Answered step by step

Verified Expert Solution

Question

1 Approved Answer

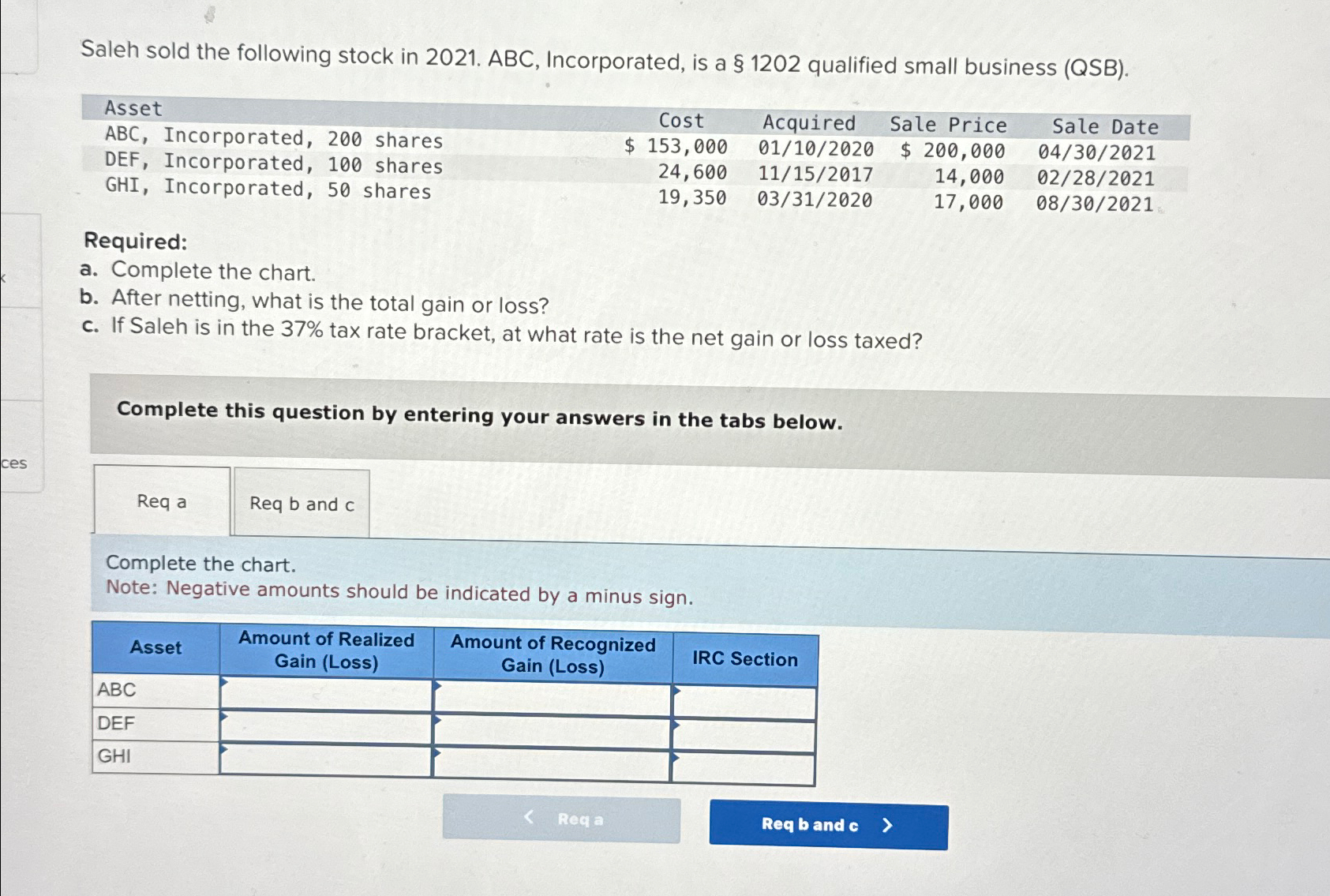

Saleh sold the following stock in 2021. ABC, Incorporated, is a 1202 qualified small business (QSB). Asset ABC, Incorporated, 200 shares DEF, Incorporated, 100

Saleh sold the following stock in 2021. ABC, Incorporated, is a 1202 qualified small business (QSB). Asset ABC, Incorporated, 200 shares DEF, Incorporated, 100 shares Cost $ 153,000 Acquired Sale Price 01/10/2020 $ 200,000 Sale Date 04/30/2021 24,600 19,350 11/15/2017 14,000 02/28/2021 03/31/2020 17,000 08/30/2021 GHI, Incorporated, 50 shares Required: a. Complete the chart. b. After netting, what is the total gain or loss? c. If Saleh is in the 37% tax rate bracket, at what rate is the net gain or loss taxed? Complete this question by entering your answers in the tabs below. ces Req a Req b and c Complete the chart. Note: Negative amounts should be indicated by a minus sign. Asset ABC DEF GHI Amount of Realized Gain (Loss) Amount of Recognized Gain (Loss) IRC Section < Req a Req b and c >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started