Question

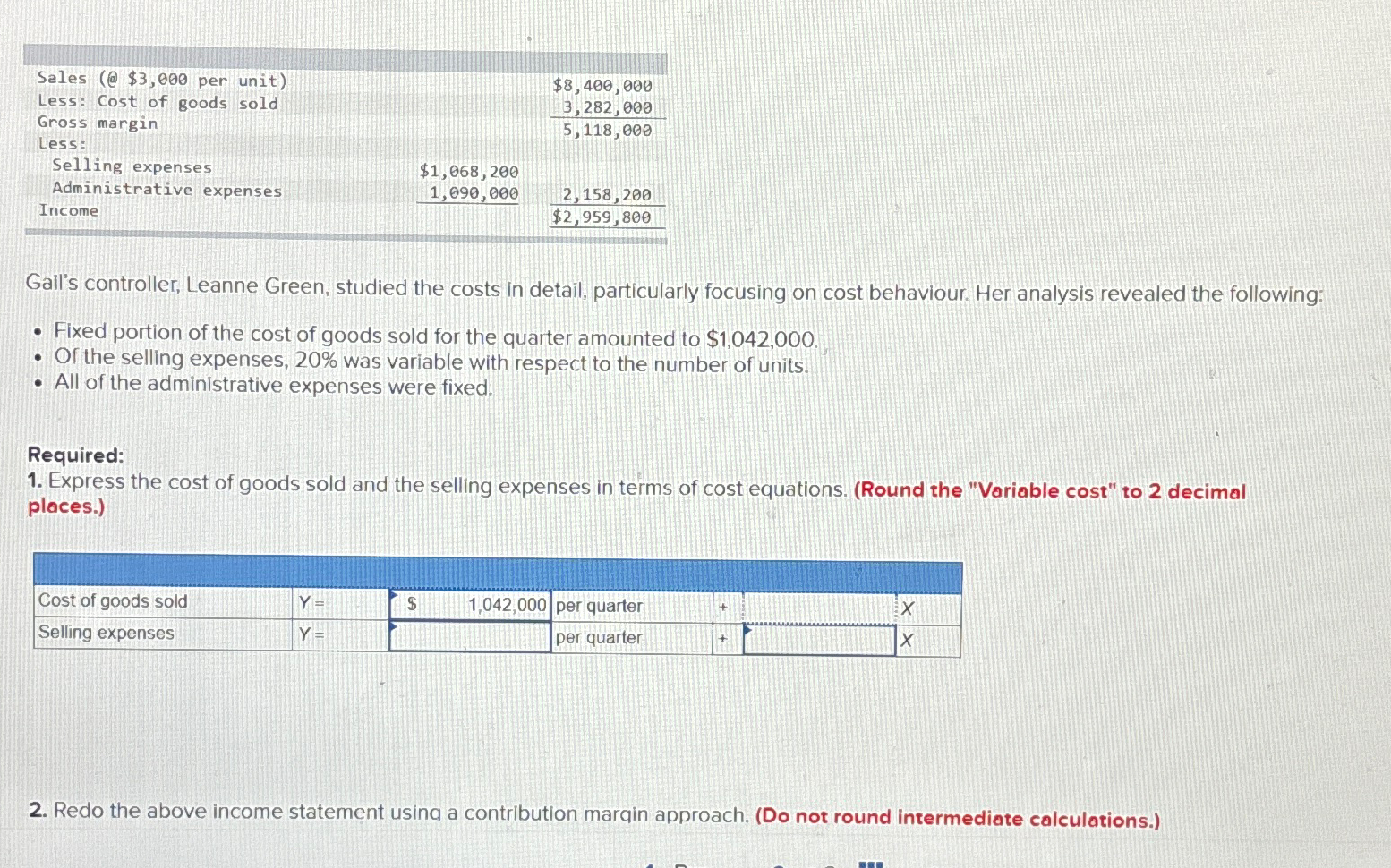

Sales (@ $3,000 per unit) Less: Cost of goods sold Gross margin Less: Selling expenses Administrative expenses Income $8,400,000 (3,282,000)/() 5,118,000 $1,068,200 (1,090,000)/((2,158,200)/($2,959,800))

Sales (@

$3,000per unit)\ Less: Cost of goods sold\ Gross margin\ Less:\ Selling expenses\ Administrative expenses\ Income\

$8,400,000\ (3,282,000)/()\ 5,118,000\

$1,068,200\ (1,090,000)/((2,158,200)/($2,959,800))\ Gail's controller, Leanne Green, studied the costs in detail, particularly focusing on cost behaviour. Her analysis revealed the following:\ Fixed portion of the cost of goods sold for the quarter amounted to

$1,042,000.\ Of the selling expenses,

20%was variable with respect to the number of units.\ All of the administrative expenses were fixed.\ Required:\ Express the cost of goods sold and the selling expenses in terms of cost equations. (Round the "Variable cost" to 2 decimal places.)\ \\\\table[[Cost of goods sold,

Y=,

$,

1,042,000,per quarter,+,

x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started