Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saleh & Nadeem are partners in a firm. On 1/1/2021, capital balances in the partnership are $160000, SI80000, respectively. Partner's Current Account balances are

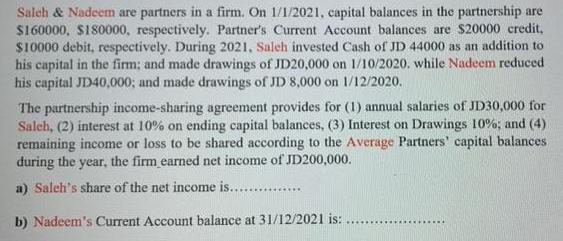

Saleh & Nadeem are partners in a firm. On 1/1/2021, capital balances in the partnership are $160000, SI80000, respectively. Partner's Current Account balances are $20000 credit, $10000 debit, respectively. During 2021, Saleh invested Cash of JD 44000 as an addition to his capital in the firm; and made drawings of JD20,000 on 1/10/2020. while Nadeem reduced his capital JD40,000; and made drawings of JD 8,000 on 1/12/2020. The partnership income-sharing agreement provides for (1) annual salaries of JD30,000 for Saleh, (2) interest at 10% on ending capital balances, (3) Interest on Drawings 10%; and (4) remaining income or loss to be shared according to the Average Partners' capital balances during the year, the firm earned net income of JD200,000. a) Saleh's share of the net income is.. . b) Nadeem's Current Account balance at 31/12/2021 is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers 1 Salehs share of net income is JD 16920 2 Nadeems ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started