Answered step by step

Verified Expert Solution

Question

1 Approved Answer

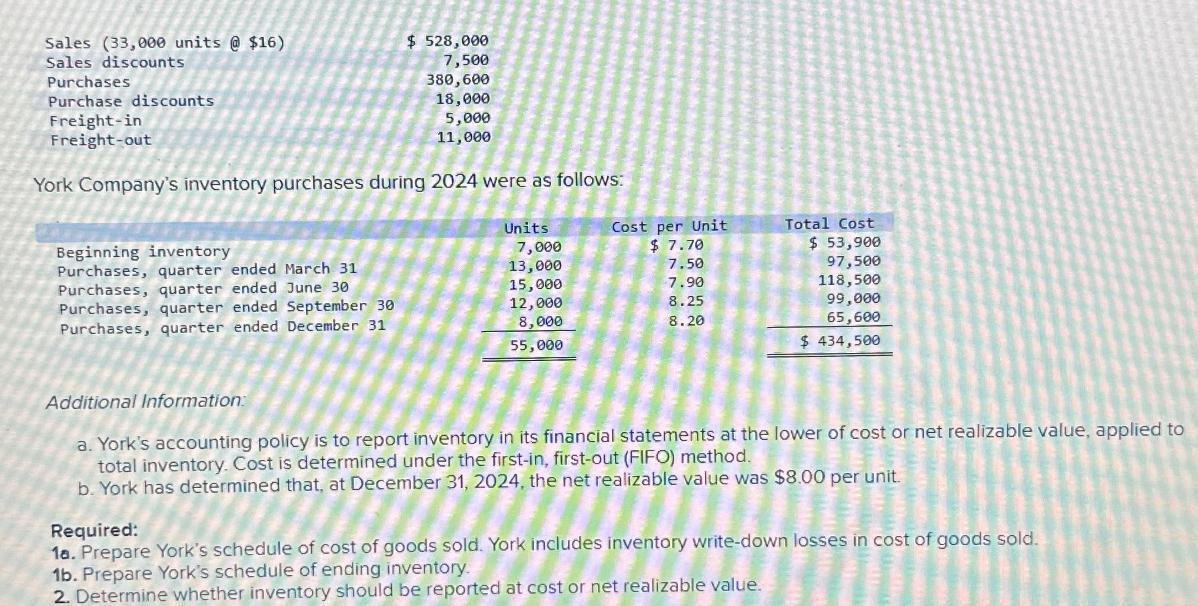

Sales (33,000 units @ $16) Sales discounts Purchases Purchase discounts Freight-in Freight-out $ 528,000 7,500 380,600 18,000 5,000 11,000 York Company's inventory purchases during

Sales (33,000 units @ $16) Sales discounts Purchases Purchase discounts Freight-in Freight-out $ 528,000 7,500 380,600 18,000 5,000 11,000 York Company's inventory purchases during 2024 were as follows: Units Cost per Unit Total Cost Beginning inventory 7,000 $ 7.70 Purchases, quarter ended March 31 13,000 7.50 Purchases, quarter ended June 30 15,000 7.90 $ 53,900 97,500 118,500 Purchases, quarter ended September 30 12,000 8.25 99,000 Purchases, quarter ended December 31 8,000 8.20 65,600 55,000 $ 434,500 Additional Information: a. York's accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total inventory. Cost is determined under the first-in, first-out (FIFO) method. b. York has determined that, at December 31, 2024, the net realizable value was $8.00 per unit. Required: 10. Prepare York's schedule of cost of goods sold. York includes inventory write-down losses in cost of goods sold. 1b. Prepare York's schedule of ending inventory. 2. Determine whether inventory should be reported at cost or net realizable value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

York Company Schedule of Cost of Goods Sold Description Units Cost per Unit Amount Beginning invento...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started