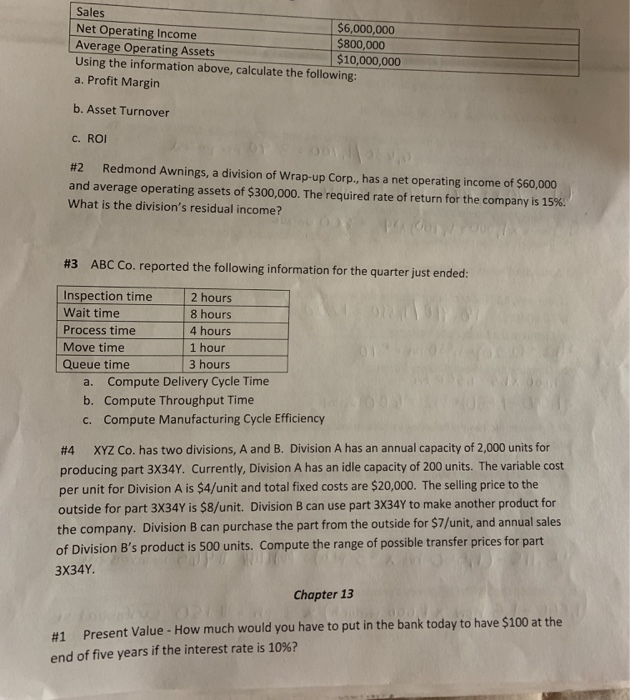

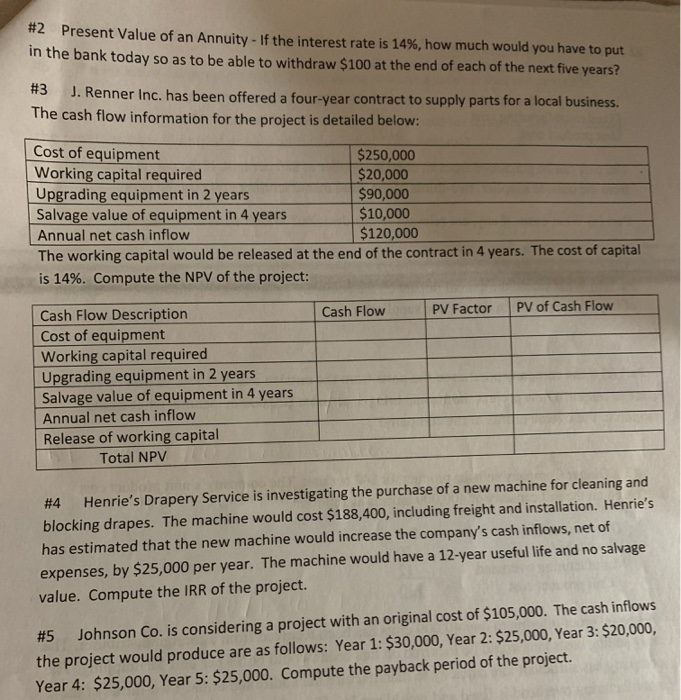

Sales $6,000,000 Net Operating Income $800,000 Average Operating Assets $10,000,000 Using the information above, calculate the following: a. Profit Margin b. Asset Turnover C. ROI #2 Redmond Awnings, a division of Wrap-up Corp., has a net operating income of $60,000 and average operating assets of $300,000. The required rate of return for the company is 15%. What is the division's residual income? #3 ABC Co. reported the following information for the quarter just ended: DODO Inspection time 2 hours Wait time 8 hours Process time 4 hours Move time 1 hour Queue time 3 hours a. Compute Delivery Cycle Time b. Compute Throughput Time C. Compute Manufacturing Cycle Efficiency #4 XYZ Co. has two divisions, A and B. Division A has an annual capacity of 2,000 units for producing part 3X34Y. Currently, Division A has an idle capacity of 200 units. The variable cost per unit for Division A is $4/unit and total fixed costs are $20,000. The selling price to the outside for part 3X34Y is $8/unit. Division B can use part 3X34Y to make another product for the company. Division B can purchase the part from the outside for $7/unit, and annual sales of Division B's product is 500 units. Compute the range of possible transfer prices for part 3X34Y. Chapter 13 #1 Present Value - How much would you have to put in the bank today to have $100 at the end of five years if the interest rate is 10%? #2 Present Value of an Annuity - If the interest rate is 14%, how much would you have to put in the bank today so as to be able to withdraw $100 at the end of each of the next five years? #3 J. Renner Inc. has been offered a four-year contract to supply parts for a local business. The cash flow information for the project is detailed below: Cost of equipment Working capital $250,000 $20,000 Upgrading equipment in 2 years $90,000 Salvage value of equipment in 4 years $10,000 Annual net cash $120,000 The working capital would be released at the end of the contract in 4 years. The cost of capital is 14%. Compute the NPV of the project: Cash Flow PV Factor PV of Cash Flow Cash Flow Description Cost of equipment Working capital required Upgrading equipment in 2 years Salvage value of equipment in 4 years Annual net cash inflow Release of working capital Total NPV #4 Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $188,400, including freight and installation. Henrie's has estimated that the new machine would increase the company's cash inflows, net of expenses, by $25,000 per year. The machine would have a 12-year useful life and no salvage value. Compute the IRR of the project. #5 Johnson Co. is considering a project with an original cost of $105,000. The cash inflows the project would produce are as follows: Year 1: $30,000, Year 2: $25,000, Year 3: $20,000, Year 4: $25,000, Year 5: $25,000. Compute the payback period of the project