Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sales and Services Tax (SST) was reintroduced back in Malaysia on September 2018 in replace of the Goods and Service Tax (GST). Discuss how

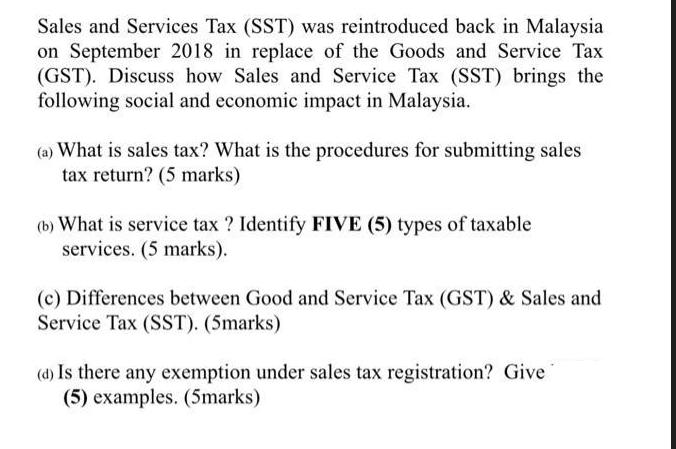

Sales and Services Tax (SST) was reintroduced back in Malaysia on September 2018 in replace of the Goods and Service Tax (GST). Discuss how Sales and Service Tax (SST) brings the following social and economic impact in Malaysia. (a) What is sales tax? What is the procedures for submitting sales tax return? (5 marks) (b) What is service tax ? Identify FIVE (5) types of taxable services. (5 marks). (c) Differences between Good and Service Tax (GST) & Sales and Service Tax (SST). (5marks) (d) Is there any exemption under sales tax registration? Give (5) examples. (5marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Sales tax is a consumption tax imposed on taxable goods at the point of sale in Malaysia It is levied on specific goods produced in or imported into Malaysia The procedures for submitting sales tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started