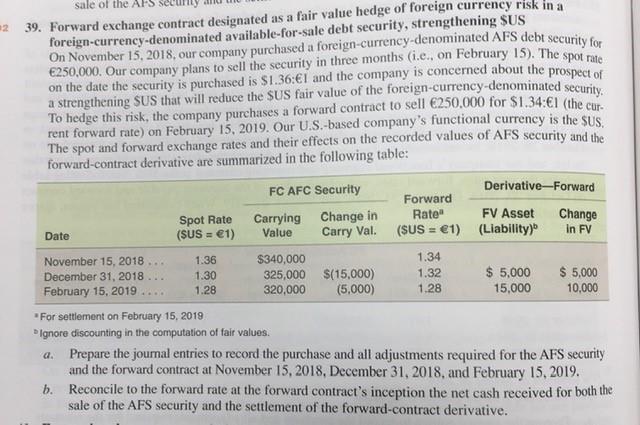

sale of the ARS secu 39. Forward exchange contract designated as a fair value hedge of foreign currency risk in a foreign-currency-denominated available-for-sale debt security, strengthening SUS On November 15, 2018, our company purchased a foreign currency-denominated AFS debt security for 250,000. Our company plans to sell the security in three months (i.c., on February 15). The spot rate on the date the security is purchased is $1.36:1 and the company is concerned about the prospect of a strengthening SUS that will reduce the SUS fair value of the foreign currency-denominated security , To hedge this risk, the company purchases a forward contract to sell 250,000 for $1.34:EI (the cup rent forward rate) on February 15, 2019. Our U.S.-based company's functional currency is the SUS. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table: FC AFC Security Derivative-Forward Forward Spot Rate Carrying Change in Rate" FV Asset Change (SUS = 1) Carry Val (SUS = 1) (Liability) in FV November 15, 2018 $340,000 325,000 $(15,000) $ 5,000 $ 5,000 February 15, 2019 320,000 (5,000) 15,000 10,000 For settlement on February 15, 2019 Ignore discounting in the computation of fair values. a. Prepare the journal entries to record the purchase and all adjustments required for the AFS security and the forward contract at November 15, 2018, December 31, 2018, and February 15, 2019. b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the sale of the AFS security and the settlement of the forward-contract derivative. Date Value December 31, 2018 .. 1.36 1.30 1.28 1.34 1.32 1.28 sale of the ARS secu 39. Forward exchange contract designated as a fair value hedge of foreign currency risk in a foreign-currency-denominated available-for-sale debt security, strengthening SUS On November 15, 2018, our company purchased a foreign currency-denominated AFS debt security for 250,000. Our company plans to sell the security in three months (i.c., on February 15). The spot rate on the date the security is purchased is $1.36:1 and the company is concerned about the prospect of a strengthening SUS that will reduce the SUS fair value of the foreign currency-denominated security , To hedge this risk, the company purchases a forward contract to sell 250,000 for $1.34:EI (the cup rent forward rate) on February 15, 2019. Our U.S.-based company's functional currency is the SUS. The spot and forward exchange rates and their effects on the recorded values of AFS security and the forward-contract derivative are summarized in the following table: FC AFC Security Derivative-Forward Forward Spot Rate Carrying Change in Rate" FV Asset Change (SUS = 1) Carry Val (SUS = 1) (Liability) in FV November 15, 2018 $340,000 325,000 $(15,000) $ 5,000 $ 5,000 February 15, 2019 320,000 (5,000) 15,000 10,000 For settlement on February 15, 2019 Ignore discounting in the computation of fair values. a. Prepare the journal entries to record the purchase and all adjustments required for the AFS security and the forward contract at November 15, 2018, December 31, 2018, and February 15, 2019. b. Reconcile to the forward rate at the forward contract's inception the net cash received for both the sale of the AFS security and the settlement of the forward-contract derivative. Date Value December 31, 2018 .. 1.36 1.30 1.28 1.34 1.32 1.28