Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Salem Corp. began the year with the following account balances corresponding to its receivables. Salem Corp. uses the net method for recording cash discounts. Accounts

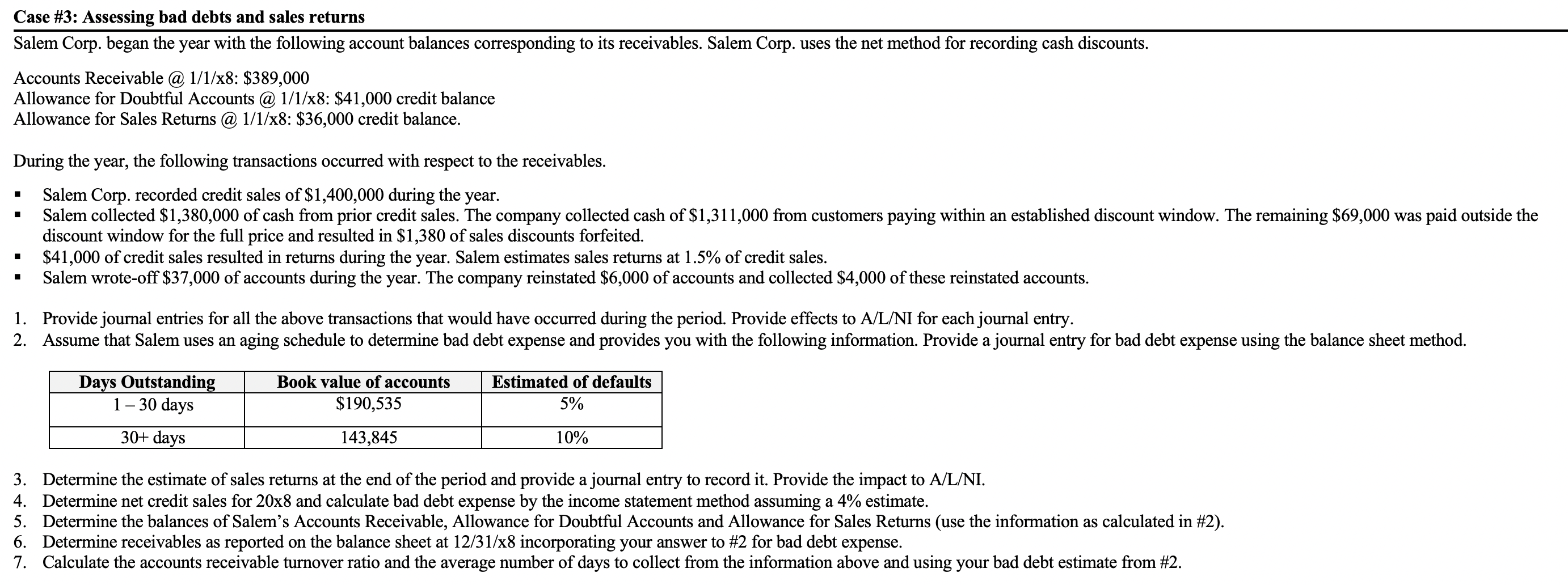

Salem Corp. began the year with the following account balances corresponding to its receivables. Salem Corp. uses the net method for recording cash discounts. Accounts Receivable @ 1/1/x8: \$389,000 Allowance for Doubtful Accounts @ 1/1/x8: \$41,000 credit balance Allowance for Sales Returns @ 1/1/x8: \$36,000 credit balance. During the year, the following transactions occurred with respect to the receivables. - Salem Corp. recorded credit sales of $1,400,000 during the year. discount window for the full price and resulted in $1,380 of sales discounts forfeited. - $41,000 of credit sales resulted in returns during the year. Salem estimates sales returns at 1.5% of credit sales. - Salem wrote-off $37,000 of accounts during the year. The company reinstated $6,000 of accounts and collected $4,000 of these reinstated accounts. 1. Provide journal entries for all the above transactions that would have occurred during the period. Provide effects to A/L/NI for each journal entry. 3. Determine the estimate of sales returns at the end of the period and provide a journal entry to record it. Provide the impact to A/L/NI. 4. Determine net credit sales for 208 and calculate bad debt expense by the income statement method assuming a 4% estimate. 5. Determine the balances of Salem's Accounts Receivable, Allowance for Doubtful Accounts and Allowance for Sales Returns (use the information as calculated in \#2). 6. Determine receivables as reported on the balance sheet at 12/31/x8 incorporating your answer to \#2 for bad debt expense. 7. Calculate the accounts receivable turnover ratio and the average number of days to collect from the information above and using your bad debt estimate from \#2

Salem Corp. began the year with the following account balances corresponding to its receivables. Salem Corp. uses the net method for recording cash discounts. Accounts Receivable @ 1/1/x8: \$389,000 Allowance for Doubtful Accounts @ 1/1/x8: \$41,000 credit balance Allowance for Sales Returns @ 1/1/x8: \$36,000 credit balance. During the year, the following transactions occurred with respect to the receivables. - Salem Corp. recorded credit sales of $1,400,000 during the year. discount window for the full price and resulted in $1,380 of sales discounts forfeited. - $41,000 of credit sales resulted in returns during the year. Salem estimates sales returns at 1.5% of credit sales. - Salem wrote-off $37,000 of accounts during the year. The company reinstated $6,000 of accounts and collected $4,000 of these reinstated accounts. 1. Provide journal entries for all the above transactions that would have occurred during the period. Provide effects to A/L/NI for each journal entry. 3. Determine the estimate of sales returns at the end of the period and provide a journal entry to record it. Provide the impact to A/L/NI. 4. Determine net credit sales for 208 and calculate bad debt expense by the income statement method assuming a 4% estimate. 5. Determine the balances of Salem's Accounts Receivable, Allowance for Doubtful Accounts and Allowance for Sales Returns (use the information as calculated in \#2). 6. Determine receivables as reported on the balance sheet at 12/31/x8 incorporating your answer to \#2 for bad debt expense. 7. Calculate the accounts receivable turnover ratio and the average number of days to collect from the information above and using your bad debt estimate from \#2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started