Question

Salem Corporation designs and manufactures wind turbine power generating systems and sells them to private energy producers. Many of their sales are structured to allow

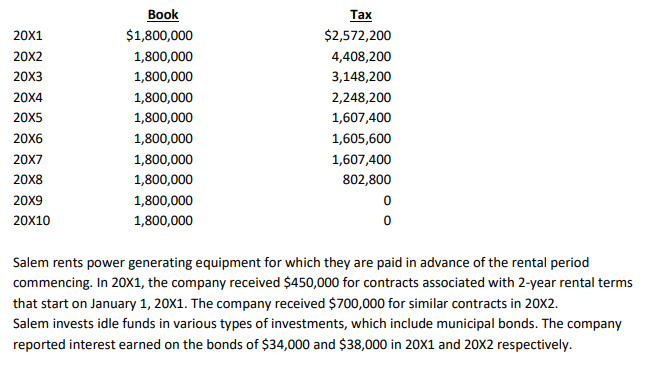

Salem Corporation designs and manufactures wind turbine power generating systems and sells them to private energy producers. Many of their sales are structured to allow their customers to pay for equipment on an installment basis. In 20X1, Salem sold 10 units on installment resulting in $1.8 million of gross profit being reported for GAAP purposes. Payments for these sales will be received evenly over a 3 year period starting with the current year. In 20X2, Salem sold 12 units on installment resulting in $2.0 million of gross profit being reported on the income statement. Salem changed the structure of these sales so that payments would be received evenly over a 2 year period starting with the current period. Salem provides warranties on the units it sells. In 20X1, the company estimated that it would incur $820,000 during the 3-year warranty period and accrued this amount for financial purposes. During the year (20X1), Salem incurred $153,000 to perform warranty related repairs. Expected warranty costs in 20X2 and 20X3 were estimated to be $334,200 and $423,400 respectively. Salem continued to offer warranties on the units it sold in 20X2 and estimated the cost associated with the coverage to be $982,000 (this amount was accrued for financial purposes). Costs incurred during the year to provide warranty services totaled $514,500 (for units sold in 20X1 and 20X2). Remaining total warranty costs of $432,020 and $358,000 and $304,600 were expected for 20X3, 20X4, and 20X5 respectively. Salem uses a wide range of capital assets to produce its products, which it depreciates on a straight-line basis for financial reporting purposes. The company depreciates the assets on an accelerated basis for tax purposes as follows:

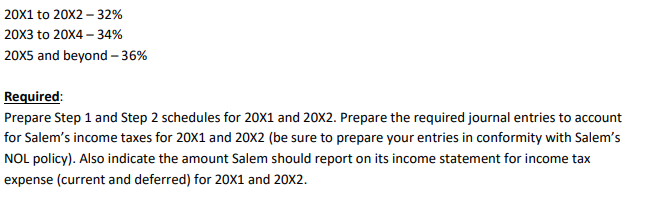

Salem insures the lives of its executives. Premiums associated with the policies were $9,000 per year in 20X1 and 20X2. Sadly, a senior executive covered by one of the policies lost her life in an automobile accident in 20X2. Per the policy terms, Salem received a death benefit of $6,000,000. In 20X2, Salem was fined $100,000 for violating safety and environmental regulations. Also, in 20X2 the company became involved in a lawsuit, for which the companys legal counsel felt probable an adverse outcome would result for Salem. The resulting loss was estimated to be in a range from $3,000,000 to $7,000,000. The appropriate amount was accrued for financial purposes. The anticipated settlement does not represent a fine or penalty and is expected to be paid in 20X4. Salem reported income before taxes of $632,400 and $6,145,345 in 20X1 and 20X2 respectively. On its 20X0 balance sheet, it reported a deferred tax asset of $1,505,400 (debit) and a deferred tax liability of $1,418,700 (credit). In 20X0, Salem reported a loss for tax purposes of $148,115 and used an anticipated future tax rate of 32% when it recorded the related Deferred Tax Asset - NOL. Assume that Salem utilizes NOL carry forwards as early as it can. Tax rates for Salem are as follows:

Step 1:

Compute Taxable Income for 20X1 and 20X2

Step 2:

Determine Deferred Tax Assets and Deferred Tax Liabilities along with the journal entries

20x1 20X2 20X3 20X4 20X5 20x6 20x7 20x8 20x9 20x10 Book $1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 Tax $2,572,200 4,408,200 3,148,200 2,248,200 1,607,400 1,605,600 1,607,400 802,800 0 Salem rents power generating equipment for which they are paid in advance of the rental period commencing. In 20x1, the company received $450,000 for contracts associated with 2-year rental terms that start on January 1, 20X1. The company received $700,000 for similar contracts in 20x2. Salem invests idle funds in various types of investments, which include municipal bonds. The company reported interest earned on the bonds of $34,000 and $38,000 in 20X1 and 20x2 respectively. 20x1 to 20x2 -32% 20x3 to 20X4 -34% 20x5 and beyond - 36% Required: Prepare Step 1 and Step 2 schedules for 20X1 and 20x2. Prepare the required journal entries to account for Salem's income taxes for 20X1 and 20X2 (be sure to prepare your entries in conformity with Salem's NOL policy). Also indicate the amount Salem should report on its income statement for income tax expense (current and deferred) for 20X1 and 20x2. 20x1 20X2 20X3 20X4 20X5 20x6 20x7 20x8 20x9 20x10 Book $1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 1,800,000 Tax $2,572,200 4,408,200 3,148,200 2,248,200 1,607,400 1,605,600 1,607,400 802,800 0 Salem rents power generating equipment for which they are paid in advance of the rental period commencing. In 20x1, the company received $450,000 for contracts associated with 2-year rental terms that start on January 1, 20X1. The company received $700,000 for similar contracts in 20x2. Salem invests idle funds in various types of investments, which include municipal bonds. The company reported interest earned on the bonds of $34,000 and $38,000 in 20X1 and 20x2 respectively. 20x1 to 20x2 -32% 20x3 to 20X4 -34% 20x5 and beyond - 36% Required: Prepare Step 1 and Step 2 schedules for 20X1 and 20x2. Prepare the required journal entries to account for Salem's income taxes for 20X1 and 20X2 (be sure to prepare your entries in conformity with Salem's NOL policy). Also indicate the amount Salem should report on its income statement for income tax expense (current and deferred) for 20X1 and 20x2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started